Now You've All Quit Buying RAM And Personal Gear, Chip Wafer Demand Stumbles

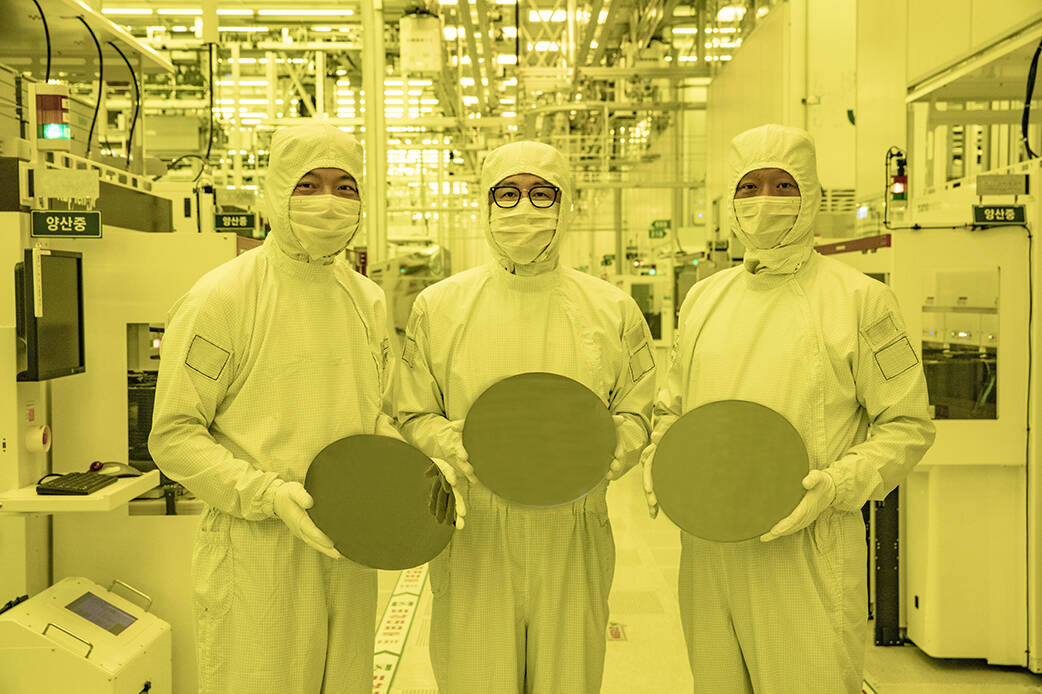

Worldwide shipments of silicon wafers slid nine percent during the first quarter of 2023 versus Q1 2021, and fell 11.3 percent from Q1 2022, the SEMI's Silicon Manufacturing Group's (SMG) reported this week.

Anna-Riikka Vuorikari-Antikainen, SMG chair, said the decline reflects in an overall softening semiconductor market in key, and very profitable, sectors.

"Memory and consumer electronics have seen the largest drops in demand while the market for automotive and industrial applications remains more stable," she said.

Silicon wafer shipments have enjoyed sequential growth over the past two years, particularly during the height of the COVID-related semiconductor shortage, according to SEMI. However the trend came to an abrupt halt during the fourth quarter of 2022 as global demand for chips plummeted across multiple industries, particularly in the consumer sector.

This trend continued into Q1, where several chipmakers, including Intel, AMD, Samsung, and SK hynix blamed weak demand on declining revenues and profit shortfalls. Based on SEMI's findings these trends are starting to trickle down to not only wafer shipments but fab equipment.

According to the group's latest figures, shipments of both polished and unpolished silicon wafers have contracted by 475 million square inches over the past two quarters. Meanwhile, fab equipment spending is projected to fall 22 percent in 2023.

The decline shouldn't come as a surprise to anyone who's been following the foundry operators' financials. Memory vendors in particular have taken a beating over the past year as inventory levels of DRAM and NAND flash have reached all-time highs, dragging down the selling price and forcing corrective measures.

- As wafer demand dries up, foundry revenues head for a cliff, we all celebrate

- TSMC revenues slide for the first time in four years

- Don't get in a semiconductor 'doom spiral' – sector will be back with a bang in 2024

- US chipmakers don't want to be locked out of industry's biggest market: China

As we reported last summer, memory vendors have been ringing the warning bells for months now. In June last year, CEO Sanjay Mehrotra told investors that some customers were paring back their memory and storage inventories. It later turned out that "some customers" really meant most customers.

Since then the situation has only grown more dire. In March Micron reported $2.3 billion loss during its second quarter of its 2023 fiscal year. And while Samsung fared better, it still saw its profits plunge 95 percent from the previous year to $478.5 million, their lowest since 2009.

And it's not just memory. Last month TSMC, the world's largest high-end chip manufacturer, saw its revenues decline for the first time in four years, with the company warning the investors the situation was unlikely to improve anytime soon.

While SEMI didn't provide a forecast for future shipments, earlier this year the industry watchers at TrendForce predicted that foundry revenues would fall in line with wafer demand and as geopolitical conflict drives chipmakers out of China.

Despite this trend, Gartner's Richard Gordon sees some light at the end of the tunnel. Last month the analyst forecast that chip revenues would rebound in 2024 and grow by as much as 18 percent. ®

From Chip War To Cloud War: The Next Frontier In Global Tech Competition

The global chip war, characterized by intense competition among nations and corporations for supremacy in semiconductor ... Read more

The High Stakes Of Tech Regulation: Security Risks And Market Dynamics

The influence of tech giants in the global economy continues to grow, raising crucial questions about how to balance sec... Read more

The Tyranny Of Instagram Interiors: Why It's Time To Break Free From Algorithm-Driven Aesthetics

Instagram has become a dominant force in shaping interior design trends, offering a seemingly endless stream of inspirat... Read more

The Data Crunch In AI: Strategies For Sustainability

Exploring solutions to the imminent exhaustion of internet data for AI training.As the artificial intelligence (AI) indu... Read more

Google Abandons Four-Year Effort To Remove Cookies From Chrome Browser

After four years of dedicated effort, Google has decided to abandon its plan to remove third-party cookies from its Chro... Read more

LinkedIn Embraces AI And Gamification To Drive User Engagement And Revenue

In an effort to tackle slowing revenue growth and enhance user engagement, LinkedIn is turning to artificial intelligenc... Read more