AMD Bets Demand For Its MI300 Accelerator Will Balance Dips Across Other Product Lines

AMD is depending on its newly launched MI300 accelerators and continued AI demand to offset an otherwise challenging start to 2024.

On Tuesday's earnings call for the chip designer’s 2023 Q4 and full financial year, executives touted early adoption of the accelerators – which debuted last month – along with assertions they deliver superior performance and efficiency compared to similar kit from AI heavyweight Nvidia.

"Our datacenter GPU business accelerated significantly in the quarter with revenue exceeding our $400 million expectation, driven by a faster ramp for MI300X with AI customers," CEO Lisa Su reported.

This was no doubt helped by bulk shipments of the HPC-centric MI300A for installation at Lawrence Livermore National Labs and the adoption of the product by Microsoft, Oracle, and Meta.

"Customer response to MI300 has been overwhelmingly positive, and we are aggressively ramping production to support the dozens of cloud enterprise and supercomputing customers deploying instinct accelerators," Su added.

Since the December 2023 launch of the MI300, AMD has managed to secure additional contract wins for datacenter APUs and GPUs, including deployments of the MI300A by Germany's University of Stuttgart High Performance Computing Center and a big buy of the older but still performant MI250X by Italian energy provider Eni – both of which our sibling site The Next Platform has explored in detail.

Su boasted that AMD now predicts datacenter GPUs – this appears to include the MI300A – to see consistent sequential growth over the next several quarters, driving revenues of $3.5 billion in 2024 alone.

