AI Chip Outfit Graphcore's Sales To China Hit By US Export Rules

AI chip developer Graphcore is laying off staff in China after ceasing sales in the country, following the introduction of updated US export restrictions.

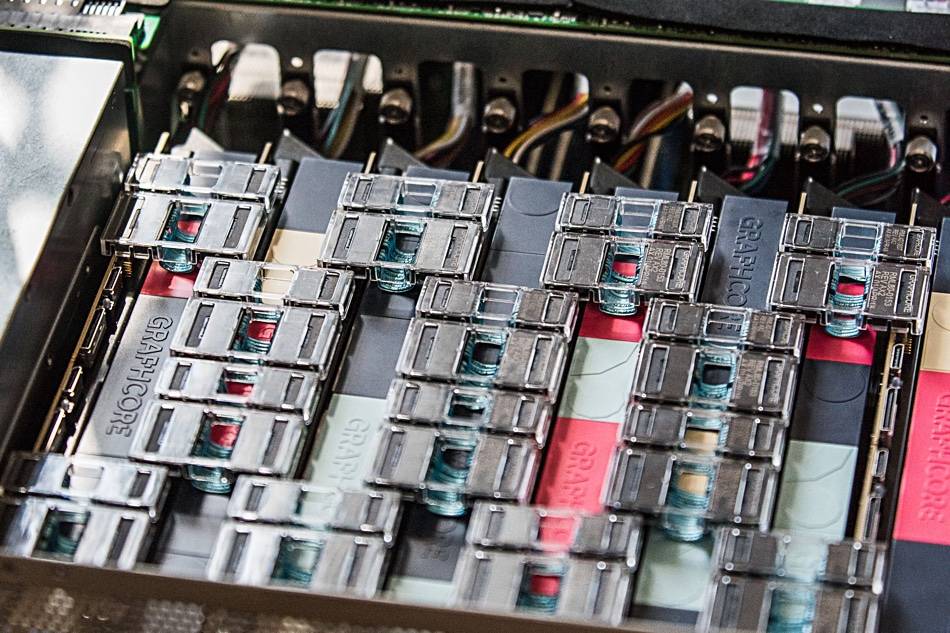

UK-based Graphcore develops AI accelerators dubbed Intelligence Processor Units (IPUs) along with an associated Poplar software stack, and IPU cloud services. Researchers reported last year that Graphcore's hardware could outperform that of GPU leviathan Nvidia in some AI workloads.

However the company has now become collateral damage in Washington's Chip Wars on China, whereby the US seeks to keep both advanced AI and the technology needed to develop it out of the hands of the Chinese military.

Graphcore confirmed to The Register that it is discontinuing sales to China, following the introduction of a further round of export restrictions by the Biden administration last month.

"The recently updated US Export Controls mean that Graphcore – in common with other AI hardware manufacturers – is no longer able to sell IPU systems in China. Regrettably, this means we will be significantly scaling back business operations in China," the company said in a statement.

The Chinese market was one area where Graphcore had hoped to boost revenue, perhaps picking up sales from GPU giant Nvidia after its higher end accelerators were banned from being exported to the country. The company had earlier reported seeing strong demand for Graphcore AI compute in the Middle Kingdom.

Although Graphcore is a British company, Washington's export bans affect manufacturers elsewhere because the restrictions cover the use of American manufacturing and design tools that are widely used across the globe in the development of advanced semiconductors.

Last month, The Reg reported that Graphcore was seeking to raise new funds from investors within the next few months in order to offset mounting losses. In its most recent accounts filed on October 4, the company reported a loss before tax for the year ended 31 December 2022 of $204.6 million, compared to a pre-tax loss of $184.5 million a year earlier.

A Graphcore spokesperson told us there is nothing further to announce at the moment with regards to funding.

However, the company added that in other countries, the need for AI compute continues to increase and "Graphcore is working with customers around the world to meet their demand for a powerful, cost-effective alternative to GPUs."

Graphcore is not the only AI silicon company affected by these new restrictions. Nvidia, which has made a fortune from making and selling GPU accelerators, said in its Q3 2024 earnings call this week that it expects sales to China to be hit.

- UK bets on Intel CPUs and GPUs, Dell boxen, OpenStack for Dawn supercomputer

- Ampere leads a pack of AI startups to challenge Nvidia's 'unsustainable' GPUs

- AI chip biz Graphcore seeks capital to remain going concern

- UK Prime Minister wants £800M to spend on big British iron

- Chipmakers threaten to defect to US, EU if UK doesn't get its semiconductor plans sorted

"Our sales to China and other affected destinations derived from products that are now subject to licensing requirements have consistently contributed approximately 20 to 25 percent of datacenter revenue over the past few quarters," said Nvidia chief financial officer Colette Kress.

"We expect that our sales to these destinations will decline significantly in the fourth quarter of fiscal 2024, though we believe the decline will be more than offset by strong growth in other regions," she added. Kress conceded: "we do not have good visibility into the magnitude of that impact even over the long term."

Nvidia's revenue for the quarter came in at $18.1 billion, triple the $5.9 billion it recorded for the same quarter in 2022, but investors should expect leaner times in the near future. ®

From Chip War To Cloud War: The Next Frontier In Global Tech Competition

The global chip war, characterized by intense competition among nations and corporations for supremacy in semiconductor ... Read more

The High Stakes Of Tech Regulation: Security Risks And Market Dynamics

The influence of tech giants in the global economy continues to grow, raising crucial questions about how to balance sec... Read more

The Tyranny Of Instagram Interiors: Why It's Time To Break Free From Algorithm-Driven Aesthetics

Instagram has become a dominant force in shaping interior design trends, offering a seemingly endless stream of inspirat... Read more

The Data Crunch In AI: Strategies For Sustainability

Exploring solutions to the imminent exhaustion of internet data for AI training.As the artificial intelligence (AI) indu... Read more

Google Abandons Four-Year Effort To Remove Cookies From Chrome Browser

After four years of dedicated effort, Google has decided to abandon its plan to remove third-party cookies from its Chro... Read more

LinkedIn Embraces AI And Gamification To Drive User Engagement And Revenue

In an effort to tackle slowing revenue growth and enhance user engagement, LinkedIn is turning to artificial intelligenc... Read more