From Financing To Empowerment – Islamic Finance As An Enabler In Eradicating Poverty

Article Overview

21 July 2017 – The Islamic Development Bank (IDB) and the Islamic Solidarity Fund for Development (ISFD) held a wonderful event at the United Nations headquarters in New York titled “From Financing to Empowerment – Islamic Finance as an Enabler in Eradicating Poverty” on 14 July. A video of the event is provided below by UN Web TV.

The event was opened by Dr. Rami Ahmad, Special Envoy on SDGs and Senior Advisor to the President, Islamic

Development Bank (IDB) Group. Other panellist included:

- Ms. Roula Majdalani, Director of the Sustainable Development Policies Division, United Nations Economic and Social Commission for Western Asia (UNESCWA)

- Anas Al-Hasnaoui, General Manager, IBF Group Consulting, IDB Consultant on Economic Empowerment Program

- Dr. Amjad Saqib, Founding Chairman and Executive Director, Akhuwat Foundation, Pakistan

- Dr. Tariq Cheema, Founder, World Congress of Muslim Philanthropists (WCMP) Development Bank (IDB) Group

- Dr. Nabil Ghalleb, Chairman and CEO, Zitouna Tamkeen, Tunisia

Access to Markets, not Throwing Money

Dr Rami stated throwing money at the poor will not solve their problems, and may make the problem worse by making the poor, the indebted poor. He added, there were two groups of people in the universe, the weak and the empowered.

- Three to four billion who do not have access to markets, institutions, legal rights, skills, training and technology.

- Two to three billion who have access to markets and all of the above.

Dr Ahmad continued whilst the number of poor has reduced, this is because of two countries, China and India. The absolute number of poor has risen in Sub-Sahara Africa. The Islamic world therefore needs to shift from financing to empowerment.

Dr. Amjad Saqib discussed Islamic micro-finance case studies, as well as the need to view Islamic finance as an empowering tool, not just for Muslims, but for all people irrespective of religion.

The objectives of the events where to discuss:

- New approaches for eradicating poverty and promoting prosperity in disadvantaged communities, especially in least developed countries;

- Innovative approaches provided by Islamic Finance as powerful tools for economic empowerment;

- Practical examples and stories on Economic Empowerment from the experience of the Islamic Development Bank;

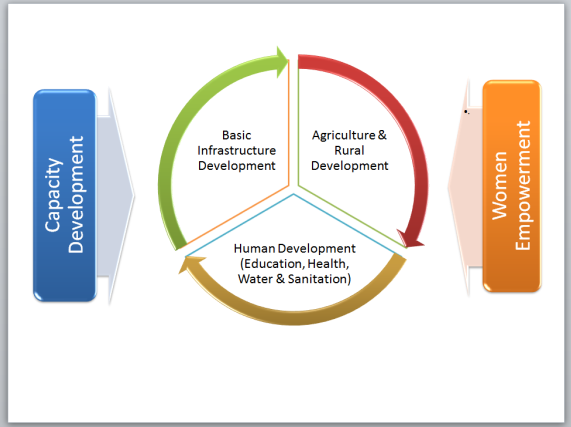

- Economic Empowerment Program of the Islamic Solidarity Fund for Development

About the ISFD

The ISFD was officially launched on 30 May, 2007 in Dakar, Senegal, and is a special fund within the IDB with a view to: (a) reduce poverty, (b) build the productive capacities of member countries, (c) reduce illiteracy, and (d) eradicate diseases and epidemics.

Riyadh Metro Spurs Residential Property Boom: Knight Frank

RIYADH: The opening of the Riyadh Metro has transformed the Saudi capital’s housing market, with villa prices near s... Read more

Saudi POS Transactions Hold Above $3bn In Mid-October

RIYADH: Saudi Arabia’s point-of-sale transactions remained above the $3 billion mark for the third consecutive week, u... Read more

IMF Expects MENA Inflation To Ease In 2025 And 2026

RIYADH: Lower energy costs will help inflation ease to 12.2 percent this year and 10.3 percent in 2026 across the Middle... Read more

Global ESG Sukuk Market Hits Record $6.5bn In Q3, Set For Strong 2026, Says Fitch

RIYADH: The global market for environmental, social and governance sukuk reached a record $6.5 billion in the third quar... Read more

Saudi Ride-hailing Trips Surge 78% In Q3, Topping 39m

RIYADH: Saudi Arabia’s ride-hailing sector witnessed a major surge during the third quarter of 2025, reaching 39.04 mi... Read more

PIFs EA Deal: Whats Happening Behind The Scenes In Esports?

RIYADH: Just weeks after the conclusion of the second edition of the Esports World Cup, the Saudis were ready for the ne... Read more