US Semiconductor Industry Braces For Tougher Trade Restrictions On China

The US semiconductor industry is facing heightened uncertainty as reports emerge that the government may impose stricter trade restrictions on China. These potential measures come amid escalating geopolitical tensions and follow recent comments by former President Donald Trump, which have already rattled investors. The market turmoil has led to a significant drop in chip stocks, reflecting widespread concern over the future of the industry.

Background

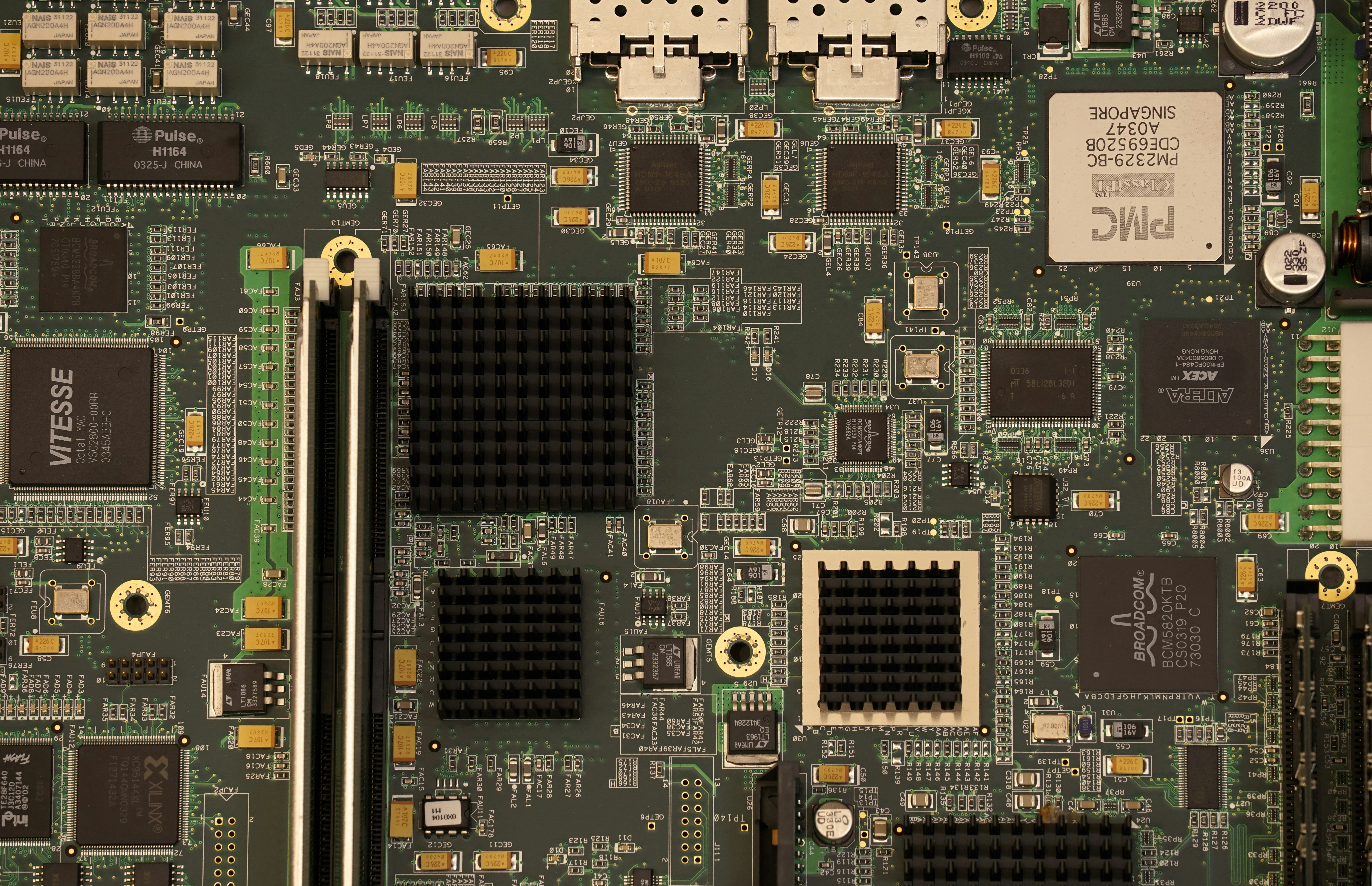

The US-China trade relationship in the semiconductor sector is a critical component of the global technology supply chain. Semiconductors, essential for various industries including consumer electronics, automotive, and telecommunications, often cross multiple borders during production. Previous trade tensions between the US and China have already impacted the industry, causing supply chain disruptions and increased costs. The potential for new restrictions adds another layer of complexity to this already delicate balance.

