Asian Markets Tilt Cautious, Canada CPI Watched

Asian markets manifested mild risk-off sentiments today, with Nikkei weighing down the broader region. As Japanese investors made their way back from an extended holiday weekend, notable sell-off in chip stocks took place. This reaction was prompted by reports that Taiwan’s premier chipmaker, TSMC, had requested its major vendors to postpone deliveries. Adding to the mix, there’s speculation that Japanese investors are aligning their portfolios in anticipation of a possible hawkish shift by BoJ set for this Friday. However, before that unfolds, other significant determinants remain, particularly FOMC rate decision and economic forecasts due tomorrow.

As of now, Canadian Dollar stands out as the dominant performer, with market participants keenly waiting on Canada’s CPI data, wherein another uptick in headline figures is widely anticipated. The prospect of another rate hike by the BoC later this year largely depends on the magnitude and endurance of inflationary forces, with a special focus on the services sector. Meanwhile, Dollar attempts a rally, though it lacks firm backing. Euro and Yen are trailing as the day’s laggards, with Sterling not far behind. Australian Dollar portrays a mixed picture post the release of RBA minutes.

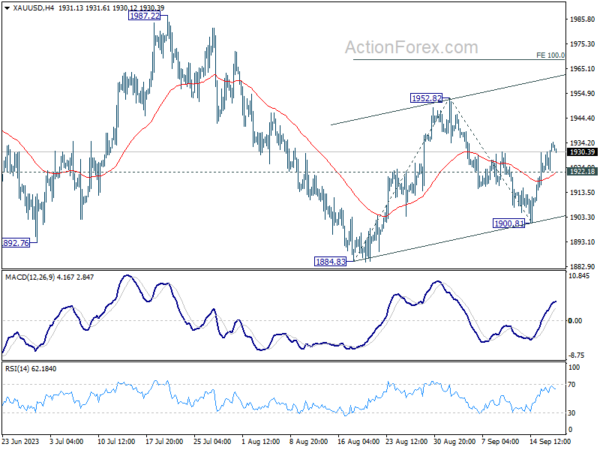

Following up on Gold, the break of 1930.56 resistance is a tentative sign that rise from 1884.83 is resume to resume. Further rally is now mildly in favor to 1952.82 resistance first. Firm break there will target 100% projection of 1884.83 to 1952.82 from 1900.81 at 1968.80 in the near term. Nevertheless, break of 1922.18 minor support will dampen this bullish case. Critical insights into Gold’s next direction could emerge in the next 48 hours, which will also serve to validate any movements in Dollar, as is traditionally observed.

In Asia, Nikkei closed down -1.07%. Hong Kong HSI is down -0.16%. China Shanghai SSE is down -0.15%. Singapore Strait Times is down -0.65%. Japan 10-year JGB yield is up 0.0077 at 0.718. Overnight, DOW rose 0.02%. S&P 500 rose 0.07%. NASDAQ rose 0.01%. 10-year yield dropped -0.003 to 4.319.

RBA minutes flag risks on growth, consumption and China

RBA’s meeting held on September 5, the minutes revealed that officials weighed two courses for monetary policy: increasing cash rate target by 25 bps or standing pat.

After a thorough consideration of the prevailing economic circumstances, members resolved that maintaining the current cash rate was the more compelling choice, highlighting the necessity to allot more time to gauge the comprehensive impacts of monetary policy tightening enacted since May 2022. This consensus is grounded in an understanding of the substantial delays that characterize transmission of policy repercussions through the economy.

Amid these considerations, members also highlighted potential risks. Specifically, there were concerns regarding the possibility that “the economy could slow more sharply than forecast.” Factors like potentially weaker consumption and mounting downside risks to the Chinese economy were flagged.

However, the minutes reflected a cautiously optimistic tone, with members deducing that “recent developments had not materially altered the outlook.” The general consensus remained that the economy still seems to be on a balanced path where inflation is poised to return to the target range, and employment growth is anticipated to sustain its momentum.

Canada’s CPI looms, can CAD/JPY sustain bullish momentum?

Today, eyes are on Canada’s CPI data, with projections pointing towards an uptick. Expectations peg the headline inflation at 3.8% yoy, an increase from July’s 3.3% yoy. Should this materialize, it would represent a consecutive monthly acceleration, with inflation rate soaring to its pinnacle since April, and significantly surpassing BoC’s 2% target. Nevertheless, monthly CPI growth is projected at 0.2% mom, decelerating from the previous 0.6% mom noted in July.

The inflation surge in August is attributed to an interplay of base effects paired with escalating energy prices. Yet, the most pronounced upside risks are to stem from an array of service prices. The spotlight will undeniably be on the core inflation metrics. Also, a surge in three-month inflation will naturally amplify the likelihood of another rate hikes by BoC, potentially as proximate as October.

BoC’s Governor, Tiff Macklem, elucidated the bank’s stance in a September 7 speech, stating that while “monetary policy may be sufficiently restrictive”, the bank aspires to witness “less-generalized price increases” alongside a dip in the average price rise. Failing to observe such a trend might compel the bank to contemplate elevating the policy rate again, particularly if inflationary tendencies persist.

