TSMC's US Builds Won't Make America Great At Chips Again, Says Ex-Intel Boss Gelsinger

Intel ex-CEO Pat Gelsinger has thrown shade on Taiwanese chipmaker TSMC's plans to build fabrication plants in the USA, saying the factories will do nothing to advance American semiconductor leadership.

"If you don't have R&D in the US, you will not have semiconductor leadership in the US," Gelsinger said, according to a report this week in the Financial Times.

"All of the R&D work of TSMC is in Taiwan, and they haven't made any announcements to move that,” Gelsinger pointed out, effectively asserting that manufacturing chips using technologies and processes developed outside the USA in a stateside factory means America won't lead the world in semiconductor fabrication. The chips themselves may be designed in the States, and fabbed in the country, but they'll be made using state-of-the-art techniques formulated in Taiwan and elsewhere, where the next-gen nodes will be devised. America at that point will be a useful overseas factory hub rather than a leader, appears to be Pat's argument.

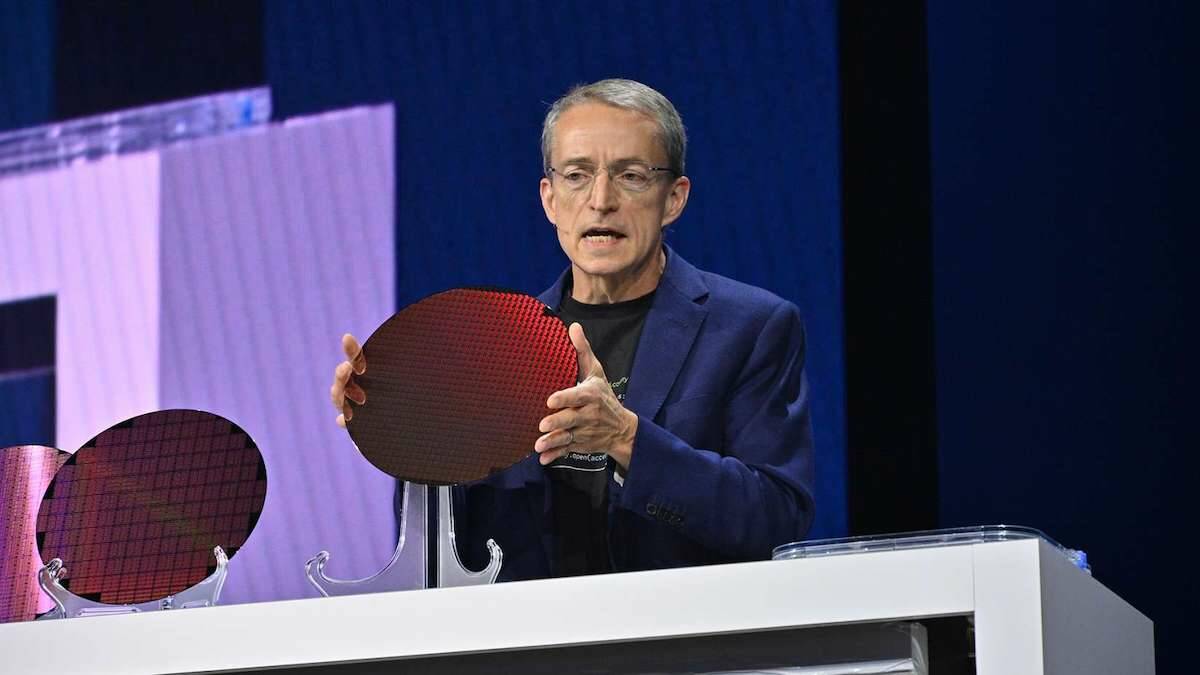

Gelsinger, whose tenure at Intel ended in early December when he was abruptly booted out, tried to turn Chipzilla into a contract manufacturing heavyweight capable of challenging market leader TSMC.

His grand plan involved Intel spending over $100 billion on new fabs in the US, Europe, and the Middle East, and creating an independent foundry business to build chips for third-party customers and Intel itself.

The former CEO hoped Intel’s foundry would be attractive to customers because the company developed an advanced manufacturing process called 18A that is thought to allow creation of chips that near the complexity and performance of products only TSMC has previously been able to fab.

The strategy did not produce immediate positive results, as Intel’s foundry business unit recorded substantial losses – and meaningful production using the 18A process is yet to commence.

Another sign that the foundry plan was not roaring ahead was the announcement that completion of two Intel fab projects in the US state of Ohio had been delayed until the late 2020s and may not open for business until as late as 2030. Less than a week later, TSMC announced its intention to plow a further $100 billion into chip plants located in the USA, in a bid to insulate its US customers from the threat of Trumpian tariffs.

- God didn't have a plan for Gelsinger at Intel. Maybe there is one for his new gig, Gloo

- TSMC promises $100B US expansion that Trump hails without clarifying chip tariff threat

- Nvidia won the AI training race, but inference is still anyone's game

- Intel's new CEO: Chip world veteran Lip-Bu Tan

While Gelsinger shares his opinions from the sidelines, Intel’s foundry ambitions are now a matter for newly appointed CEO Lip Bu Tan to consider.

He's yet to detail any new strategy publicly, but will have new help to develop one as a Thursday regulatory filing revealed three Intel directors won’t seek reelection.

Medtronic CEO Omar Ishrak, UC Berkeley College of Engineering Dean Tsu-Jae King Liu, and Risa Lavizzo-Mourey, a former professor at the University of Pennsylvania, will all exit Intel’s board later this year.

In Intel’s annual report, which appeared on Thursday, Tan wrote he remains committed to Intel’s foundry ambitions, without explicitly endorsing Gelsinger’s strategy of making Intel a contract manufacturer.

“To enable great products, I am equally focused on creating great process technology, which is core to our strategy for building a world-class foundry,” he wrote.

"We are excited to begin high-volume production on Intel 18A at our newest fab in Arizona later this year and look forward to continued work with the US administration to strengthen the country’s technology and manufacturing leadership," he said. "While some companies are returning to the US or investing here for the first time, Intel never left — and we continue to expand our operations." ®

From Chip War To Cloud War: The Next Frontier In Global Tech Competition

The global chip war, characterized by intense competition among nations and corporations for supremacy in semiconductor ... Read more

The High Stakes Of Tech Regulation: Security Risks And Market Dynamics

The influence of tech giants in the global economy continues to grow, raising crucial questions about how to balance sec... Read more

The Tyranny Of Instagram Interiors: Why It's Time To Break Free From Algorithm-Driven Aesthetics

Instagram has become a dominant force in shaping interior design trends, offering a seemingly endless stream of inspirat... Read more

The Data Crunch In AI: Strategies For Sustainability

Exploring solutions to the imminent exhaustion of internet data for AI training.As the artificial intelligence (AI) indu... Read more

Google Abandons Four-Year Effort To Remove Cookies From Chrome Browser

After four years of dedicated effort, Google has decided to abandon its plan to remove third-party cookies from its Chro... Read more

LinkedIn Embraces AI And Gamification To Drive User Engagement And Revenue

In an effort to tackle slowing revenue growth and enhance user engagement, LinkedIn is turning to artificial intelligenc... Read more