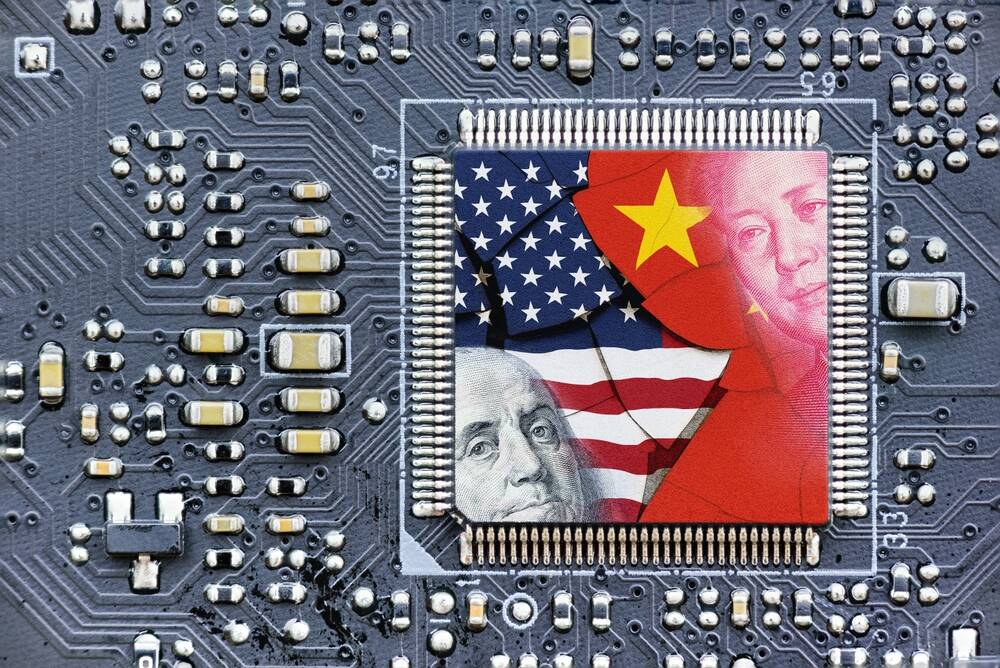

China Suggests America 'carefully Consider' Those Chip Investment Bans

China has formally asked the United States to reconsider rules curbing investments in companies based in the Middle Kingdom.

According to Chinese telly, the request came from China's Council for the Promotion of International Trade — a division of the country's Commerce Ministry. The group argued an executive order signed by President Joe Biden last month, which will restrict US investments in Chinese firms developing sensitive technologies, is too vague and fails to differentiate between civilian and military applications.

"That not only gives rise to transaction risks and compliance cost… but also damages the highly interdependent global industrial chain," the group was quoted as saying. Which is kinda funny because that's exactly what America wants to do at the moment: reduce its dependence on foreign supply chains.

The US investment rules are due to go into effect later next year and target Chinese production of semiconductors, microelectronics, quantum computers, and AI software with tight export controls. The rules mark the Biden administration's latest move to stifle China's fledgling semiconductor industry and hamper any advances in AI technology.

Over the past year, the US has pushed to restrict the sale of advanced chipmaking equipment, including cutting-edge extreme ultraviolet (EUV) as well as deep ultraviolet (DUV) lithography machines. This included pressuring allies in The Netherlands and Japan to restrict sales of that machinery and tech as well.

The Biden administration has also taken steps to prevent the sale of advanced semiconductors, like AMD's MI250X or Nvidia's A100 and H100 GPUs in China. These chips can be used to develop AI and are used in supercomputers to simulate everything from fluid dynamics and drug development, to nuclear testing.

- Huawei's UK tech eviction reportedly caused Sky to fall on mobile customers

- Micron revenue halved in FY23 as China ban bites

- Uncle Sam is this keen to keep US CHIPS funds out of China

- So what if China has 7nm chips now, there's no Huawei it can make them 'at scale'

Despite the administration's efforts, AI accelerators and DUV manufacturing equipment continue to flow into China. Shortly after the export ban went into place, Nvidia, and later Intel, announced tuned-down versions of their chips designed to comply with US sanctions. Meanwhile, Dutch equipment vendor ASML has received permission to continue exporting certain DUV machines to China through the end of the year, despite sanctions going into effect in September.

Bear in mind... The US may well, if it hasn't already, indefinitely extend waivers granted to South Korea's Samsung Electronics and SK Hynix allowing the chipmakers to import American semiconductor factory technology into China for the pair's plants in the Middle Kingdom. That would allow export-restricted manufacturing equipment to still find a way into China, albeit in South-Korean-owned facilities.

In response to US sanctions, Chinese regulators have fired back with their own. In May, Chinese officials accused US chipmaker Micron of baking backdoors into its products and banned many domestic entities from purchasing the company's chips moving forward. The move mirrored actions taken by the US restricting the sale of goods by Chinese telecommunications giant Huawei and memory supplier YMTC in the US.

More recently, China has restricted the export of germanium and gallium — raw materials used in the production of semiconductors.

Chinese semiconductor spending up

Recent reports suggest that US efforts to disarm the Chinese semiconductor industry may actually be having little effect. Earlier this month, Huawei surprised many by launching a new phone powered by a 7nm Arm-compatible processor fabbed by China's Semiconductor Manufacturing International Co. (SMIC).

SMIC was rumored to have developed a 7nm process node as early as last summer, however, until now, the most advanced chips we'd seen out of the fab were limited to 14nm. It's understood SMIC was able to use DUV to reach 7nm, just as Intel and TSMC were able to years ago – those two soon switched to more advanced equipment for 7nm and smaller nodes. In other words, SMIC didn't need EUV to get to 7nm.

Chinese investment in domestic semiconductor equipment has increased considerably over the past year according to Cinno Research.

In a report published Thursday, the group found that China's top 10 semiconductor equipment vendors brought in more than 16 billion yuan, or about $2.2 billion in the first half of 2023.

For comparison, ASML and Applied Materials brought in $13.6 billion and $13.37 billion in revenues respectively during the first two quarters of fiscal 2023. However, Cinno notes that Chinese equipment vendors are growing rapidly with collective revenues up 39 percent from this time last year. ®

From Chip War To Cloud War: The Next Frontier In Global Tech Competition

The global chip war, characterized by intense competition among nations and corporations for supremacy in semiconductor ... Read more

The High Stakes Of Tech Regulation: Security Risks And Market Dynamics

The influence of tech giants in the global economy continues to grow, raising crucial questions about how to balance sec... Read more

The Tyranny Of Instagram Interiors: Why It's Time To Break Free From Algorithm-Driven Aesthetics

Instagram has become a dominant force in shaping interior design trends, offering a seemingly endless stream of inspirat... Read more

The Data Crunch In AI: Strategies For Sustainability

Exploring solutions to the imminent exhaustion of internet data for AI training.As the artificial intelligence (AI) indu... Read more

Google Abandons Four-Year Effort To Remove Cookies From Chrome Browser

After four years of dedicated effort, Google has decided to abandon its plan to remove third-party cookies from its Chro... Read more

LinkedIn Embraces AI And Gamification To Drive User Engagement And Revenue

In an effort to tackle slowing revenue growth and enhance user engagement, LinkedIn is turning to artificial intelligenc... Read more