Trump's Comments and Market Reaction

Former President Donald Trump's recent remarks have injected fresh uncertainty into the market. His comments suggested a potentially tougher stance on trade relations, particularly concerning the technology sector and semiconductors. Investors, already wary of geopolitical risks, reacted swiftly. The market saw a marked sell-off in chip stocks, highlighting the sector's vulnerability to political developments. The immediate response underscores the significant role investor sentiment plays in the semiconductor industry's performance.

Potential US Trade Restrictions on China

Reports indicate that the US government is considering imposing stricter trade restrictions on China, specifically targeting the semiconductor sector. These measures could include tighter export controls and restrictions on the transfer of critical semiconductor technologies. The rationale behind these potential restrictions is likely tied to national security concerns and the desire to maintain a technological edge over China. If implemented, these restrictions could hinder the flow of essential components and technology between the two countries, posing significant challenges for the semiconductor industry.

Implications for the Semiconductor Industry

The potential trade restrictions could have far-reaching implications for the semiconductor industry. In the short term, companies may face supply shortages and increased production costs due to disrupted supply chains. In the long term, the industry might need to undergo strategic shifts to mitigate these risks. Diversifying supply chains, exploring alternative markets, and investing in domestic manufacturing capabilities could become critical strategies. The global semiconductor market, heavily integrated and interdependent, would likely experience increased volatility as companies adapt to the new regulatory environment.

Investor and Market Analyst Perspectives

Market analysts and key investors have expressed concern over the potential trade restrictions. Many predict continued volatility in semiconductor stocks as the situation evolves. Some analysts suggest that investors may adopt a more cautious approach, focusing on companies with diversified supply chains and lower exposure to US-China trade dynamics. The anticipation of further policy announcements keeps the market on edge, with investors closely monitoring developments.

Strategic Responses from Semiconductor Companies

In response to the potential trade restrictions, semiconductor companies are likely to develop contingency plans to safeguard their operations. These plans might include diversifying supply chains to reduce dependence on Chinese manufacturing and exploring new markets to offset potential losses. Collaboration with governments and other industry players could also play a role in mitigating the impact of the restrictions. Companies may invest in research and development to advance technology domestically and reduce reliance on international partners.

Conclusion

The semiconductor industry is at a crossroads, facing significant challenges due to potential US trade restrictions on China. The sector's heavy reliance on global supply chains makes it particularly vulnerable to geopolitical risks. As policymakers weigh their decisions, the industry must prepare for continued volatility and strategic realignments. Monitoring policy developments and adopting proactive strategies will be crucial for semiconductor companies navigating these uncertain times. The future outlook remains uncertain, but the industry's ability to adapt and innovate will be key to overcoming these challenges.

Author: Gerardine Lucero

The Self-Destructive Nature Of Anti-Tourism Protests: Balancing Resident Concerns With Tourism Benefits

In recent years, anti-tourism protests have become increasingly common across popular tourist destinations. From the Bal... Read more

Military And Strategic Implications Of The Ukrainian Drone Attack In Kursk

On a recent morning, the Kursk region in south-western Russia witnessed an unexpected and significant event: a Ukrainian... Read more

Chinese Tech Stocks Gain Ground Despite Wall Street Technology Sell-Off

Chinese tech shares in Hong Kong gained on Friday, defying a technology stock sell-off on Wall Street, driven by strong ... Read more

Defense Pact Between Britain And Germany: A Focus On Cybersecurity And Joint Operations

In a move set to redefine European defense collaboration, Britain and Germany have signed a comprehensive defense pact a... Read more

US Secret Service Director Steps Down After Trump Assassination Attempt

Security lapses admitted by Kimberly Cheatle prompt resignation.Kimberly Cheatle, the head of the US Secret Service, has... Read more

Kamala Harris Promises A Brighter Future In Official Campaign Launch

In a vibrant and impassioned campaign launch, Vice President Kamala Harris vowed to lead America toward a "brighter futu... Read more