Global Semiconductor Revenues Slid 11 Percent In 2023, Despite AI Silicon Splurge

2023’s copious chatter about generative AI has not translated into surging semiconductor revenues across the industry, according to analyst firm Gartner.

Dismal memory revenues, exacerbated by excess inventories and slow demand, saw total semiconductor revenue slide about 11 percent compared to 2022, Gartner reported on Tuesday.

"While the cyclicality in the semiconductor industry was present again in 2023, the market suffered a difficult year with memory revenue recording one of the worst declines in history," Gartner analyst Alan Priestley said in a statement. "The underperforming market also negatively impacted several semiconductor vendors. Only nine of the top 25 semiconductor vendors posted revenue growth in 2023, with 10 experiencing double digit declines."

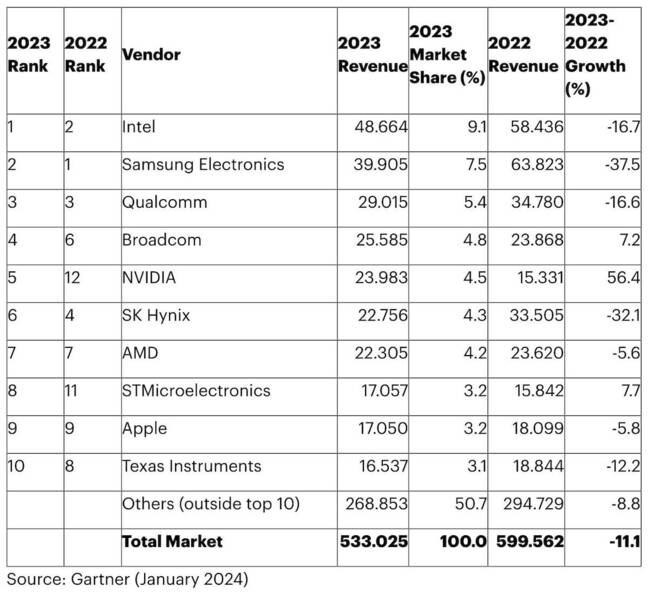

Intel reclaimed it's number one spot over Samsung for the first two years, but Nvidia was the clear winner. - Click to enlarge

Memory sales may have suffered the most in 2023, but that's not to say AI didn't drive revenues across the semi sector.

Nvidia — by far the largest producer of semiconductors for AI applications — saw explosive revenue growth, surging 56 percent to $24 billion. This put the chipmaker squarely in the top five largest semiconductor vendors in the world, Gartner reported.

The weak memory arena also paid dividends for Intel, which exited the NAND flash market years ago.

In terms of overall semiconductor-derived revenue, Chipzilla regained top place from Samsung for the first time in two years. However, it's not because Intel's revenues grew in 2023. According to Gartner, the x86 giant's annual revenues actually fell 16.7 percent from 2022 to $48.7 billion. Instead, Intel simply bled less cash in 2023 than Samsung, an outcome likely helped by drastic spending cuts implemented in late 2022 by CEO Pat Gelsinger.

Samsung, the largest producer of NAND and DRAM memory, saw its revenues slide 37.5 percent last year to just shy of $40 billion. SK Hynix fared better as it endured a mere 32 percent revenue drop, to $33.5 billion.

- NVMe consortium polishes its specs to support computational storage

- STMicroelectronics slims to be lean, mean, chipmaking machine

- 2024 sure looks like an exciting year for datacenter silicon

- Chip wars could lead to oversupply as China increases domestic capacity

"Unlike memory vendors, most non-memory vendors experienced a relatively benign pricing environment in 2023," Gartner's Joe Unsworth said in a release. "The demand for non-memory semiconductors for AI applications was the strongest growth driver, with the automotive sector — especially electric vehicles — defense, and aerospace industries, also outperforming most other application segments."

Speaking of the automotive sector, STMicroelectronics enjoyed a 7.7 percent boost in revenues, which Gartner attributed to increased demand for electric vehicles.

As we reported last summer, STMicro is one to watch as alongside partner GlobalFoundries it is working on a fab project in France to produce chips using fully-depleted silicon on insulator (FD-SOI) technology, a technology that promises low power consumption and impressive speed. The tech has applications in a number of fields, including industrial, IoT, and automotive applications. STMicro has also invested heavily in the production of silicon carbide and gallium-nitride semiconductors used in EV power units. ®

From Chip War To Cloud War: The Next Frontier In Global Tech Competition

The global chip war, characterized by intense competition among nations and corporations for supremacy in semiconductor ... Read more

The High Stakes Of Tech Regulation: Security Risks And Market Dynamics

The influence of tech giants in the global economy continues to grow, raising crucial questions about how to balance sec... Read more

The Tyranny Of Instagram Interiors: Why It's Time To Break Free From Algorithm-Driven Aesthetics

Instagram has become a dominant force in shaping interior design trends, offering a seemingly endless stream of inspirat... Read more

The Data Crunch In AI: Strategies For Sustainability

Exploring solutions to the imminent exhaustion of internet data for AI training.As the artificial intelligence (AI) indu... Read more

Google Abandons Four-Year Effort To Remove Cookies From Chrome Browser

After four years of dedicated effort, Google has decided to abandon its plan to remove third-party cookies from its Chro... Read more

LinkedIn Embraces AI And Gamification To Drive User Engagement And Revenue

In an effort to tackle slowing revenue growth and enhance user engagement, LinkedIn is turning to artificial intelligenc... Read more