Get Your Cheap Memory While Growing Stockpiles Push Prices Low

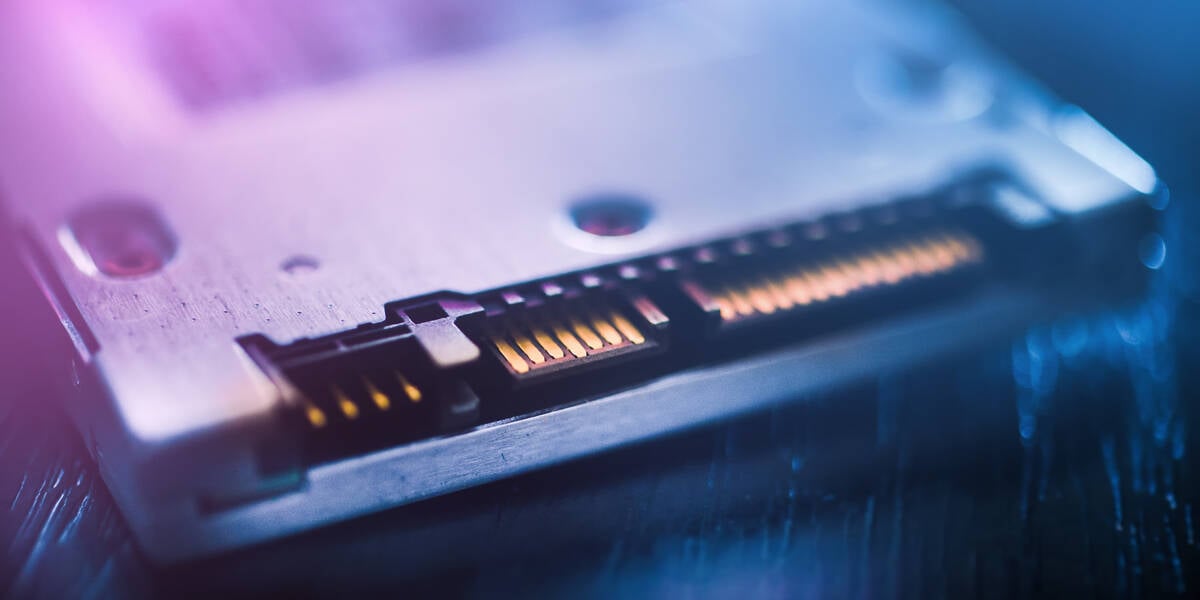

Semiconductor stockpiles appear to be growing due to the slowdown in demand, which is bad news for chipmakers but could be good news for anyone in the market for a memory or SSD upgrade.

According to Bloomberg, South Korea’s semiconductor inventory rose by 83 percent in April compared with a year earlier, said to be the largest increase in about 7 years. At the same time, factory shipments fell 33 percent year-on-year while production has been cut by 20 percent, according to figures from the national Statistics Korea agency.

This is significant because Korea is home to two of the three major global memory suppliers, Samsung and SK hynix, with Micron in the US making up the third. The health or otherwise of Korea’s semiconductor industry can thus be viewed as a proxy for the worldwide demand for electronic devices.

This is backed up by market intelligence outfit TrendForce, which recently said there was a significant 21.2 percent drop in revenues for all DRAM manufacturers during the first quarter of 2023, with average selling price (ASP) falling for those three major suppliers. It blames “an enduring oversupply issue”, as the chief culprit behind the decline in pricing.

In response to this, the three major suppliers have implemented production cuts, with utilization of manufacturing capacity expected to fall to 77 percent for Samsung, 74 percent for Micron, and 82 percent for SK hynix.

In a separate report, TrendForce said that production cuts to DRAM and the NAND flash used in storage have not kept pace with weakening demand, and predicted that the ASP of some products will decline further; DRAM prices by 13 to 18 percent, and NAND flash by 8 to 13 percent.

The significant drop in DRAM prices was largely due to high inventory levels of DDR4 and LPDDR5, while the market share for DDR5 remains relatively low, the analyst reported.

However, NAND flash is chiefly affected by price drops in enterprise SSDs and Universal Flash Storage (UFS), with these product categories accounting for over half of total NAND Flash consumption, according to TrendForce, plus there is still oversupply in this sector.

- Uncle Sam vows to Micron-manage China's memory chip ban

- Since when did my SSD need water cooling?

- Look mom, no InifiniBand: Nvidia's DGX GH200 glues 256 superchips with NVLink

- AMD scours parts bin for old CPUs, GPUs to put in Chromebooks

Demand for enterprise SSDs, however, is expected to grow in the second half of 2023 in response to new platforms being released, TrendForce predicts.

Buyers should probably take advantage of falling prices while they can, because the cyclical nature of the semiconductor market and memory in particular, means that demand will pick up again and once those stockpiles are exhausted, prices will start to rise once more.

According to forecasts by Gartner, the memory market is likely to “bounce back with a vengeance” next year, and the company recently predicted that memory companies will enjoy a 70 percent growth in revenue in 2024 off the back of demand pushing up prices.

The bounceback could even come sooner, thanks to the renewed interest in AI applications caused by the introduction of new and more capable models like OpenAI's ChatGPT.

According to Bloomberg, Netherlands-based ASM International reports that the impact on its sales from US chip export controls against China has been offset by increased demand for chips because of AI.

Meanwhile, GPU maker Nvidia briefly joined the ranks of companies with a more than $1 trillion valuation in this past week, as its share price shot up following forecasts of strong demand for its products to accelerate AI processing. ®

From Chip War To Cloud War: The Next Frontier In Global Tech Competition

The global chip war, characterized by intense competition among nations and corporations for supremacy in semiconductor ... Read more

The High Stakes Of Tech Regulation: Security Risks And Market Dynamics

The influence of tech giants in the global economy continues to grow, raising crucial questions about how to balance sec... Read more

The Tyranny Of Instagram Interiors: Why It's Time To Break Free From Algorithm-Driven Aesthetics

Instagram has become a dominant force in shaping interior design trends, offering a seemingly endless stream of inspirat... Read more

The Data Crunch In AI: Strategies For Sustainability

Exploring solutions to the imminent exhaustion of internet data for AI training.As the artificial intelligence (AI) indu... Read more

Google Abandons Four-Year Effort To Remove Cookies From Chrome Browser

After four years of dedicated effort, Google has decided to abandon its plan to remove third-party cookies from its Chro... Read more

LinkedIn Embraces AI And Gamification To Drive User Engagement And Revenue

In an effort to tackle slowing revenue growth and enhance user engagement, LinkedIn is turning to artificial intelligenc... Read more