JPMorgan Latest To Pile Into Quantum Upstart With $5B Valuation

The wave of generative AI may have captured the world's attention, but that hasn't stopped the flow of capital into quantum computing as JPMorgan Chase and others plow more cash into the emerging tech.

The banking giant, along with Mitsui & Co. and Amgen injected $300 million into Honeywell-backed quantum computing startup Quantinuum to accelerate development of a "universal fault-tolerant quantum computer" and the requisite software to commercialize such a machine.

Launched in late 2021, Quantinuum has already raised $625 million, and with this latest cash infusion, the company's valuation now tops $5 billion.

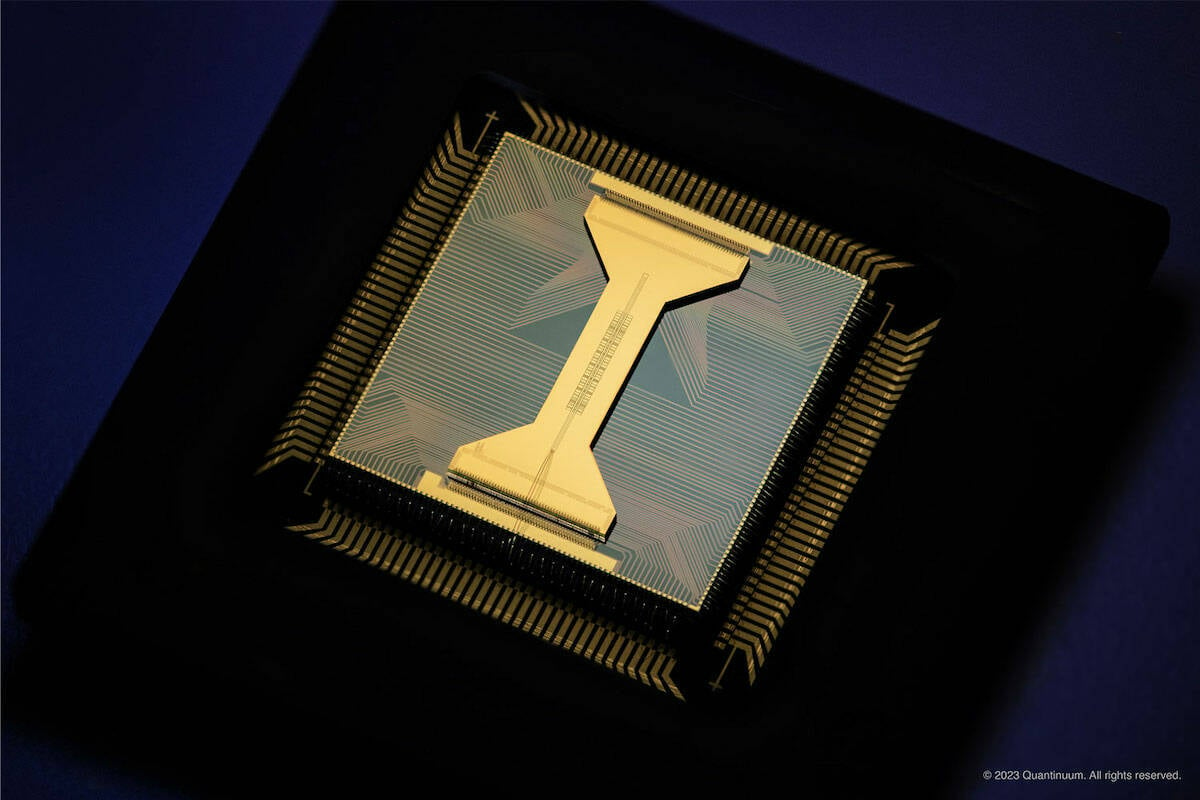

The upstart is the result of a merger between Cambridge Quantum and Honeywell Quantum Solutions. Since then Quantinuum has gone on to develop the H-series of trapped-ion quantum computers.

