A Multi-Decade Trend Reversal Underway In EUR/USD?

The sharp contrast between Europe’s newfound unity and the ongoing tariff chaos in the US has been a defining theme in the financial markets. Euro’s extraordinary strength last week reflected growing investor confidence in the region’s strategic shift toward fiscal expansion and defense spending. From the formation of the “Coalition of the Willing” to the ReArm Europe initiative, they highlighted a strong, coordinated response to challenges, be it geopolitical or economic. That could set the stage for a long-term structural shift in European markets.

Meanwhile, the US continued to grapple with trade policy uncertainty, with tariffs now more seen as a drag on sentiment and economic growth rather than a source of inflationary pressure. The recent exemptions granted to Canada and Mexico only reinforced the perception of inconsistency in Washington’s trade strategy. The lack of clarity on future policy moves has started to weigh on investor sentiment. That, if persists, could lead to a outflow of capital from the US and weakening the Dollar further.

From a technical points of view, EUR/USD has shown clear signs of a potential long-term bullish reversal. The pair’s strong surge last week suggests that the multi-year downtrend may have bottomed out, with further upside potential if Europe successfully executes its ambitious fiscal and defense spending plans. However, challenges remain, including implementation risks and the broader impact of trade tensions on European exports.

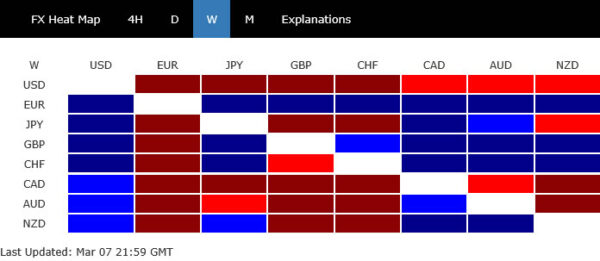

Currency market performance last week reflected the shifting sentiment. Euro ended as the strongest performer, followed by Sterling and Swiss Franc, which also benefited from Europe’s renewed economic confidence.

On the other hand, Dollar closed as the worst performer, struggling under the weight of investor skepticism and diminishing safe-haven appeal. Elsewhere, Canadian Dollar and Australian Dollar also underperformed, indicating that risk-off sentiment remains present, particularly in the US. Yen and Kiwi positioned themselves in the middle of the performance spectrum.

Europe’s Bold Shift Ignites Market Optimism

Last week brought a seismic shift in Europe’s geopolitical, defense, and fiscal policies. In a move not seen in decades, the region is asserting greater strategic independence while ramping up economic stimulus. The changes were embraced by investors with enthusiasm, fueling rallies in European assets, particularly in Euro and German equities.

Euro surged 4.4% against Dollar, its best weekly performance since 2009. Meanwhile, Germany’s 10-year yield posted its biggest jump since the fall of the Berlin Wall. DAX hit fresh record highs, with cyclical and defense-related stocks leading the charge.

At the heart of this shift is the “ReArm Europe” initiative, which commits the EU to a significant defense buildup. European Commission President Ursula von der Leyen has proposed mechanisms to mobilize up to EUR 800B in special funds. This landmark decision not only strengthens military readiness, but also reduces reliance on external allies.

Further reinforcing this new direction, EU leaders took a bold stand against Hungarian Prime Minister Viktor Orbán, overriding his veto on aid to Ukraine. In an unusual move, member states issued a separate statement reaffirming their unified support for Kyiv.

Meanwhile, in Germany, despite ongoing coalition talks, CDU leader Friedrich Merz wasted no time aligning with the SPD to push for loosening of the “debt brake”, which would unlock EUR 500B for infrastructure projects. Additionally, defense spending above 1% of GDP will be permanently exempt from fiscal constraints. Over the next decade, these measures could increase government spending by a staggering 20% of GDP. The scale surpasses even that seen after German reunification in the 1990s.

This massive fiscal shift in Germany carries significant upside potential for both domestic and Eurozone growth. With a sharp boost in public spending, it could also act as a buffer against potential US tariffs. For years, European growth has been held back by fiscal conservatism—but now, these bold new policies could reshape the region’s economic future for years to come.

