Water Worries Flood In As Chip Industry And AI Models Grow Thirstier

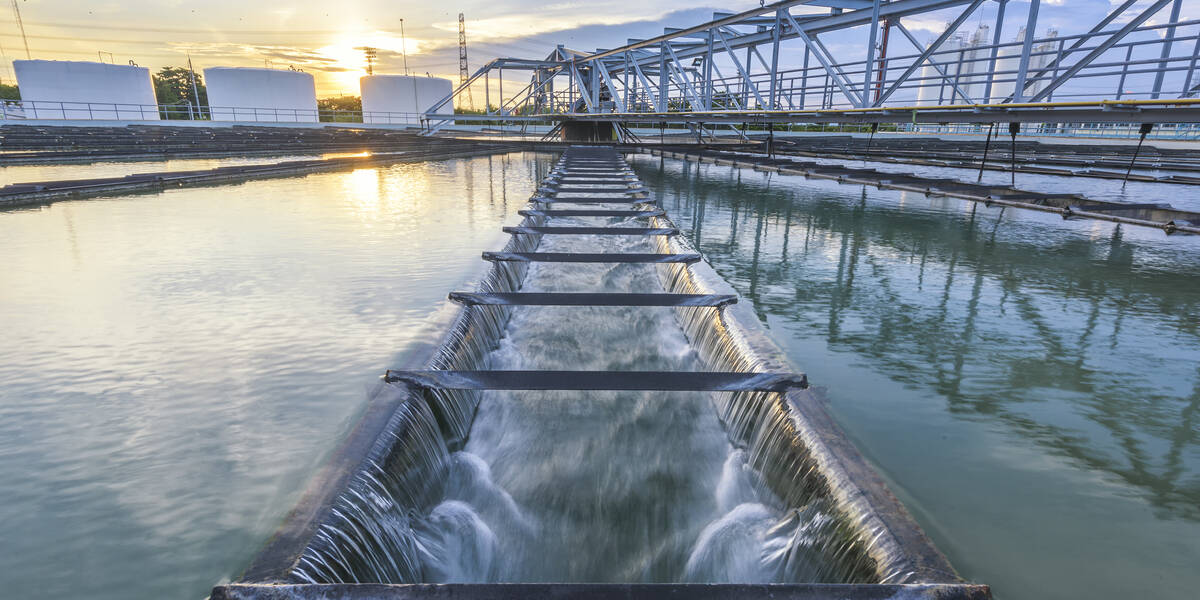

Water supply is seen as a growing risk factor for the chip industry with consumption rising by up to ten percent each year, and many of the biggest producers already operating in areas prone to water scarcity.

A new report from market intelligence outfit S&P Global highlights what it sees as the expanding credit risks for chipmakers, and potential cost increases for buyers, as a result of greater stress on water supplies likely to arise from climate change.

The water consumption of semiconductor companies is on the increase, it notes, both absolutely and on a per-unit basis as production processes become more advanced. At the same time, changes in weather patterns are making water availability unpredictable, with more extreme weather, droughts and less frequent rainfall.

Semiconductor manufacturing already consumes as much water as Hong Kong, a city of 7.5 million people, the report claims.

Taking Taiwan's TSMC as an example, which accounted for 58 percent of the entire global semiconductor wafer market in Q3, 2023, the S&P report says the chipmaker's water consumption per unit grew by more than 35 percent in 2015 following the introduction of its 16nm process nodes.

Fabrication plants use ultrapure water to rinse the wafers between each process step, and more advanced production processes have more of these steps requiring more water. The volume of wafer shipments is also likely to increase in future, following a decline last year due to slowing demand for chips.

TSMC's demand for water at its Taiwan factories could double from the 2022 level by 2030, S&P Global estimates, and the report warns that if the company misjudges its water supply management, the result could see it miss production forecasts for 2030 by up to ten percent.

This would likely push up the price of chips because of the shortfall, while the company would have to pass on extra costs to its customers of potentially higher water tariffs and the expense of using tanker trucks when facing a severe drought, S&P Global reckons.

Global IT supply chains are dependent on just a handful of key chipmakers, and a reduction in output from one of these could hit production for a wide range of downstream manufacturers that use their chips. S&P Global cites the chip shortages caused by the covid pandemic as an example of what could happen.

Many of these producers paradoxically operate in areas where there is water scarcity, such as Shanghai in China, parts of Korea, and the US state of Arizona, where both TSMC and Intel are building new facilities.

While S&P Global concludes that water supply risk is unlikely to affect its ratings for TSMC for the next three years, water shortages are increasingly becoming a rating consideration in the finance world for the semiconductor industry and other water-intensive industries.

Water-intensive industries also include datacenters, as recent concerns have highlighted the growing consumption of water used for cooling IT infrastructure due to the increasing demand for AI processing.

A report [PDF] published last year claimed that global demand for AI may be accountable for 4.2 to 6.6 billion cubic meters of water withdrawal by 2027, or the equivalent to half the annual water withdrawal of the United Kingdom, a nation of 67 million people.

Training GPT-3 in Microsoft's datacenters may consume a total of 5.4 million liters of water, and additionally uses the equivalent of a 500ml bottle of water for every 10-50 responses, depending on when and where it is deployed, the report claims.

The report calls for increased transparency of AI model water consumption, and concludes that AI's water usage can no longer stay under the radar, stating that "water footprint must be addressed as a priority as part of the collective efforts to combat global water challenges."

- Plans to heat districts with datacenters may prove too hot to handle

- Texas judge turns out the lights on federal survey of cryptominers' energy consumption

- Please stop pouring the wrong radioactive water into the sea, Fukushima operator told

- Iran's cyber operations in Israel a potential prelude to US election interference

This week, a court in Chile halted permission for Google to build a datacenter in the country because of concerns over water consumption, according to Reuters.

Google received initial authorization for a datacenter in Santiago in early 2020, but complaints from residents and local officials over the potential impact on the water supply have prompted a rethink.

Google has been asked to incorporate consideration of climate change effects in its evaluation of the water supply and consider a modification of its cooling system. ®

From Chip War To Cloud War: The Next Frontier In Global Tech Competition

The global chip war, characterized by intense competition among nations and corporations for supremacy in semiconductor ... Read more

The High Stakes Of Tech Regulation: Security Risks And Market Dynamics

The influence of tech giants in the global economy continues to grow, raising crucial questions about how to balance sec... Read more

The Tyranny Of Instagram Interiors: Why It's Time To Break Free From Algorithm-Driven Aesthetics

Instagram has become a dominant force in shaping interior design trends, offering a seemingly endless stream of inspirat... Read more

The Data Crunch In AI: Strategies For Sustainability

Exploring solutions to the imminent exhaustion of internet data for AI training.As the artificial intelligence (AI) indu... Read more

Google Abandons Four-Year Effort To Remove Cookies From Chrome Browser

After four years of dedicated effort, Google has decided to abandon its plan to remove third-party cookies from its Chro... Read more

LinkedIn Embraces AI And Gamification To Drive User Engagement And Revenue

In an effort to tackle slowing revenue growth and enhance user engagement, LinkedIn is turning to artificial intelligenc... Read more