Aussie And Kiwi Feel The Heat As Asian Risks Rise

Australian and New Zealand Dollars faced broad-based pressures in today’s Asian session, as markets are gripped by risk-off mood. Hong Kong HSI is witnessing the most significant downturn, in the wake of the beleaguered Chinese property developer, Country Garden, halting trading on at least ten of its mainland bonds. This move has ignited broader decline in property-related stocks. Kiwi faces added burdens, stemming from lackluster services data signaling an intensified contraction in activity. Meanwhile, both Yen and Dollar have risen amid heightened risk aversion, though the former appears to be marginally in the lead. European majors present a mixed picture at the moment.

Despite today’s potential trading lull, due to a barren economic calendar in Europe and North America, the markets are bracing themselves for a whirlwind of significant events. Come tomorrow’s Asian session, all eyes will be on Japan’s GDP, minutes from RBA meeting, and a suite of Chinese economic indicators including industrial production, retail sales, and the unemployment rate. Hence, beware that some traders are jumping the gun to prepare for tomorrow.

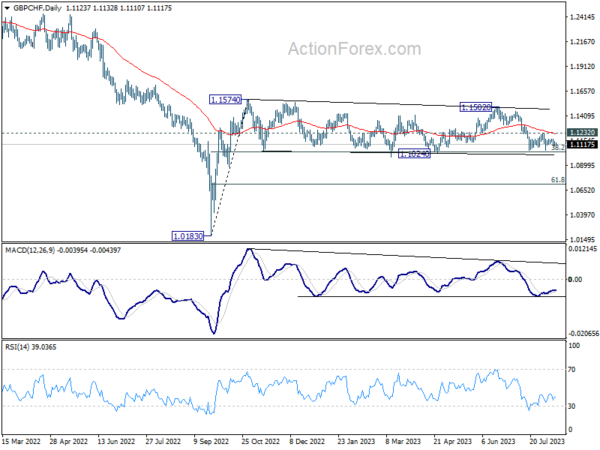

This week also casts a spotlight on Sterling, with UK’s employment statistics, inflation data, and retail sales figures due for release. On the technical front, GBP/CHF is still battling to uphold 1.1024 support level, which has kept it within the medium-term range stemming from 1.1574. Risk is tilted to the downside as 1.1232 resistance remains intact. Firm break of 1.1024, spurred either by adverse UK data or a shift towards Franc as a safe haven, would send the cross lower to 61.8% retracement of 1.0183 to 1.1574 at 1.0714.

In Asia, Nikkei closed down -1.27%. Hong Kong HSI is down -2.06%. China Shanghai SSE is down -0.33%. Singapore Strait Times is down -1.66%. Japan 10-year yield is up 0.0193 at 0.608, back above 0.6%.

NZ BNZ services plunges down to 47.8, deepening contraction as activity dives

New Zealand’s service sector, as gauged by the BusinessNZ Performance of Services Index, experienced a marked decline in July, descending from 49.6 to a worrying 47.8. This latest reading is not only the lowest since January 2022 but also trails the long-term average of 53.5 significantly.

A detailed analysis of the index highlights concerning trends. The activity component has sharply dropped from 50.9 to 39.6, marking its worst performance since August 2021 and setting a gloomy record. Specifically, this month’s reading stands as the worst non-lockdown related reading on record since 2007. New orders within businesses have taken a substantial hit, plummeting from 50.4 to 43.8.

Meanwhile, employment showed a marginal decrease, moving from 49.1 to 49.0. On a brighter note, stocks or inventories observed an increase, jumping from 47.2 to 54.0, with supplier deliveries also ticking up from 51.0 to 52.1.

BusinessNZ’s Chief Executive, Kirk Hope, said. “The further fall into contraction during July also saw another lift in the proportion of negative comments,” he remarked, drawing attention to the sharp increase in negative feedback, which escalated to 67% from 55.6% in June and 49.4% in May.

Hope continued, “Overall, negative comments received were strongly dominated by a general downturn in the economic conditions/slowing economy, as well as ongoing increased costs.”

BNZ Senior Economist, Doug Steel, weighed in on the data, highlighting a distressing pattern. “The results all point to a sharp drop in demand in July, significantly accelerating the slowing trend that had been evident for many months,” he said.

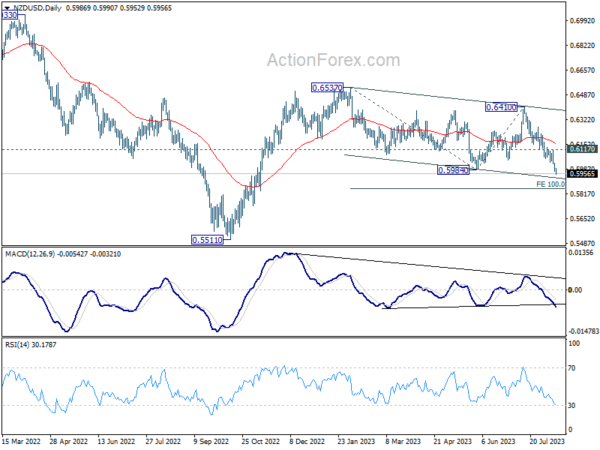

NZD/USD under siege on domestic data and Asian market risks

NZD/USD is having a notable decline today, pressured by dismal services data from New Zealand and an escalating sense of risk aversion throughout Asian markets. This downtrend also sets a tense backdrop leading up to this week’s RBNZ rate decision, with the central bank widely anticipated to hold for the second consecutive month.