Technically, DAX might be rebuilding upside momentum as seen in D MACD. Current up trend should head to take on 161.8% projection of 14630.21 to 18892.92 from 17024.82 at 23921.87. Decisive break there would target 200% projection at 25550.22 next. Nevertheless, firm break of 22226.34 support will suggest DAX has topped for the near term at least, and consolidations should follow first.

Is Euro Entering a Long-Term Bull Cycle?

As Europe embarks on a new era of fiscal expansion and policy coordination, Euro’s looks well-positioned for a prolonged rally and with prospects of long term bullish trend reversal.

Another key factor supporting Euro is the growing belief that ECB is nearing a pause in its policy easing cycle. With monetary policy now “meaningfully less restrictive”, as described by President Christine Lagarde, a pause could start as soon as in April. ECB could opt for a wait-and-see approach, to assess how trade policy, fiscal initiatives, and broader geopolitical risks play out.

However, key risks remain, including escalation in trade disputes with the US, as well as how effectively Europe executes its ambitious spending plans. The coming months will be crucial in determining whether this historic shift translates into sustained economic momentum or if internal and external headwinds slow down the Euro’s resurgence.

Technically, EUR/USD’s strong rally suggests that fall from 1.1274 (2023 high) has completed as a correction, with three waves down to 1.0176. Firm break of 1.1274 would resume larger rally from 0.9534 (2022 low), to 100% projection of 0.9534 to 1.1274 from 1.0176 at 1.1916.

More significantly, if the bullish case is realized, that would push EUR/USD through the two-decade falling channel resistance, which could be an important sign of long term trend reversal.

US Stocks at Risk of Bearish Trend Reversal Amid Tariff Chaos

US stocks endured a turbulent week as investors wrestled with the unpredictable nature of President Donald Trump’s trade policies. The volatility has taken a clear toll on market sentiment, with technical indicators increasingly pointing to bearish trend reversal in major indexes. The coming weeks could prove decisive in determining whether the strong uptrend that has defined the past few months has reversed or if equities can regain their footing.

S&P 500 logged its worst week since September, falling -3.1%, while DOW dropped -2.4%. NASDAQ was hit hardest, tumbling -3.5%.

The implementation of 25% tariffs on Canadian and Mexican imports on March 4, had initially sent markets into a tailspin. However, Trump’s decision on Thursday to pause tariffs on USMCA-covered goods for another month only added to the confusion, as investors struggled to decipher the long-term direction of trade policy.

This chaotic cycle of tariff imposition followed by temporary reversals has created an uncertain and fragile investment environment. Businesses remain hesitant to make forward-looking decisions, while consumer confidence is showing signs of strain. The erratic nature of US trade policy has left markets with little clarity, and the risk of further deterioration in sentiment remains high.

Nevertheless, Friday’s non-farm payroll report provided some relief, as job growth remained near its recent average, unemployment stayed within its recent range, and wage growth held robust. The data suggested that, at least for now, the feared economic fallout from tariffs has not yet materialized in a meaningful way. However, lingering uncertainty around trade and global economic conditions continues to weigh on sentiment.

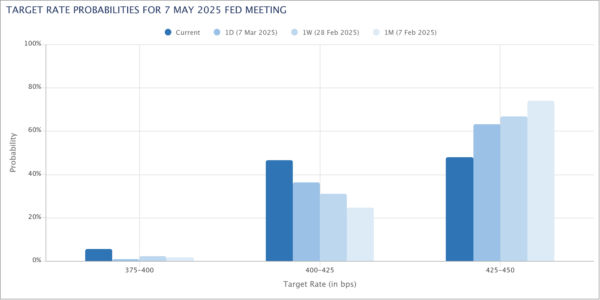

Meanwhile, Fed Chair Jerome Powell reiterated on Friday that the central bank is in no rush to cut rates, stating that the Fed is “well-positioned to wait for clarity.” Powell’s cautious stance contrasts with growing market expectations for rate cuts, as investors bet on economic weakness forcing the Fed’s hand.

While a hold in March remains the base case, with 88% odds, Fed fund futures now price in a 52% probability of a 25bps rate cut in May, up sharply from 33% a week ago and 26% a month ago. This suggests that investors are bracing for the possibility of further economic softening, with Fed being forced to act sooner than its current guidance suggests.

