US Venture Capitalist Spending Continues To Slide, Hits Six Year Low In Q3

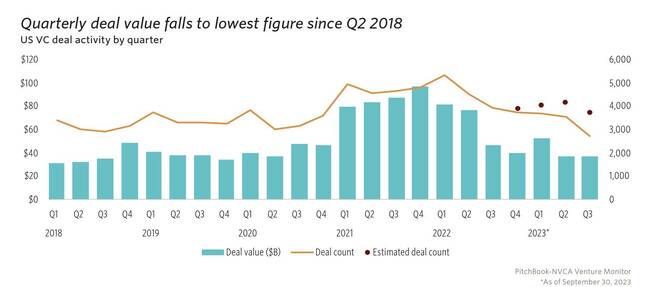

Hopes that the venture capital market would recover in the latter half of 2023 can be considered well and truly dashed, with a report finding VC spending in Q3 reached its lowest level in six years.

The data comes from PitchBook and the National Venture Capital Association's Q3 Venture Monitor report, released today, which also found the total number of observable VC deals themselves fell last quarter to their lowest level in three years. The mid-coronavirus-pandemic boom is over.

In short, it continues to be a bad time to be a startup or other org looking for a handout, and that's unlikely to change anytime soon. "There is no expectation that dealmaking for US [venture capital] will shift during Q4, and the market should continue to operate as it currently is," the report predicted.

Not a lot to be hopeful for here ... Graph showing a decline in VC deals and spending. Click to enlarge. Source: NVCA

While noting some stabilization in total deal value over the past few quarters, the number of VC investments is still down based on historical levels, the report found. The only reason total VC spend in Q3 2023 was on a par with Q2 2023 – slightly lower, technically – was because of Amazon's $4 billion investment in OpenAI rival Anthropic late last month.

"Large deals have become increasingly uncommon, in part due to the pullback from nontraditional investors and to the ability of strong companies that are well positioned from a cash standpoint to stay out of the market while it is in their best interest," the report noted. Large deals, those over $100 million, made up just 48.5 percent of deal value in Q3, as opposed to the halcyon days of Q4 2021, when they made up 60 percent.

Stage-by-stage funding: It's all been downhill

Pre-seed and seed funding is also at a three-year low, with early-stage companies only pulling in $3.2 billion across an estimated 1,214 deals. Pitchbook and NVCA say the continued drop in early-stage investment reflects VCs being slower and pickier in their selection over risk worries in the current economy.

"In an investor-favored dealmaking environment, VCs have slowed their pace of investment, which allows them to conduct more thorough due diligence and uncover red flags that may have been previously overlooked" in earlier, more frenzied investment quarters, opines the report.

Despite that, median seed deal size remains at record levels - in other words, VCs are being picky, but they're spending where it looks like a safe bet.

Early-stage investment is also down after a slight jump in Q2, putting it on pace for a six-year low with just $8.5 billion invested across an estimated 1,341 deals. The median early-stage investment was $40 million, a 13.4 percent decrease from 2022.

- Venture capital firm makes 'unsolicited' bid for MariaDB buyout

- Databricks shakes VC money tree and $500M falls out

- As semiconductor VC funding dips, startups trip, crash, build for the next boom

- Silicon Valley billionaires secretly buy up land for new California city

Late stage VC spend was buoyed by Amazon's Anthropic investment, boosting total deal value over Q2 2023, but that's the odd deal out. Total investment value and deal count still declined among late-stage VC investment in Q3 if Amazon is removed from the equation.

Are there any bright spots?

"While there are a few pockets of optimism within venture, the dust has not totally settled for much of the ecosystem," noted John China, co-head of innovation economy and commercial banking for JP Morgan, in the report.

"Given the more discerning environment, many startups that were backed in 2021 are unlikely to get the same warm reception when they next need to raise," China added, so as the numbers forecast, companies shouldn't expect VCs to get free with their money any time soon.

JP Morgan, one of the sponsors of the report, said that the effects of higher interest rates and tighter credit conditions that have been hallmarks of the US economy of late are still playing out, making investors unwilling to take bets on moonshot companies or innovative ideas without an visible payout.

Simply put, the end of low interest rates, and thus free money to invest in organizations, is playing a big role here. These rates went up as the COVID-19 pandemic subsided in the US to counteract rising inflation.

Additionally, JP Morgan analysts noted, the ongoing situation in Russia and Ukraine, and trade tensions between the US and China have created "a greater-than-normal degree of unpredictability." Add Israel and Hamas to the mix and the level of global uncertainty is only rising, which puts people off investing.

Law firm Dentons, which specializes in venture tech and startup law and also sponsored the Q3 study, has found a bright spot in the current startup economy not from VCs, but in the public sector. Things like the Infrastructure Investment and Jobs Act, CHIPS and Science Act and the Inflation Reduction Act have dumped billions into public programs to foster tech innovation in the US.

"In the current macroeconomic economic environment where venture capital financings are down some 25 percent, it is important for emerging growth companies to consider ways to tap into the large amount of federal stimulus funding opportunities," said Victor Boyajian, chair of Dentons' global venture technology and emerging growth companies group.

Don't rely on AI being the way out that many predicted, either. Mentions of AI being the VC attractor that many companies thought it would be was largely absent from the report, and AI wasn't mentioned at all in its sector-by-sector breakdown. That VC-blinding flash in the pan was already fading over the summer, so no bright spot there, either. ®

From Chip War To Cloud War: The Next Frontier In Global Tech Competition

The global chip war, characterized by intense competition among nations and corporations for supremacy in semiconductor ... Read more

The High Stakes Of Tech Regulation: Security Risks And Market Dynamics

The influence of tech giants in the global economy continues to grow, raising crucial questions about how to balance sec... Read more

The Tyranny Of Instagram Interiors: Why It's Time To Break Free From Algorithm-Driven Aesthetics

Instagram has become a dominant force in shaping interior design trends, offering a seemingly endless stream of inspirat... Read more

The Data Crunch In AI: Strategies For Sustainability

Exploring solutions to the imminent exhaustion of internet data for AI training.As the artificial intelligence (AI) indu... Read more

Google Abandons Four-Year Effort To Remove Cookies From Chrome Browser

After four years of dedicated effort, Google has decided to abandon its plan to remove third-party cookies from its Chro... Read more

LinkedIn Embraces AI And Gamification To Drive User Engagement And Revenue

In an effort to tackle slowing revenue growth and enhance user engagement, LinkedIn is turning to artificial intelligenc... Read more