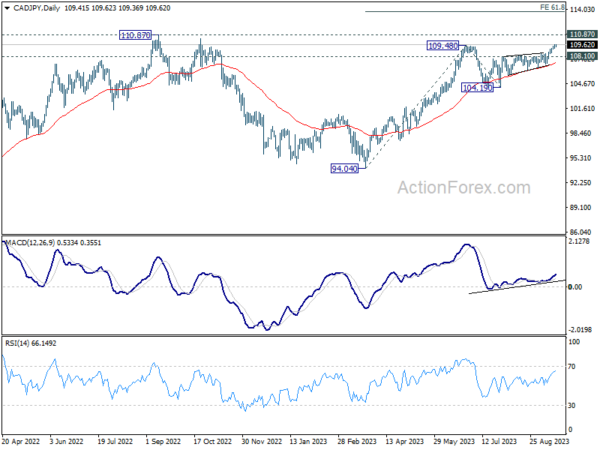

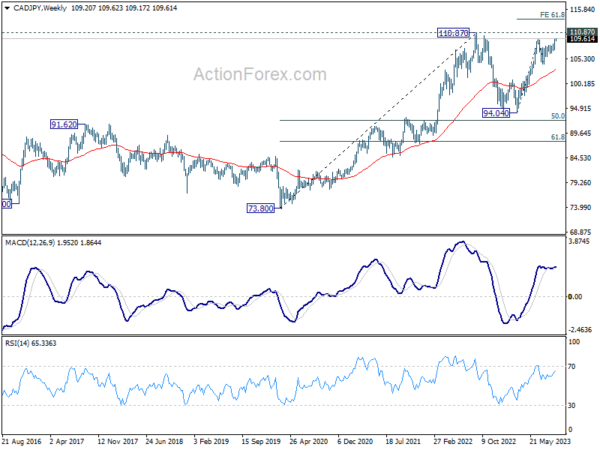

On the currency front, the Canadian Dollar has showcased commendable strength this month, propelled by a spike in oil prices. CAD/JPY’s break of 109.46 resistance this week argues that rise from 94.04 is resuming for a test on 110.87 key resistance (2022 high). Firm break there will confirm larger up trend resumption. Next target will be 61.8% projection of 94.04 to 109.48 from 104.19 at 113.73. In any case, near term outlook will stay bullish as long as 108.10 resistance turned support holds.

Looking ahead

Eurozone CPI final will be released in European session. In the US session, US will release building permits and housing starts. Canada CPI will be the main focus.

EUR/GBP Daily Outlook

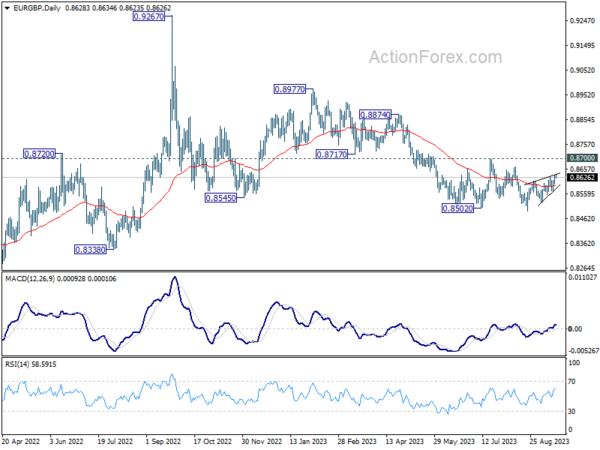

Daily Pivots: (S1) 0.8610; (P) 0.8622; (R1) 0.8645; More…

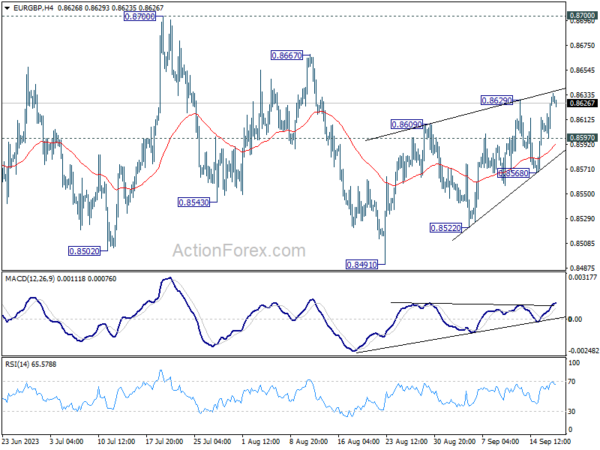

EUR/GBP’s rebound from 0.8491 resumed by breaking 0.8629 and intraday bias is back on the upside. This rise is seen as the third leg of the corrective pattern from 0.8502. Upside should be limited by 0.8667/8700 resistance zone. On the downside, below 0.8597 minor support will turn intraday bias neutral first. Further break of 0.8568 support will turn bias back to the downside for retesting 0.8491 low.

In the bigger picture, the down trend from 0.9267 (2022 high) is seen as part of the long term range pattern from 0.9499 (2020 high). Fall from 0.8977 is seen as the third leg. As long as 0.8700 resistance holds, further decline is still expected. Break of 0.8491 will resume the fall towards 0.8201 (2022 low). Nevertheless, firm break of 0.8700 will now be a sign of bullish reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | RBA Minutes | ||||

| 06:00 | CHF | Trade Balance (CHF) Aug | 4.23B | 3.13B | ||

| 08:00 | EUR | Current Account (EUR) Jul | 30.2B | 35.8B | ||

| 09:00 | EUR | Eurozone CPI Y/Y Aug F | 5.30% | 5.30% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y Aug F | 5.30% | 5.30% | ||

| 12:30 | USD | Building Permits Aug | 1.45M | 1.44M | ||

| 12:30 | USD | Housing Starts Aug | 1.44M | 1.45M | ||

| 12:30 | CAD | CPI M/M Aug | 0.20% | 0.60% | ||

| 12:30 | CAD | CPI Y/Y Aug | 3.80% | 3.30% | ||

| 12:30 | CAD | CPI Median Y/Y Aug | 3.70% | 3.70% | ||

| 12:30 | CAD | CPI Trimmed Y/Y Aug | 3.50% | 3.60% | ||

| 12:30 | CAD | CPI Common Y/Y Aug | 4.80% | 4.80% |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more