A Moment Of Silence For All The Drives That Died In The Making Of This Backblaze Report

Cloud storage and backup provider Backblaze has released a report on its hard drive failure rates for 2022 which appears to verify that the age of a drive is a key metric for predicting potential failure.

Backblaze regularly releases stats covering the failure rates of all the hard drives under its management, and these datasets have proven a treasure trove for others to analyze for their own purposes – provided they cite Backblaze as the source and do not sell the data.

The latest figures published on the Backblaze blog cover the hard drive failure rates it saw for 2022 across its storage portfolio, which stood at 235,608 individual drives as of December 31.

However, 4,299 of these were boot drives while another 388 drives were removed from consideration because they had been used for testing purposes or were models for which the company did not have at least 60 drives in operation. This still leaves statistics covering 230,921 hard drives used for data storage purposes.

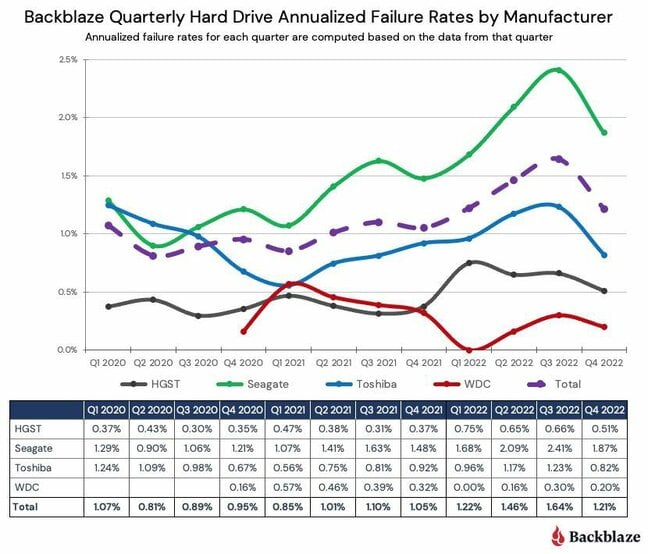

According to Backblaze's principal cloud storage evangelist, Andy Klein, there was a notable increase in the annualized failure rate (AFR) during last year, rising from 1.01 percent in 2021 to 1.37 percent during 2022.

"In our Q2 2022 and Q3 2022 quarterly Drive Stats reports, we noted an increase in the overall AFR from the previous quarter and attributed it to the aging fleet of drives, but is that really the case?" he asked.

The answer, it seems, is yes.

Klein compared 2021 and 2022 annualized failure rates for large drives (which Backblaze defines as 12TB, 14TB and 16TB) against smaller drives (4TB, 6TB, 8TB and 10TB) and found that every size (with the exception of 16TB drives) showed an increase in AFR between 2021 and 2022. The figures show the smaller drives failing more often, but they are also older.

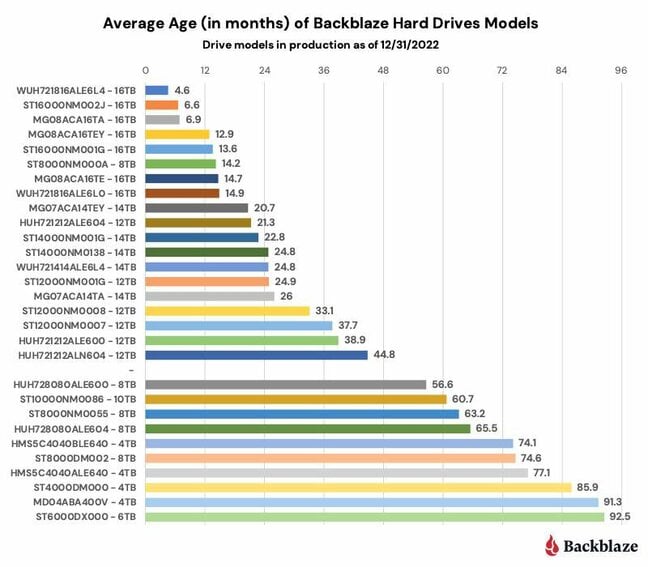

A chart showing the average age of each drive model deployed by Backblaze against size shows clearly that the smaller a drive is in capacity, the older it tends to be, with 16TB spinners less than six months old while some 4TB and 6TB models were over 90 months old.

This increase as a drive model ages follows the bathtub curve, whereby a typical drive can be expected to exhibit a rash of early failures, followed by a period when there are relatively few, followed by an uptick once more as all the drives approach the end of their lives and wear out.

- Barge off: Nautilus to bring floating datacenters to two new sites in US, France

- New SI prefixes clear the way for quettabytes of storage

- Backblaze thinks SSDs are more reliable than hard drives

- Yes, it's true: Hard drive failures creep up as disks age

Looking at a chart of annualized failure rates over time and by manufacturer, it might appear that much of the overall rise over the past year has been driven by Seagate and Toshiba models. However, Klein points out that in the case of Seagate, most of the models from that vendor are significantly older than many others, and there is also the lifecycle cost of a given hard drive model versus its failure rate to consider.

"In general, Seagate drives are less expensive and their failure rates are typically higher in our environment. Their failure rates are typically not high enough to make them less cost effective over their lifetime. You could make a good case that for us, many Seagate drive models are just as cost effective as more expensive drives," he said.

When it comes to the lifetime annualized failure rates across all the drive models in production at Backblaze, the current overall rate is 1.39 percent, which the company reckons is down from that of a year ago (1.40 percent) and also down from the previous quarter (1.41 percent).

Klein says that in 2023, the company's focus is expected to be on replacing the older drives with 16TB and larger hard drives, which means that its 4TB drives and the 6TB Seagate drives (which have an average age of 92.5 months) are likely to go.

As usual, the complete data set used for Backblaze's report is available from the company's Hard Drive Test Data page. ®

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more