Beijing's Silent Treatment Topples Tower Semiconductor Merger With Intel

Intel's planned $5.4 billion buy of Israeli chip biz Tower Semiconductor has fallen through after the vendor failed to get regulatory approval from China within the time frame for the deal to close.

The incident is being seen as payback from Beijing for US semiconductor sanctions against China.

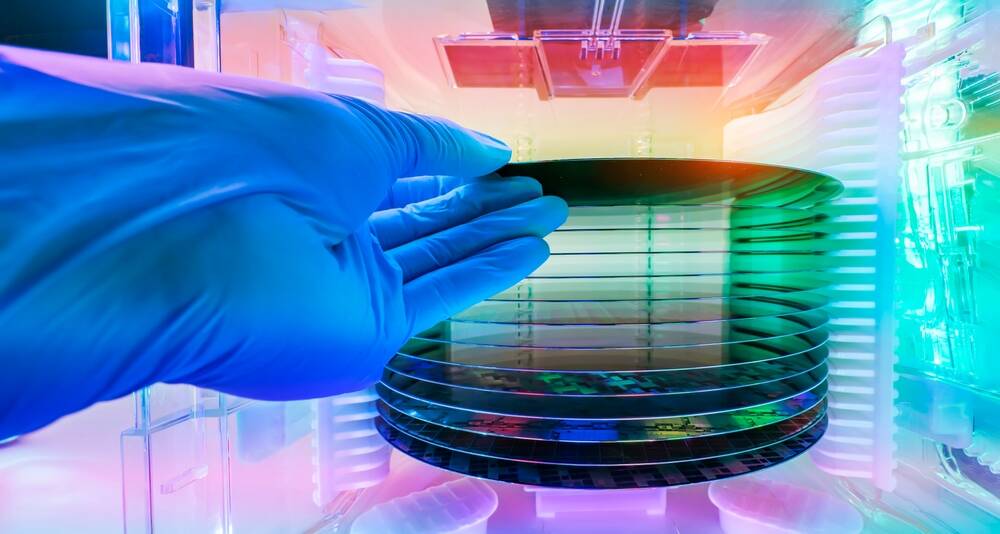

The two companies announced 19 months ago that they'd entered into a definitive agreement for Intel to acquire Tower Semiconductor, which specializes in manufacturing high-value analog semiconductor components for customers worldwide.

However, as with many mergers, approval was required from the regulatory bodies in various territories, and it is understood the proposed sale was given the go-ahead everywhere except for China.

The transaction was originally expected to close within 12 months, but the pair extended the deadline while awaiting approval from China's State Administration for Market Regulation (SAMR), first until June and then again to August 15.

$353M later...

Now it appears that rather than extend the deadline further, Intel and Tower Semiconductor have mutually agreed to call the whole deal off. This will not come without cost – in accordance with the terms of the merger agreement, Intel is required to pay Tower a termination fee of $353 million, which totally wipes out the $232 million revenue Intel Foundry Services (IFS) reported for for Q2 2023. The division only officially opened for business in 2021.

In a statement, Tower Semiconductor said the decision followed careful consideration and discussions after the companies had received "no indications regarding certain required regulatory approval," and as a consequence, both agreed to terminate their merger agreement once the August 15 date was reached.

At the time of its first announcement, the purchase was billed as a "highly complementary transaction" that would play a key role in Intel's plans to become a major provider of foundry services and semiconductor manufacturing capacity globally.

Stuart Pann, Intel senior vice president and general manager for IFS, claimed today the company had nevertheless made significant advancements toward becoming the second largest global external foundry by 2030.

"We are building a differentiated customer value proposition as the world's first open system foundry, with the technology portfolio and manufacturing expertise that includes packaging, chiplet standards and software, going beyond traditional wafer manufacturing," Pann said.

But Omdia Principal Analyst Manoj Sukumaran told us he believed the deal falling through would be a blow to Intel's transition to become a foundry services provider.

- Gelsinger: Intel should get more CHIPS Act funding than rivals

- Get 'em while you can: Intel begins purging NUCs from inventory

- Say hello to Downfall, another data-leaking security hole in several years of Intel chips

- Apple, Samsung, and Intel to invest in Arm IPO, and emerge with some control: report

"Tower is an established foundry service provider with many key customers, IPs, EDA partnerships and expertise in specialty technologies for RF, Power and industrial sensors. Intel will be losing out not just their capacity, customers, and technology, but also their process and expertise in offering services to fabless companies which I believe would have been very important for the success of IFS," he said.

The two companies did not explicitly state it, but the apparent lack of engagement from the Beijing authorities on approving or rejecting the merger is likely caused by the current sour relations between the US and China over semiconductor technology.

It isn't all bad news for IFS. Intel announced a partnership with Synopsys this week that will see designs such as interface technologies available for inclusion in chip designs by Intel foundry customers.

The move followed a similar deal with Arm a few months ago that makes it easier for Arm licensees to have their system-on-chip (SoC) products manufactured at an Intel fab using the upcoming Intel 18A process node. ®

From Chip War To Cloud War: The Next Frontier In Global Tech Competition

The global chip war, characterized by intense competition among nations and corporations for supremacy in semiconductor ... Read more

The High Stakes Of Tech Regulation: Security Risks And Market Dynamics

The influence of tech giants in the global economy continues to grow, raising crucial questions about how to balance sec... Read more

The Tyranny Of Instagram Interiors: Why It's Time To Break Free From Algorithm-Driven Aesthetics

Instagram has become a dominant force in shaping interior design trends, offering a seemingly endless stream of inspirat... Read more

The Data Crunch In AI: Strategies For Sustainability

Exploring solutions to the imminent exhaustion of internet data for AI training.As the artificial intelligence (AI) indu... Read more

Google Abandons Four-Year Effort To Remove Cookies From Chrome Browser

After four years of dedicated effort, Google has decided to abandon its plan to remove third-party cookies from its Chro... Read more

LinkedIn Embraces AI And Gamification To Drive User Engagement And Revenue

In an effort to tackle slowing revenue growth and enhance user engagement, LinkedIn is turning to artificial intelligenc... Read more