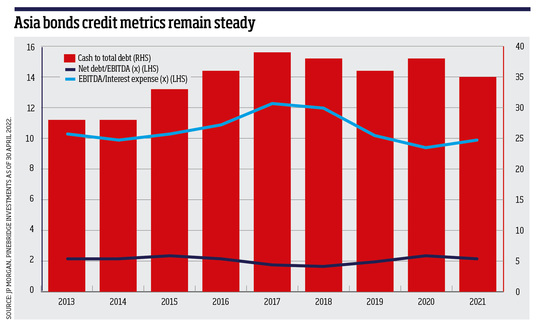

Credit fundamentals have held steady despite pressures from rising US and regional rates and concerns about inflation's impact on earnings. Given the short duration profile of Asia bonds in general, we think the interest rate trajectory in the US will have minimal impact on the asset class. Nevertheless, we remain underweight on duration.

The spotlight for the remainder of year will likely remain on China and the impact of its policy easing in stemming the economic slowdown and stabilising the property sector, which is a key component of the Asia and emerging market high-yield market. Further easing should support Chinese credits, especially select Chinese property issuers, and we believe this should create opportunities among better-quality issuers that are likely to recover earlier when the property sector stabilises.

Pressure is easing in Asia high yield

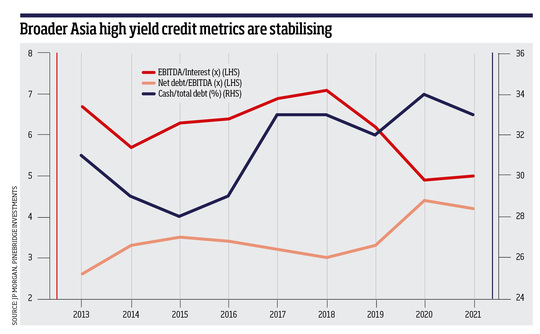

Recent volatility in the Asia high yield market will subside in the next several months on the back of steady credit fundamentals for non-Chinese issuers. China's Covid-delayed recovery means more defaults are expected in the Chinese property sector before stabilisation measures take wider effect. This, together with Sri Lanka's default in May, indicates the expected decline in the Asia bond default rate will be pushed to the first half of 2023 instead of this year.

The extended lockdown in some major Chinese cities in recent months has dampened the effectiveness of policy easing. More supportive measures to property developers and buyers should eventually stabilise the sector and relieve distress among property developers. However, consumption and investment sentiment remain fragile. Physical transactions in the property market continue to disappoint, which means the cash flow pressure on developers persists. The good news is that the onshore credit market and bank credit facility are again available to select property developers, which could offer a new lifeline. On the whole, we believe select higher-quality names in the property sector offer compelling value and will generate decent returns to patient investors in next 12 months.

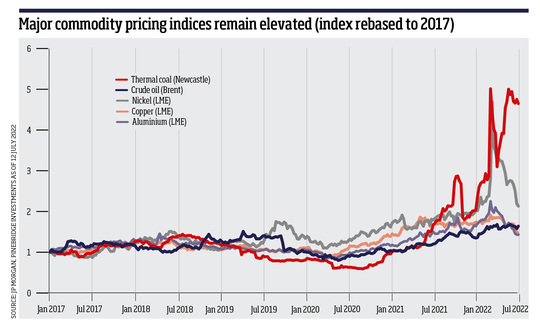

Commodity opportunity

Meanwhile, some non-China high-yield credits are benefiting from strong commodity prices and steady credit fundamentals. We continue to favour commodity names as inflation becomes a tailwind for the sector. We expect this strong commodity cycle to last longer due to geopolitical tensions and the reopening of many major economies post-Covid.

We are closely watching emerging credit events in two Asian frontier sovereigns. We expect Sri Lanka's debt restructuring process to take a few months to resolve, while the International Monetary Fund review of Pakistan is unlikely to conclude anytime soon. We will remain underweight high-yield frontier sovereigns until there is greater clarity about the outcomes of these restructurings.

Henderson trust: Profit growth expected for Asia Pacific ex-Japan

Significant yield backup to benefit Asia IG

The June rate hike in the US further supports the argument that Asia IG (which largely consists of China credits) will outperform US IG as China continues to ease while the US follows an aggressive tightening cycle. Trade figures from China are strong, and industrial activities show a better-than-expected trend, although consumption still lags due mainly to the lockdown. We think the credit spread premium of Asia IG over US IG, which has narrowed noticeably recently may continue to compress given the supportive policy backdrop and growing recessionary risk concern in the US. Annualised volatility for the asset class has remained comparatively subdued, and we believe the market's characteristics continue to support this trend.

All these further confirms that the Asia credit market looks attractive because of shorter duration, more favourable policy support and better credit fundamental outlook.

The reopening theme is strengthening, with Thailand and Indonesia among the latest IG sovereigns to announce significant relaxation to border measures. Economic momentum broadly remains healthy, with inflationary expectations uneven across Asia. Flexibility and selectivity will remain the watchwords for the rest of the year. With strong fundamentals anchoring the market, Asia fixed income should offer investors the stability that may be lacking elsewhere.

Arthur Lau is co-head of emerging markets fixed income at PineBridge Investments