This particular breed of quantum systems utilizes electromagnetic fields to suspend charged particles in free space. Qubits — the base unit of compute for these quantum systems — are then stored in the electronic state of each ion while operations are performed using lasers.

Quantinuum's H1 system can wrangle up to 20 trapped ion qubits. While that might not sound like a lot next to competing systems like IBM's 433 qubit Osprey system, more doesn't always translate into higher performance or greater capability. We're told factors like decoherence and the quality of the qubits themselves often plays a bigger role than quantity.

JPMorgan Chase was an early customer of Quantinuum and its predecessors quantum systems, including its H-series systems, going back to 2020.

"Financial services has been identified as one of the first industries that will benefit from quantum technologies," said Lori Beer, global CIO for JPMorgan Chase, in a statement. "As such, we have been investing in quantum research and our team of experts – led by Dr. Marco Pistoia – have made groundbreaking discoveries, partnering with quantum computing leaders like Quantinuum."

As we've seen in the fintech arena with things like FPGAs, only a narrow advantage over conventional systems is required to generate profits and therefore justify the investment.

JPMorgan, for its part, is already investigating ways to do just that. In a paper published by the financial institution last summer, researchers explored the application of future fault tolerant quantum systems on optimization problems.

The idea here was to use quantum systems to optimize investment portfolios while also accounting for the litany of regulatory constraints. These exercises were then applied as part of a proof of concept on Quantinuum's H-series accelerators, though it appears fault tolerant — that is to say error correcting — quantum systems will be required to fully realize an advantage.

- Quantum computing eggheads throw some other qubits at the wall to see what sticks

- IBM takes a crack at 'utility scale' quantum processing with Heron processor

- Alibaba shuts down quantum lab, donates it to university

- Quantum computing next (very) cold war? US House reps want to blow billions to outrun China

JPMorgan Chase is not the only major company investing in quantum computing. Toyota, Hyundai, BBVA, BSAF, and ExxonMobil represent just a handful of enterprises which have thrown their weight behind quantum startups to help develop new materials, optimize routes, or reduce investment risk.

Meanwhile, over the past year or so, quantum has enjoyed growing interest among government and research institutions. Quantinuum recently announced Japan's Riken would deploy an H1 system alongside a superconducting quantum system developed by Fujitsu at a research center in Wako.

In the US, the government is pouring significant funding into the technology with a push to do more. Early last year the Defense Advanced Research Projects Agency (DARPA) launched the Underexplored Systems for Utility-Scale Quantum Computing (US2QC) to accelerate development of quantum systems. The idea being that if a quantum system has world altering implications —running a zipper down existing cryptographic algorithms for example — Uncle Sam would really like to do it first.

More recently, the US House Committee on Science, Space, and Technology put forward a bill that, if passed, would direct roughly $3 billion of dollars into quantum research and development over the next four years. ®

From Chip War To Cloud War: The Next Frontier In Global Tech Competition

The global chip war, characterized by intense competition among nations and corporations for supremacy in semiconductor ... Read more

The High Stakes Of Tech Regulation: Security Risks And Market Dynamics

The influence of tech giants in the global economy continues to grow, raising crucial questions about how to balance sec... Read more

The Tyranny Of Instagram Interiors: Why It's Time To Break Free From Algorithm-Driven Aesthetics

Instagram has become a dominant force in shaping interior design trends, offering a seemingly endless stream of inspirat... Read more

The Data Crunch In AI: Strategies For Sustainability

Exploring solutions to the imminent exhaustion of internet data for AI training.As the artificial intelligence (AI) indu... Read more

Google Abandons Four-Year Effort To Remove Cookies From Chrome Browser

After four years of dedicated effort, Google has decided to abandon its plan to remove third-party cookies from its Chro... Read more

LinkedIn Embraces AI And Gamification To Drive User Engagement And Revenue

In an effort to tackle slowing revenue growth and enhance user engagement, LinkedIn is turning to artificial intelligenc... Read more