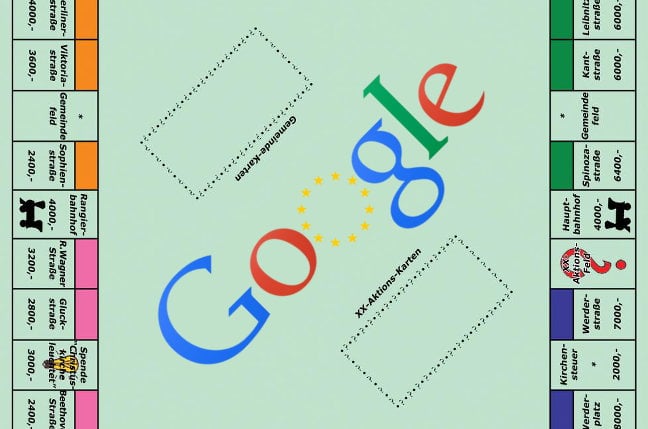

Europe Teases Breaking Up Google Over Ad Monopoly

The European Commission (EC) believes Google may be violating antitrust rules by favoring its own ad tools at the expense of competitors and is considering whether it will have to break up the company to end the alleged self-preferencing.

"Google controls both sides of the adtech market: sell and buy," said Margrethe Vestager, European Commissioner for Competition, via Twitter. "We are concerned that it may have abused its dominance to favor its own AdX platform. If confirmed, this is illegal, [the European Commission] might require Google to divest part of its services."

If so. It might. Maybe. It's been 14 years since London-based shopping site Foundem accused Google of abusing its dominant market position in a complaint to the European Commission and not much has changed.

The EC in 2017 fined Google €2.42 billion for violating antitrust rules for favoring its own products in Google Shopping. The company earned $110.9 billion that year. And then three years later, a coalition of 165 internet companies penned a letter to the EU arguing that Google continues to abuse its dominant position.

The EC in 2018 took similar steps to end antitrust abuses in Google's Android business. This time the fine was €4.34 billion. So, yeah. There's that.

There have been some other high-profile antitrust cases filed against Google and its ad business, notably the lawsuit filed by the US Justice Department and 11 states in October 2020, which lately has been dealing with accusations that Google destroyed evidence.

The EU's latest attempt to bring Google to heel is focused on the ad giant's supposed habit of steering business to its own ad exchange, AdX.

Google operates ad buying tools (Google Ads and DV 360), ad selling tools (DoubleClick For Publishers, or DFP), and an exchange through which ads are bought and sold (AdX).

The EC thinks maybe, just maybe, this could be a problem. Specifically, the EC worries that DFP informs AdX about bids to buy ads so that AdX can pick a price that wins the auction, at the expense of competing ad exchanges. And on the ad buying side, the claim is that Google Ads mostly places bids on AdX, making the Google-run exchange more appealing to ad space sellers than other exchanges with less business.

"The Commission is concerned that Google's allegedly intentional conducts aimed at giving AdX a competitive advantage and may have foreclosed rival ad exchanges," the EC said in a statement. "This would have reinforced Google's AdX central role in the adtech supply chain and Google's ability to charge a high fee for its service."

If this turns out to be the case, the endgame may not be a laughably consequential fine. Rather, the Commission says its preliminary view is "that only the mandatory divestment by Google of part of its services would address its competition concerns."

In other words, AdX and perhaps other ad services would have to be sold.

Dr. Lukasz Olejnik, an independent privacy researcher, challenged the EC claim that the only answer is divestment. He told The Register that he was referring to the Privacy Sandbox technology Google has been developing, which potentially obviates the need for a central ad exchange.

Movement for an Open Web, a group of ad tech firms that compete with Google, argues the EC's teased breakup would not be enough because it fails to deal with the dominance of Google's Chrome browser.

- Another cloud provider runs to shelter from Microsoft's licensing practices

- Amazon, Bing, Wikipedia make EU's list of 'Very Large' platforms

- Tech giants could pay 10% of turnover under draft UK law

- Nine more US states join ad antitrust legal battle against Google

"A breakup of Google only solves half of the problem," the group said in an emailed statement. "Whilst selling businesses such as DFP and AdX would remove one conflict of interest, it would still leave Google with monopoly control of the digital advertising market through the Chrome browser."

“Chrome gives Google control of more than 60 percent of the advertising data that flows across the web and they are already using that control to benefit themselves whilst blocking their competition. Even if Google is broken up, the remaining business would need to be subject to strict controls to ensure that it doesn’t misuse its still dominant market power: both structural change and change to behavior is needed."

Google, meanwhile, disagrees with the way EC has characterized its ad business.

“Our advertising technology tools help websites and apps fund their content, and enable businesses of all sizes to effectively reach new customers," said Dan Taylor, VP of global ads at Google, in an emailed statement.

"Google remains committed to creating value for our publisher and advertiser partners in this highly competitive sector. The Commission’s investigation focuses on a narrow aspect of our advertising business and is not new. We disagree with the EC’s view and we will respond accordingly." ®

From Chip War To Cloud War: The Next Frontier In Global Tech Competition

The global chip war, characterized by intense competition among nations and corporations for supremacy in semiconductor ... Read more

The High Stakes Of Tech Regulation: Security Risks And Market Dynamics

The influence of tech giants in the global economy continues to grow, raising crucial questions about how to balance sec... Read more

The Tyranny Of Instagram Interiors: Why It's Time To Break Free From Algorithm-Driven Aesthetics

Instagram has become a dominant force in shaping interior design trends, offering a seemingly endless stream of inspirat... Read more

The Data Crunch In AI: Strategies For Sustainability

Exploring solutions to the imminent exhaustion of internet data for AI training.As the artificial intelligence (AI) indu... Read more

Google Abandons Four-Year Effort To Remove Cookies From Chrome Browser

After four years of dedicated effort, Google has decided to abandon its plan to remove third-party cookies from its Chro... Read more

LinkedIn Embraces AI And Gamification To Drive User Engagement And Revenue

In an effort to tackle slowing revenue growth and enhance user engagement, LinkedIn is turning to artificial intelligenc... Read more