Now Middle East Nations Banned From Getting Top-end Nvidia AI Chips

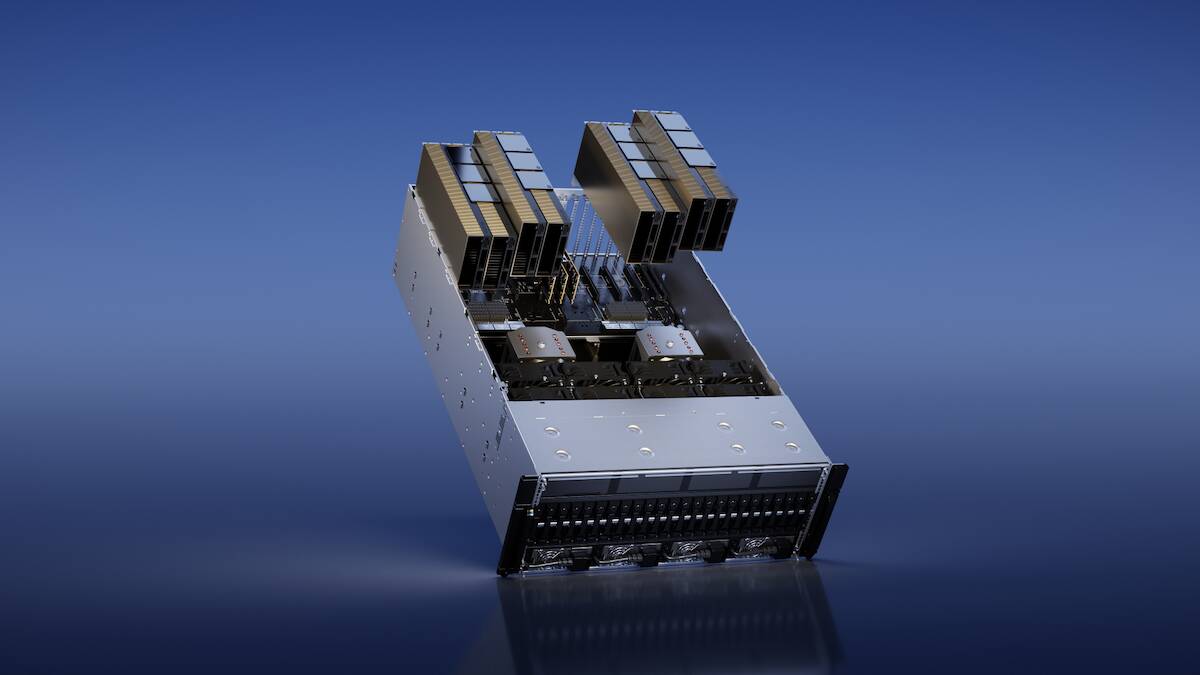

You can add parts of the Middle East to the list of regions where you can't buy Nvidia's top-specced A100 and H100 accelerators, judging from a regulatory filing by the chip designer for investors this week.

Which countries made the list wasn't specified in the regulatory filing [PDF]. With that said, it's not unusual for US regulators to alert companies likely to be impacted by imminent trade restrictions ahead of time.

In a statement to The Register, a US Bureau of Industry Spokesperson told us “the administration has not blocked chip sales to the Middle East.”

The government agency doesn't ban chip exports to China, either, but it does restrict sales into the Middle Kingdom. It didn’t address our questions regarding the export restrictions cited in Nvidia’s SEC filing, stating that the agency was “not in a position to confirm or deny any company-specific actions.”

Nvidia's filing comes just weeks after reports surfaced that Saudi Arabia and the United Arab Emirates were buying up thousands of Nvidia H100s. Given the United States' military support of and ties to Saudi Arabia it seems unlikely that nation would be the target of US restrictions.

However, in January, Reuters reported that Brian Nelson, the US Treasury's undersecretary for terrorism and financial intelligence, warned UEA and Turkish officials that if they didn't clampdown on Russian attempts to circumvent sanctions, they could find themselves cut off from American suppliers. Perhaps the latest export limits are aimed more at stopping the Kremlin from getting its hands on US tech.

While Nvidia is among the first to acknowledge the restrictions, it's unlikely they're limited to just one chipmaker.