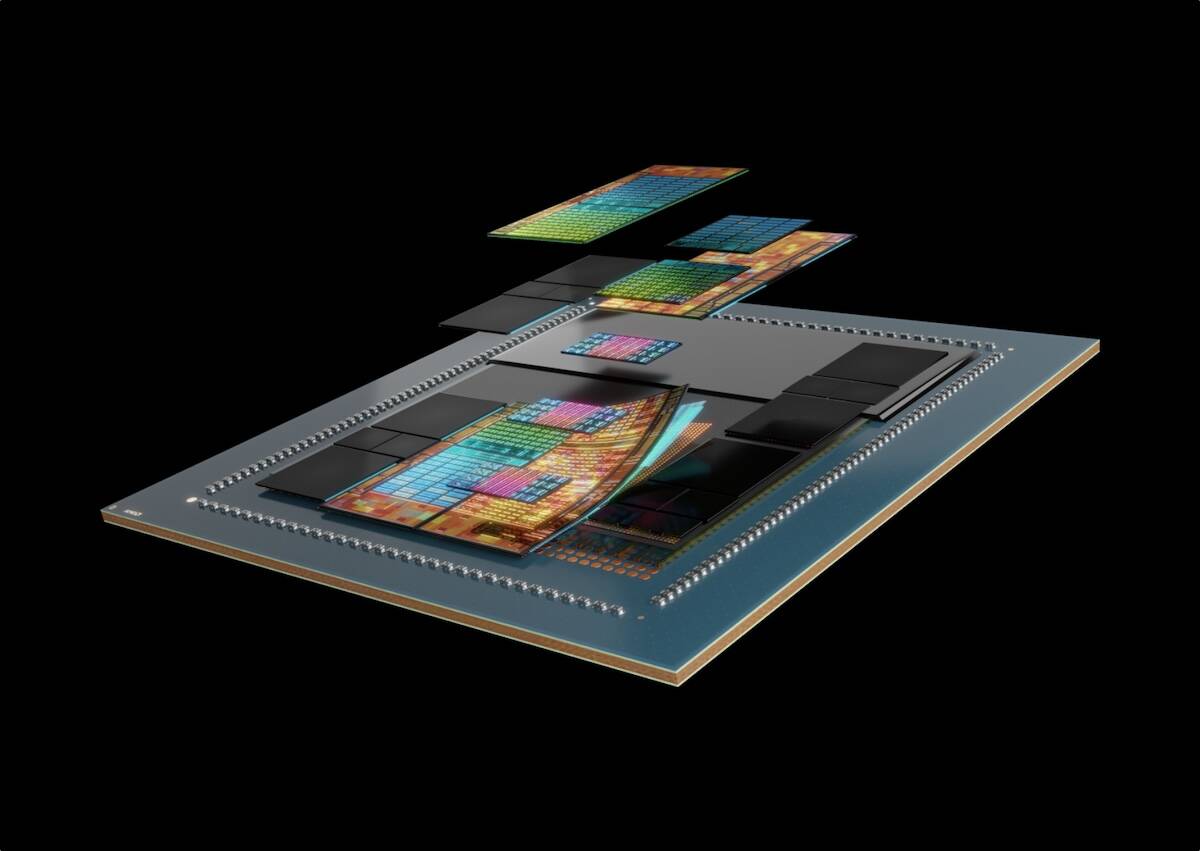

While nowhere near the revenues commanded by rival Nvidia, the MI300 represents AMD’s first compelling contender in the AI arena, with its previous-gen MI200 parts primarily designed for high-performance computing deployments. But, with AI demand anticipated to outstrip supply of accelerators in 2024, AMD is poised to win simply by virtue of the fact Nvidia can't satisfy the market alone.

Nvidia's struggles with supply chains are good news for AMD, given it faces stiff financial headwinds across the rest of its client, embedded, gaming, and semi-custom portfolios. The accelerator champ forecast first-quarter datacenter revenues will be flat, with GPU demand offsetting a seasonal decline in server sales.

AMD's guidance for Q1 revenue was $5.4 billion, plus or minus $300 million. This means that, in the best-case scenario, AMD's revenues will, at best grow 5.6 percent year over year in Q1.

Ryzen rallies and Instinct takes off

AMD's Q1 forecast comes in stark contrast to an otherwise strong conclusion to the 2023 fiscal year. In Q4, the House of Zen raked in $6.2 billion in revenues, up 10 percent from the year prior, on $667 million in profits.

In fact, AMD realized nearly 80 percent of its $854 million annual profits during the holiday quarter, thanks to a surge in datacenter and PC sales. Those business units grew 38 and 62 percent year over year to $2.28 billion and $1.46 billion, respectively.

This ramp helped to offset sustained weak performance in the FPGA and gaming divisions, which declined 24 and 16.8 percent respectively during the quarter.

According to CFO Jean Hu, the weakness in FPGA sales was driven by inventory corrections, while she attributed slowing semi-custom gaming revenues to market saturation in the console caper – a field in which Microsoft, Sony, and Valve all have old-ish offerings.

- The latest cold war is already being fought in the supply chain trenches

- Intel warns of Q1 nosedive... and its shares follow suit

- AI is changing search, for better or for worse

- Things are going to get weird as the nanometer era draws to a close

While AMD ended the year on a high note, revenues declined four percent overall in 2023 to $22.68 billion, while net income contracted by 35 percent.

The executives didn't provide full-year guidance for 2024. However, Hu predicted that a healthy ramp in datacenter and PC sales, aided by the launch of new CPUs over the next several quarters, will more than account for ongoing weakness in its FPGA and semi-custom businesses. ®

Need more commentary? Don't miss our friends at The Next Platform on AMD's latest financial numbers

From Chip War To Cloud War: The Next Frontier In Global Tech Competition

The global chip war, characterized by intense competition among nations and corporations for supremacy in semiconductor ... Read more

The High Stakes Of Tech Regulation: Security Risks And Market Dynamics

The influence of tech giants in the global economy continues to grow, raising crucial questions about how to balance sec... Read more

The Tyranny Of Instagram Interiors: Why It's Time To Break Free From Algorithm-Driven Aesthetics

Instagram has become a dominant force in shaping interior design trends, offering a seemingly endless stream of inspirat... Read more

The Data Crunch In AI: Strategies For Sustainability

Exploring solutions to the imminent exhaustion of internet data for AI training.As the artificial intelligence (AI) indu... Read more

Google Abandons Four-Year Effort To Remove Cookies From Chrome Browser

After four years of dedicated effort, Google has decided to abandon its plan to remove third-party cookies from its Chro... Read more

LinkedIn Embraces AI And Gamification To Drive User Engagement And Revenue

In an effort to tackle slowing revenue growth and enhance user engagement, LinkedIn is turning to artificial intelligenc... Read more