The Challenges Intel Faces To Compete With TSMC, Samsung

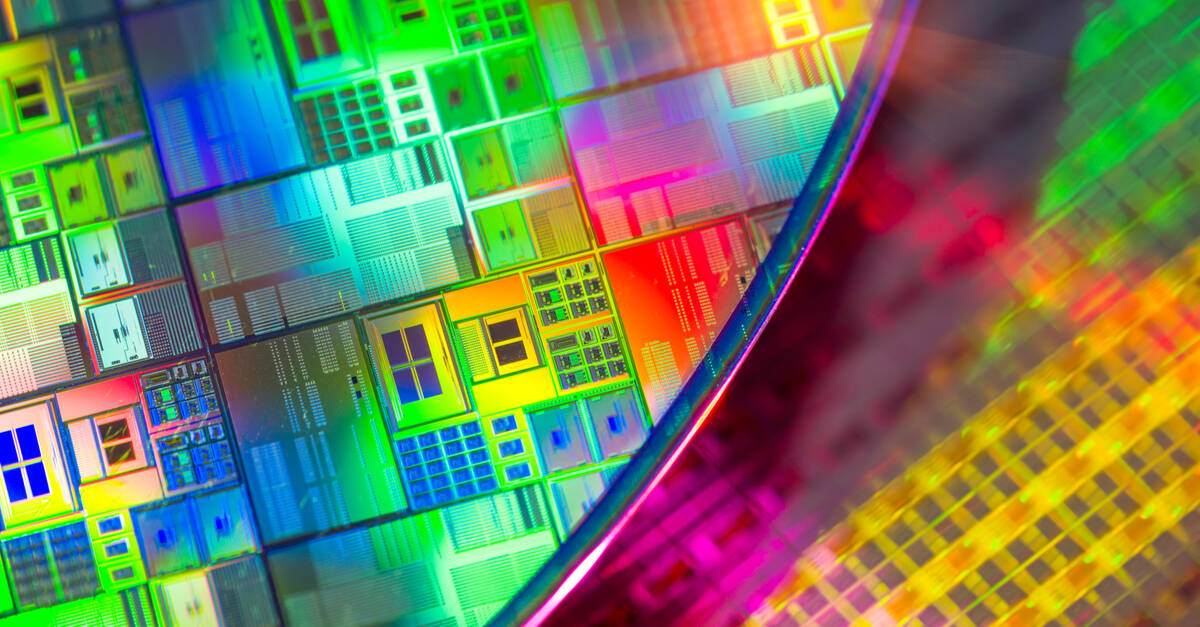

Analysis Ever since CEO Pat Gelsinger announced Intel was opening its fabs to contract manufacturing, the question has been: for whom?

Who was going to pay to have their chips made by an American giant with such a spotty reputation for execution and whose process tech has been not only falling behind TSMC and Samsung, but even Intel's own roadmaps at that?

At Computex last month, Nvidia CEO Jensen Huang revived the question, reminding reporters his GPU giant was open to the idea of using Intel's assembly lines; Huang said as much this time last year.

To be clear, Intel Foundry Services (IFS) – which wants to make chips for all kinds of customers, just like TSMC, Samsung, and UMC do – has won some victories in the two years since it was introduced, just not for the kinds of process tech that grabs headlines. Last summer, MediaTek announced it would use Intel to fabricate some chips on a 22nm node.

But for a company like Nvidia, which is currently building chips on TSMC's N4 process, Intel's six-year-old tech isn't going to cut it, and it's hard to say whether Intel's 7nm — now called Intel 4 — will be good enough either.

So while Huang's comments might have sounded like a renewed ringing endorsement for IFS, they're really a pragmatic statement about the nature of the semiconductor industry. Things change, so, why wouldn't he keep his options open?

While Nvidia's current generation of chips are largely manufactured by TSMC, that hasn't always been the case - the GeForce giant has a long history of working with Samsung. The whole advantage of being a fabless chipmaker is you can have your chips built by whomever you want. Who is to say Intel won't be leading the pack a few years from now? It's simply too soon to say.

That said, Intel has a lot of work ahead of it, if it seriously expects to compete with TSMC and Samsung any time in the near future.

Intel has fabs to build

As we've pointed out on multiple occasions, building a foundry business doesn't happen overnight. A single leading-edge fab can cost $10-15 billion and take more than four years to finish.

Intel's existing capacity was sized to meet its internal needs. To meet demands as a contract manufacturer, it needs to build fabs — lots of them.

To Intel's credit, it's already made good progress in this regard. The super-corp has broken ground on two factories at its Arizona campus, as well as a pair of fabs at its Ohio mega-site. Barring any delays, all four facilities are slated to come online sometime in 2025.

Intel has also figured out how to manage the cost of these facilities (sort of) even as its financials have taken a turn for the worse. On top of cutting billions in annual spending, Intel has convinced private-equity firm Brookfield Asset Management to cover $15 billion of its Arizona fab project. Factoring in higher-than expected costs, this works out to about half of the facility's build cost.

