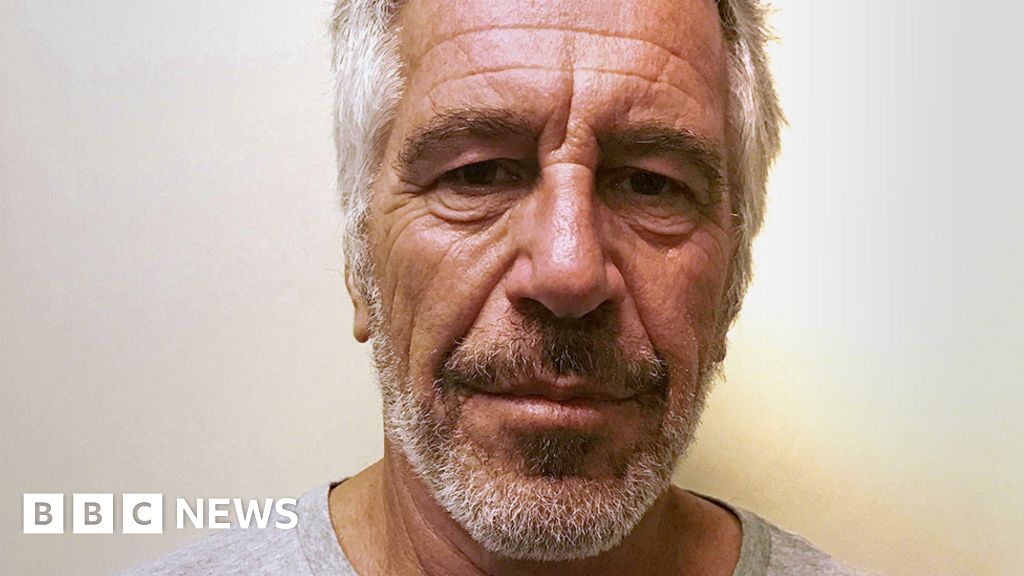

JP Morgan Agrees To Pay $290m To Settle Lawsuit Brought By Jeffrey Epstein Victims

JP Morgan has agreed to pay roughly $290m (£232m) to settle a lawsuit brought on behalf of alleged victims of convicted sex offender Jeffrey Epstein.

Attorneys for the bank said it was "in the best interests of all parties, especially the survivors who were the victims of Epstein's terrible abuse".

The lawsuit had alleged the largest US bank ignored warning signs about its client during a 15-year relationship.

The agreement is subject to court approval.

JPMorgan Chase will not admit liability in the case, but upon the settlement's approval the bank will put out a statement regretting its association with Epstein, David Boies, one of the victims' attorneys, told CNN.

"We all now understand that Epstein's behaviour was monstrous," lawyers for the bank said in a statement on Monday.

"Any association with him was a mistake and we regret it. We would never have continued to do business with him if we believed he was using our bank in any way to help commit heinous crimes."

The settlement follows weeks of embarrassing revelations about the extent of JP Morgan's relationship with the late financier.

Late last month, long-time chief executive Jamie Dimon provided a formal statement under oath for the case, in what turned out to be a day-long deposition from the bank's headquarters in New York.

Lawyers representing the unnamed accuser who filed the suit - identified only as Jane Doe 1 - asked a federal judge on Friday to allow them to take new testimony from Mr Dimon.

They also asked to reopen depositions for three other key witnesses in the case.

Another lawsuit filed against the bank late last year in federal court is still pending. That case was brought on behalf of the government of the US Virgin Islands, where Epstein owned a private island with a mansion.

The financier kept hundreds of millions of dollars in more than 50 accounts at JP Morgan between 1998 and 2013, five years after he pleaded guilty to soliciting a minor for prostitution.

He was found dead at the age of 66 in a prison cell in 2019. New York City's medical examiner ruled the death a suicide.

The Jane Doe 1 lawsuit said that JP Morgan "knowingly facilitated, sustained and concealed" the frequent cash withdrawals Epstein made to pay the young women he trafficked, while profiting from the deals and clients that the financier brought in.

The bank, which earlier failed to dismiss the dual suits, has countered that any civil liability should rest with Jes Staley, a former top executive who befriended Epstein.

Mr Staley has said his former employer is trying to "deflect blame" for its own failures and sought to dismiss the claims, but the complaint against him remains active.

Last month, Deutsche Bank, where Epstein was a client after he left JP Morgan in 2013, settled for $75m with Epstein accusers.

To date, the Epstein estate has paid out more than $150m to more than 100 of his victims.

From Chip War To Cloud War: The Next Frontier In Global Tech Competition

The global chip war, characterized by intense competition among nations and corporations for supremacy in semiconductor ... Read more

The High Stakes Of Tech Regulation: Security Risks And Market Dynamics

The influence of tech giants in the global economy continues to grow, raising crucial questions about how to balance sec... Read more

The Tyranny Of Instagram Interiors: Why It's Time To Break Free From Algorithm-Driven Aesthetics

Instagram has become a dominant force in shaping interior design trends, offering a seemingly endless stream of inspirat... Read more

The Data Crunch In AI: Strategies For Sustainability

Exploring solutions to the imminent exhaustion of internet data for AI training.As the artificial intelligence (AI) indu... Read more

Google Abandons Four-Year Effort To Remove Cookies From Chrome Browser

After four years of dedicated effort, Google has decided to abandon its plan to remove third-party cookies from its Chro... Read more

LinkedIn Embraces AI And Gamification To Drive User Engagement And Revenue

In an effort to tackle slowing revenue growth and enhance user engagement, LinkedIn is turning to artificial intelligenc... Read more