Export controls on the sale of AI chips to China, implemented last October by the Biden administration placed limits on the interconnect bandwidth of accelerators. Since large AI training workloads typically require meshing tens or even hundreds of GPUs together, limiting their interconnect bandwidth effectively nerfs their performance at scale. The decision effectively barred the sale of Nvidia, AMD, and Intel's top-specced GPUs and accelerators in the region.

We've reached out to Intel and AMD for comment; we'll let you know if we hear anything back.

In the wake of the restrictions, several US chipmakers introduced cut down products that weren't subject to the export restrictions. Nvidia for instance developed the A800 and H800 GPUs for the Chinese market. The company has reportedly received orders for more than $1 billion worth of these cards and expected to sell another $4 billion GPUs to Chinese web giants next year.

- US and China to keep talking about chip bans, just not when they'll end

- China cooks covert chips, recruits global geeks to dodge US restrictions

- Arm reveals just how vulnerable it is to trade war with China

- US tech titans say a heads-up about India's PC import license would've been nice

Intel has also launched a China-specific version of its Habana Gaudi2 AI chip and AMD in its most recent earnings call revealed it's willing to jump through Uncle Sam's hoops and develop parts for China and other restricted regions.

The availability of lower performance, export-compliant chips may be why Nvidia doesn't seem to be that worried about the new restrictions, which it says shouldn't have an immediate impact on its financial results. However, in the filing, the graphics processor giant warned that should the US pursue tighter restrictions on the sale of GPUs outside of America, it could prove costly.

"Any future transitions could be costly and time consuming, and adversely affect our research and development and supply and distribution operations, as well as our revenue, during any such transition period," the biz said.

And this is a distinct possibility: several US lawmakers have called on the Biden administration to enact tighter controls on the sale of AI accelerators abroad. In particular they think the performance limits don't go far enough.

ASML says it won't cease exports of DUV kit to China until next year

While US chip houses grapple with revised export restrictions, Dutch semiconductor equipment manufacturer ASML claims it can keep selling deep ultraviolet lithography machines to China through the end of the year, despite restrictions on the sale of the equipment going into effect tomorrow.

"The Dutch licensing authorities have issued the licenses we need as of September 1, to be able to continue shipments of the NXT:2000i and subsequent systems this year," an ASML spokesperson told The Register.

We're told the extension will allow ASML to comply with existing contract obligations with Chinese customers. However after January the manufacturer doesn't expect to be able to continue selling the machines.

"Our customers are aware of the export control regulations, so, they know that as of January 1, 2024, it is unlikely we will receive export licenses for these systems for shipment to domestic Chinese customers," the spokesperson said.

While ASML is already barred from selling its most advanced extreme ultraviolet lithography EUV machines to China, the country has come under pressure from the US and allies to restrict the sale of older DUV equipment. In March, the Dutch government formally joined US efforts to block Chinese access to the machines and software essential to growing the Middle Kingdom's semiconductor manufacturing capabilities.

While no longer the most advanced chipmaking equipment out there, DUV machines still command multi-million dollar price tags. Despite the loss of business the equipment maker doesn't expect the restrictions will have a significant impact on its financials long term. ®

From Chip War To Cloud War: The Next Frontier In Global Tech Competition

The global chip war, characterized by intense competition among nations and corporations for supremacy in semiconductor ... Read more

The High Stakes Of Tech Regulation: Security Risks And Market Dynamics

The influence of tech giants in the global economy continues to grow, raising crucial questions about how to balance sec... Read more

The Tyranny Of Instagram Interiors: Why It's Time To Break Free From Algorithm-Driven Aesthetics

Instagram has become a dominant force in shaping interior design trends, offering a seemingly endless stream of inspirat... Read more

The Data Crunch In AI: Strategies For Sustainability

Exploring solutions to the imminent exhaustion of internet data for AI training.As the artificial intelligence (AI) indu... Read more

Google Abandons Four-Year Effort To Remove Cookies From Chrome Browser

After four years of dedicated effort, Google has decided to abandon its plan to remove third-party cookies from its Chro... Read more

LinkedIn Embraces AI And Gamification To Drive User Engagement And Revenue

In an effort to tackle slowing revenue growth and enhance user engagement, LinkedIn is turning to artificial intelligenc... Read more