IMF Highlights Islamic Finance Instrument Development In UAE

Article Overview

The IMF has highlighted the development of Islamic finance instruments in the UAE, stating the UAE is a major hub for Sukuk issuances. During 2001–15, $53.8 billion or 36 percent of all global sukuk issuances originated in the UAE. Report highlights are presented below.

UAE Banking System Challenges

The UAE has come a long way in the development of its financial markets over the past several decades. Capital market development has become even more important in the new “lower-for-longer” oil price environment to diversify sources of funding for governments and firms and to support economic growth and diversification. The CBU’s steps towards more active liquidity management are welcome. Complementing the recent strengthening of bank liquidity regulations, these reforms should encourage banks to manage their liquidity and risks more actively and further develop capital markets. The CBU’s reforms could be usefully complemented by governments’ efforts to develop domestic debt markets, including for Islamic instruments.

The new setting calls for upgrading the CBU’s liquidity management framework, along with further steps to develop domestic money and debt markets. More active management of system-wide liquidity, as is already being planned by the CBU, and streamlining the gamut of the CBU’s liquidity management instruments would encourage banks to manage their own liquidity better and develop money markets. These efforts would complement the implementation of the new Basel III-compliant liquidity requirements recently issued by the CBU. Starting the issuance of domestic government bonds would support these changes by providing another liquid asset, in addition to the CBU’s certificates of deposit (CDs), for liquidity management by the CBU and banks. These reforms are critical for the creation, deepening and/or broadening of other financial markets, including for corporate bonds and Islamic financial instruments, by facilitating pricing and integration of markets.

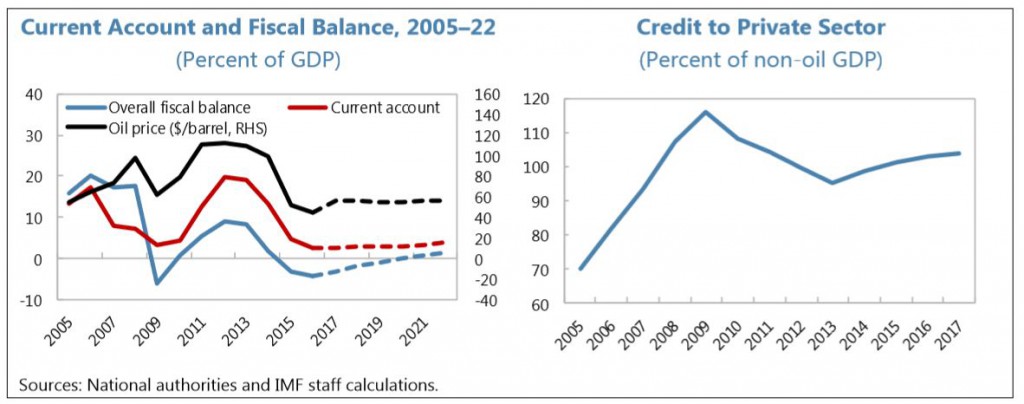

The UAE economy and banking system are facing new challenges. Oil prices have stabilized at around half of their 2014 peak and are expected to stay broadly stable at this level over the medium term. With lower oil revenues, current account surpluses have declined, and fiscal surpluses have turned into deficits. In this setting, the public sector’s propensity to accumulate deposits in the banking system has weakened. In addition, the normalization of U.S. interest rates and banking regulatory changes in the UAE are creating new challenges for banks’ management of liquidity. Yet ensuring healthy liquidity conditions and promoting financial market development is important for supporting robust credit and economic growth and diversification goals.

The UAE banking system is well developed and strong.

Its 59 banks provide a full range of services to their clients. The banking system is large, with total assets amounting to AED 2.6 trillion or 204 percent of GDP at end-March 2017. The banking system is concentrated, with the largest three banks holding over 50 percent of total assets of the banking system. Banks are adequately capitalized and profitable. The capital ratio for the banking system was 18.6 percent at end-March 2017. The ratio of nonperforming loans (NPLs) to gross loans was stable over the past few years at 5.3 percent with NPLs fully covered by provisions. Return on equity was 11.7 percent at end-March 2017. Banks are efficient with the cost-to-income ratio below 38 percent. Banks’ liquidity buffers are healthy. Large banks are internationally active and have high credit ratings. Islamic banking is developing rapidly with some of the world’s largest Islamic banks headquartered in the country. Islamic banks in the UAE had assets of AED 522 billion or 20 percent of total bank assets at end-March 2017.

Sovereign AED Sukuk Issuance

Governments could issue dirham-denominated debt at medium to long-term maturities. Over time, governments may consider creating debt management offices to oversee the issuance and monitoring of debt. Sukuk issuance could be usefully incorporated in the calendar of debt issuance, deepening Islamic markets.

The importance of financial market development has increased in the new oil price environment.

Lower oil revenues have weakened medium-term prospects, pointing to the need for diversifying the economy away from reliance on oil. Capital market development—including the development of Islamic finance—is important to allow companies, governments, and GREs to reduce their reliance on bank financing.

Download Full Report

![]() IMF Report on UAE (845kb)

IMF Report on UAE (845kb)

Riyadh Metro Spurs Residential Property Boom: Knight Frank

RIYADH: The opening of the Riyadh Metro has transformed the Saudi capital’s housing market, with villa prices near s... Read more

Saudi POS Transactions Hold Above $3bn In Mid-October

RIYADH: Saudi Arabia’s point-of-sale transactions remained above the $3 billion mark for the third consecutive week, u... Read more

IMF Expects MENA Inflation To Ease In 2025 And 2026

RIYADH: Lower energy costs will help inflation ease to 12.2 percent this year and 10.3 percent in 2026 across the Middle... Read more

Global ESG Sukuk Market Hits Record $6.5bn In Q3, Set For Strong 2026, Says Fitch

RIYADH: The global market for environmental, social and governance sukuk reached a record $6.5 billion in the third quar... Read more

Saudi Ride-hailing Trips Surge 78% In Q3, Topping 39m

RIYADH: Saudi Arabia’s ride-hailing sector witnessed a major surge during the third quarter of 2025, reaching 39.04 mi... Read more

PIFs EA Deal: Whats Happening Behind The Scenes In Esports?

RIYADH: Just weeks after the conclusion of the second edition of the Esports World Cup, the Saudis were ready for the ne... Read more