Last week’s break of 0.5984 support should confirm resumption of whole decline from 0.6537. Near term outlook in NZD/USD will stay bearish as long as 0.6117 resistance holds. Next target is 100% projection of 0.6537 to 0.5894 from 0.6410 at 0.5857.

For now, the structure of the decline from 0.6537 is still favoring that it’s a correction to rebound from 0.5511. Hence, strong support should emerge below 0.5857 to bring reversal. However, any downside acceleration below 0.5857 would raise the chance that it’s indeed resuming the larger down trend through 0.5511.

A busy week with RBNZ decision, RBA and Fed minutes, lots of data

In a week set to be bustling with significant economic updates, market watchers are paying attention to pivotal decisions and minutes from leading central banks, as well as a string of important data.

RBNZ is widely anticipated to maintain its OCR at 5.50% in its upcoming gathering, marking a second consecutive pause. While Q2 inflation rate of 6% came in below the bank’s own forecasts, the sudden rise in inflation expectations, as indicated in RBNZ’s latest survey, has raised eyebrows. The robust job market, although slightly marred by a marginal increase in unemployment rate, keeps the speculation rife. Market whispers suggest a coin toss probability for another rate hike this year, but this balance hangs precariously, susceptible to shifts based on any unforeseen projection revelations.

Also Down under, RBA’s August minutes are expected to echo the familiar tune of contentment with the prevailing monetary policy. The bank exudes confidence in maneuvering the challenging course towards a low inflation environment, ensuring minimal adverse impacts on the economy.

Meanwhile, the Federal Reserve’s July meeting minutes are drawing significant attention. The overarching sentiment leans towards Fed maintaining its current stance in the upcoming September meeting. But the waters are murky beyond that, with evident divisions among Fed officials. Investors and analysts alike will dissect the minutes, seeking clues on potential tightening debates. However, clear directives might be elusive, reinforcing the bank’s data-dependent strategy.

Furthermore, an array of economic data from around the globe will punctuate the week. Notable releases include US retail sales, Germany’s ZEW, UK’s employment and CPI figures, Japan’s GDP and CPI, Canada’s CPI, Australia’s employment metrics, and a suite of Chinese economic indicators. Undoubtedly, traders and investors will be kept on their toes, with potential market-moving news popping up daily.

Here are some highlights for the week:

- Monday: NZ BusinessNZ services index; Germany WPI.

- Tuesday: Japan GDP; RBA minutes, wage price index; China industrial production, retail sales, fixed asset investment; UK employment; Swiss PPI; Germany ZEW economic sentiment; Canada CPI, manufacturing sales; US retail sales, Empire State manufacturing index, import prices, business inventories, NAHB housing index.

- Wednesday: RBNZ rate decision; UK CPI, PPI; Eurozone GDP revision, industrial production; Canada housing starts, wholesales sales; US housing starts and building permits, industrial production; FOMC minutes.

- Thursday: New Zealand PPI; Japan trade balance, machine orders, tertiary industry index; Australia employment; Eurozone trade balance; US jobless claims, Philly Fed index.

- Wednesday: Japan CPI; UK Gfk consumer confidence, retail sales; Eurozone CPI final; Canada IPPI and RMPI.

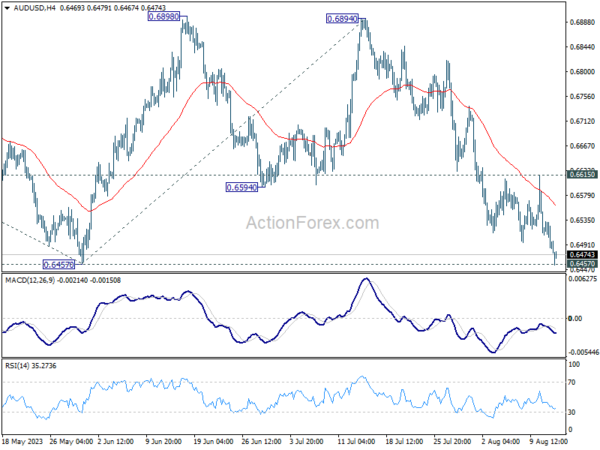

AUD/USD Daily Report

Daily Pivots: (S1) 0.6476; (P) 0.6505; (R1) 0.6524; More…

Intraday bias in AUD/USD stays on the downside at this point. Decisive break of 0.6457 support will confirm resumption of whole fall from 0.7156. Next target is 100% projection of 0.7156 to 0.6457 from 0.6894 at 0.6195. Nevertheless, firm break of 0.6615 minor resistance will dampen this view, and turn bias back to the upside for stronger rebound.

In the bigger picture, the down trend from 0.8006 (2021 high) could still be in progress. Break of 0.6457 will affirm this bearish case. Further break of 0.6169 will target 61.8% projection of 0.8006 to 0.6169 to 0.7156 at 0.6021. This will now remain the favored case as long as 0.6894, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PSI Jul | 47.8 | 50.1 | 49.6 | |

| 06:00 | EUR | Germany Wholesale Price Index M/M Jul | -0.20% | -0.20% |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more