Intel has also had a bit of luck on its side. Last summer, after months of wrangling, and plenty of pleading on the part of Gelsinger, America's CHIPS and Science Act was signed into law, unlocking roughly $53 billion in funding for domestic semiconductor manufacturing. We estimated Intel could score as much as $7.5 billion from Uncle Sam. And earlier this year, the European Chip's Act was finalized, unlocking another $43 billion, though it remains to be seen how much of that Intel will actually walk away with.

While Intel has made progress in the US, it is still having trouble getting its Magdeburg, Germany fab funded, so clearly there's still work to be done.

- What to expect from AMD's June datacenter, AI shindig

- Intel mulls cutting ties to 16 and 32-bit support

- Intel says AI is overwhelming CPUs, GPUs, even clouds – so all Meteor Lakes get a VPU

- Intel abandons XPU plan to cram CPU, GPU, memory into one package

Intel still needs to commercialize a competitive process node

But four or five new fabs still won't do Intel much good if it doesn't have a competitive product to sell. Yes, Intel could churn out chips – like microcontrollers and simpler system-on-chips – on larger nodes, but then it'll have to compete against all the cheap contract factories out there doing the same. Chipzilla is, publicly at least, gunning for contracts for high-end, relatively expensive nodes and features, such as multi-die interconnects, stacking, and packaging.

Despite Intel's challenges bringing its 10nm and 7nm process nodes to market — we're still waiting for the latter — there's actually reason to be optimistic.

Intel has promised a couple of leading edge process nodes that are timed to launch alongside its shiny new fabs. Intel's 20A will see the chipmaker move away from nanometers as a naming convention in favor of ångströms. There are 10 ångströms in a nanometre, so the implication seems to be that it'll compete with rival fabs' 2nm process tech.

Of course, process naming has become pretty arbitrary since the move to finFET, so it's hard to say for sure. Intel's roadmap, for what it's worth, has 20A making its first appearance sometime at the end of 2024. The company plans to follow up shortly after with 18A and continue on from there.

If a jump from 7nm to 2nm — or 20A rather — in such a short timeframe seems like a lot, it might be because Intel isn't entirely responsible for the process tech. You see, back when Intel announced it was building two new fabs in Arizona, the company also entered into a vague development partnership with IBM.

In 2021 IBM showed off a 2nm manufacturing process it developed at its Albany, New York lab using a gate-all-around transistor design. Then, two months later, Intel made a near-identical announcement, but this time promising 20-ångström parts using the same transistor tech. Coincidence? Your humble vulture isn't convinced, especially not after GlobalFoundries named Intel and Japanese foundry startup Rapidus in a lawsuit alleging IBM licensed its 2nm chip-making tech without permission.

But in any case, it looks like Intel is just over a year away from having a truly competitive process node to not only power its own chips, but sell to others. That is, of course, unless things don't go to plan, like say a court order barring the x86 goliath from using the tech, or there's yet another technical hold-up.

Don't forget about cost

Even if Intel can build enough fabs and commercialize a competitive process node, it ultimately has to compete on cost. Unless your process tech is miles better than the competition, nobody is going to pay more for the privilege of using it.

This is perhaps the biggest unknown at this point. Intel will have at least one customer that can act as a showcase — for better or worse — of what their fabs are capable of: Intel.

On one hand, if their chips are good, that might be enough to convince chipmakers that fabbing their parts in Intel facilities is worth it, regardless of the cost. On the other, if Intel's chips aren't competitive the Silicon Valley stalwart faces serious problems.

Still, Intel-made chips could end up being more expensive simply because of where they're being made. TSMC founder Morris Chang has previously said that manufacturing chips at its US fab in Oregon was roughly 50 percent more expensive than at home in Taiwan.

But even if Intel's fabs aren't cost competitive, there may be one customer willing to pay any price for chips made in America by an American company: the good old US of A. Intel and the US government have a longstanding relationship after all and it has been awarded several exploratory contracts over the years to develop various emerging technologies under Defense Advanced Research Projects Agency, and the Department of Energy is using their chips in the long-delayed Aurora Supercomputer.

Intel may lean into these relationships to grow its foundry business in the early days. Whether or not it'll be enough for IFS to be successful, only time will tell. ®

From Chip War To Cloud War: The Next Frontier In Global Tech Competition

The global chip war, characterized by intense competition among nations and corporations for supremacy in semiconductor ... Read more

The High Stakes Of Tech Regulation: Security Risks And Market Dynamics

The influence of tech giants in the global economy continues to grow, raising crucial questions about how to balance sec... Read more

The Tyranny Of Instagram Interiors: Why It's Time To Break Free From Algorithm-Driven Aesthetics

Instagram has become a dominant force in shaping interior design trends, offering a seemingly endless stream of inspirat... Read more

The Data Crunch In AI: Strategies For Sustainability

Exploring solutions to the imminent exhaustion of internet data for AI training.As the artificial intelligence (AI) indu... Read more

Google Abandons Four-Year Effort To Remove Cookies From Chrome Browser

After four years of dedicated effort, Google has decided to abandon its plan to remove third-party cookies from its Chro... Read more

LinkedIn Embraces AI And Gamification To Drive User Engagement And Revenue

In an effort to tackle slowing revenue growth and enhance user engagement, LinkedIn is turning to artificial intelligenc... Read more