Intuit Ordered To Use The Word 'free' Less Freely In Its Ads

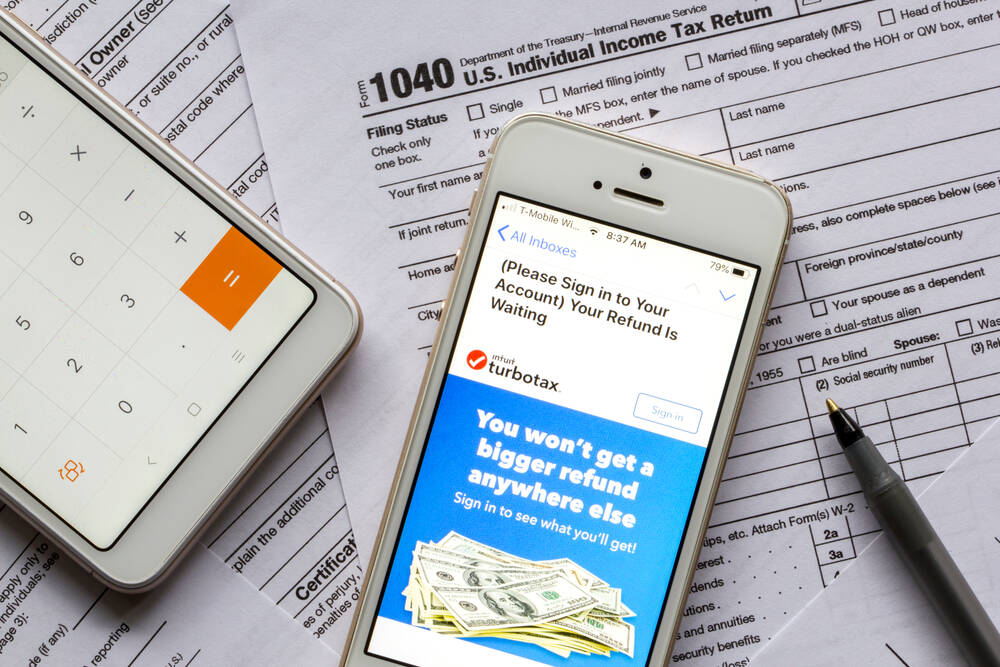

Intuit, the maker of TurboTax, is no longer free to tout its tax filing software as "free" when it isn't free to most customers.

America's Federal Trade Commission on Monday – in time for the annual tax season – said the financial software maker engaged in deceptive advertising when it ran ads for "free" tax products and services that most users were in fact ineligible to use. Though Intuit offered various defenses for its marketing claims, the FTC dismissed these as lacking merit – and ordered the corporation to stop tricking people with offers of free stuff that isn't actually free.

The watchdog's order [PDF] states that Intuit "must not represent that a good or service is 'free' unless" it's available to all taxpayers, or the percentage of those eligible for free use is conspicuously disclosed.

Essentially, people were lured into using TurboTax on the promise the filing software would be free for them to use, only to discover they're not really eligible for the free version, due to their circumstances, and with their personal info all entered and ready to go, they find themselves pressured into using a paid-for TurboTax offering.

The FTC vowed to take Intuit to task over its advertising in March 2022, when legal wrangling over the cost of the developer's "free" software had already been underway for several years.

In 2019, the Los Angeles City Attorney, the County Counsel for the County of Santa Clara, California, and other plaintiffs filed separate lawsuits against Intuit alleging unfair and deceptive marketing of TurboTax. That led to an investigation by assorted State Attorneys General. In May 2022, Intuit agreed to pay $141 million in restitution to customers in 50 states who were charged for tax software they believed was free.

That deal, overseen by New York Attorney General Letitia James, required Intuit "suspend TurboTax’s 'free, free, free' ad campaign that lured customers with promises of free tax preparation services, only to deceive them into paying."

As documented in the FTC opinion [PDF], Intuit for years has promoted various tax software products and services as free while hiding disclaimers in small print.

"During TY 2018-2021, Intuit ran its 'free, free, free' campaign featuring television ads enacting various scenarios in which nearly every word spoken by the actors was the word 'free,' except for a voice-over at the end of the advertisement," the FTC document states, citing a 30-second "Game Show" ad in which participants said the word "free" about 35 times.

- HP sued over use of forfeited 401(k) retirement contributions

- Users accuse Intuit of 'heavy-handed' support changes on QuickBooks for Desktop

- Intuit pulls QuickBooks from India, uncomfortably quickly

- TurboTax to pay $141m to settle claims it scammed millions of people

The FTC opinion further notes that Intuit's own internal documents describe deluging ad viewers with the word "free" to beguile them: "As one Intuit document described these ads and their impact, 'Consistent, unwavering use of the word "free" throughout captivates viewers as they make sense of the bizarre single word worlds.'"

Despite its fetishization of "free," Intuit limited its no-payment offer to taxpayers who have "simple tax returns," a term that, according to the FTC, Intuit defined differently at different times.

"Most taxpayers do not have 'simple tax returns,' as defined by Intuit, and thus do not qualify to file for free using Free Edition," the FTC opinion says, and it cites various customer complaints about Intuit's manic use of "free."

For example, one customer comment captured by third-party partner Bazaarvoice, said, "Your TV commercials are a big lie, this company should be put out of business for deceptive practices. Free, free, free, yes right $154.00 to file this return, Free, free, free."

Intuit, perhaps inspired by ad maximalist Meta's recent effort to kneecap the FTC, responded by apologizing and promising to do better challenging the legitimacy of the watchdog agency. The software maker is upset about the way the watchdog, using its regulatory powers under the FTC Act, issues decisions against organizations like Intuit, and signaled it hopes to ultimately triumph against its critics.

"Absolutely no one should be surprised that FTC commissioners – employees of the FTC – ruled in favor of the FTC as they have done in every appeal for the last two decades," a spokesperson told The Register in an email.

"This decision is the result of a biased and broken system where the commission serves as accuser, judge, jury, and then appellate judge all in the same case. Intuit has appealed this deeply flawed decision, and we believe that when the matter ultimately returns to a neutral body Intuit will prevail."

Meanwhile, the US Internal Revenue Service is preparing to join the modern world with the roll out of Direct File, which "will allow eligible taxpayers to file their taxes online, for free, directly with the IRS." ®

From Chip War To Cloud War: The Next Frontier In Global Tech Competition

The global chip war, characterized by intense competition among nations and corporations for supremacy in semiconductor ... Read more

The High Stakes Of Tech Regulation: Security Risks And Market Dynamics

The influence of tech giants in the global economy continues to grow, raising crucial questions about how to balance sec... Read more

The Tyranny Of Instagram Interiors: Why It's Time To Break Free From Algorithm-Driven Aesthetics

Instagram has become a dominant force in shaping interior design trends, offering a seemingly endless stream of inspirat... Read more

The Data Crunch In AI: Strategies For Sustainability

Exploring solutions to the imminent exhaustion of internet data for AI training.As the artificial intelligence (AI) indu... Read more

Google Abandons Four-Year Effort To Remove Cookies From Chrome Browser

After four years of dedicated effort, Google has decided to abandon its plan to remove third-party cookies from its Chro... Read more

LinkedIn Embraces AI And Gamification To Drive User Engagement And Revenue

In an effort to tackle slowing revenue growth and enhance user engagement, LinkedIn is turning to artificial intelligenc... Read more