Technically, DOW’s up trend should still be intact as long as 41844.89 support holds. However, firm break there will argues that it’s already in correction to the up trend from 28660.93 (2022 low). Sustained trading below 55 W EMA (now at 41332.86) will further solidify this bearish case. Next target will be 38.2% retracement of 28660.94 to 45087.75 at 38812.71.

As for NASDAQ, it’s now pressing 55 W EMA (at 17878.67). Sustained break there will also indicate that it’s already correcting the up trend from 10088.82 (2022 low). Next target is 38.2% retracement of 10088.82 to 20204.58 at 16340.36.

As for Dollar Index, last week’s steep decline and strong break of 55 W EMA (now at 105.31) argues that corrective pattern from 99.57 (2023 low) has completed with three waves up to 110.17. Near term risk will now stay on the downside as long as 55 D EMA (now at 106.91) holds. Further downside acceleration will raise the chance that Dollar Index is indeed resuming the whole down trend from 114.77 (2022 high) .

While it’s still too early to confirm the bearish case, firm break of 100.15 support could set up further medium term fall to 100% projection of 114.77 to 99.57 from 110.17 at 94.97.

The challenge for Dollar is that risk aversion no longer seems to be offering support. Tariffs are providing little help unlike what it did this year. Meanwhile, Fed appears poised to resume rate cuts sooner than expected. With these factors in play, it’s unclear what could drive a rebound for the greenback, other then implosion of Euro and other currencies

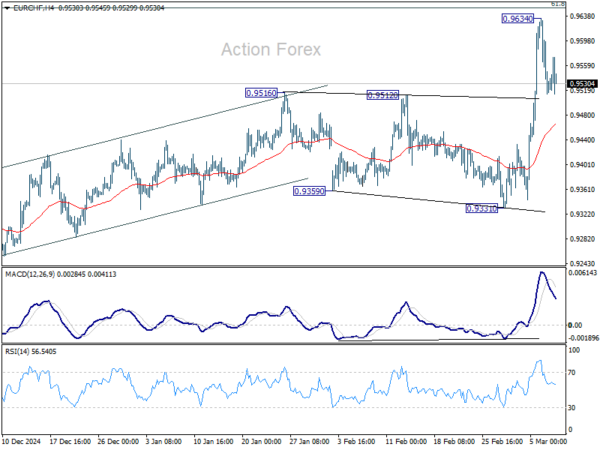

EUR/CHF surged to as high as 0.9634 last week but faced strong resistance from long term falling channel and retreated. Initial bias stays neutral this week first and some more consolidations could be seen. Further rally will be expected as long as 55 4H EMA (now at 0.9467) holds. On the upside, above 0.9634, and sustained trading above 0.9651 fibonacci level will pave the way back to 0.9928 key resistance next.

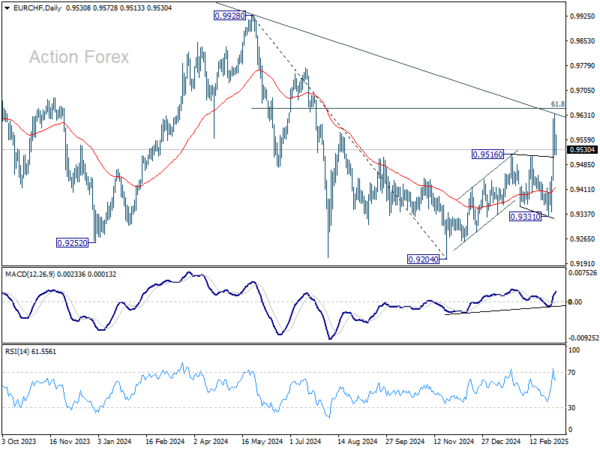

In the bigger picture, the strong break of 55 W EMA (now at 0.9482) is a medium term bullish sign. Sustained break trading above long-term falling channel resistance (at around 0.9620) would suggest that the downtrend from 1.2004 (2018 high) has bottomed at 0.9204. Stronger rally should then be see to 0.9928 key resistance at least.

In the long term picture, bullish signs are emerging. However, the important hurdle at 0.9928 resistance, which is close to 55 M EMA (now at 0.9960), is needed to be taken out decisively before considering long term trend reversal. Otherwise, outlook is neutral at best.

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more