Affordable Housing Schemes: 'Invisible' Renters Earning £30k Not Eligible

Sam was turned down from renting an affordable housing property because of his "low income" - he earns just under £33,000

People earning more than £30,000 are being told they don't have enough money to be eligible to rent so-called affordable housing schemes in London.

Under the deals, renters on lower incomes should be able to secure homes at rates below market value.

But the BBC has found that some landlords insist on applicants earning between £35,000 and £60,000 to stand any chance of being accepted.

MPs say the regulator needs to investigate how tenants are chosen.

The term "affordable housing" covers various schemes to rent or buy, each with their own qualifying criteria, but the application system and terminology can be confusing.

The affordable housing sector has changed a lot since 2011, when affordable rent schemes were introduced in England. According to the UK government's housing department they are for people "on limited incomes".

Rates are set at least 20% below market value in any given area. Councils, housing associations and private firms can all offer affordable housing as long they are a "registered provider" of social housing.

But many landlords don't publicly list how much they expect applicants to earn in order to be able to qualify.

Looking through adverts of affordable housing to rent in London, the BBC found that 28 out of 40 listings seen did not state a minimum income requirement.

Eleven of those that did advertise minimum income criteria required between £30,000 and £60,000. There was one exception of £27,750.

The median salary in the capital is about £34,000 per year, according to Office for National Statistics data.

Housing charity Shelter told us people on lower incomes were "effectively being screened out" by housing providers, in favour of higher-earners seen as less likely to miss monthly rent payments.

Image source, Getty Images

East London skyline

Government cuts to affordable housing funding have meant providers must be "really focused on their bottom line", says the charity's head of policy, Charlie Trew.

The BBC put that to the Department for Levelling Up, Housing and Communities - but it did not provide a response.

We also asked whether renters on lower incomes were being "screened out".

In a statement, a spokesperson said that "affordable housing is for those on limited incomes and offers must reflect this".

They added that it was "completely unacceptable" that providers were "misleading tenants with inaccurate advertising".

These listings we saw were on the websites of housing providers, property search sites, as well as the London mayor's Homes for Londoners website. Other listings couldn't be accessed by the BBC, because it meant registering with a housing association or local authority.

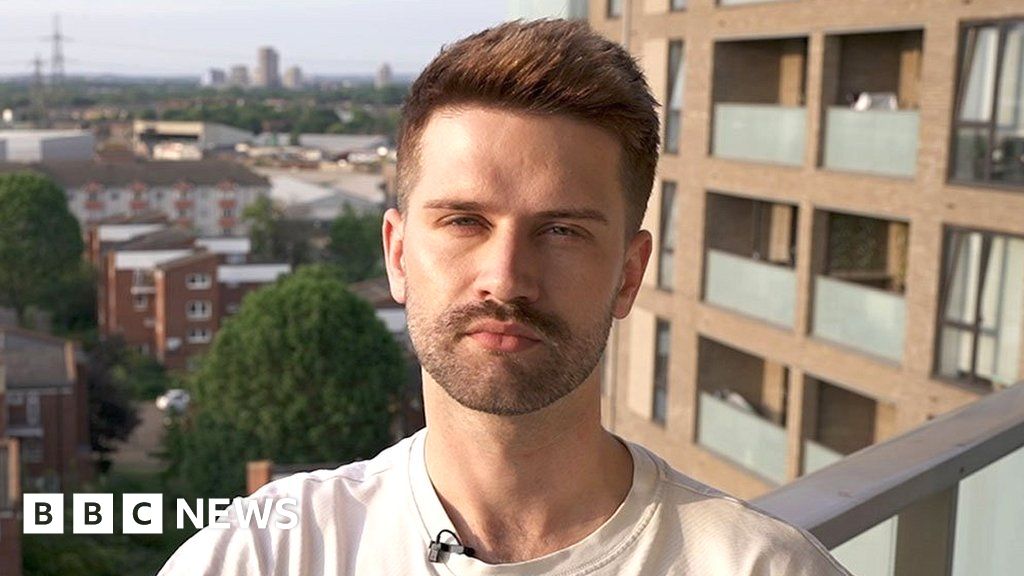

Sam's story - annual income of just under £33,000

Sam, who's 26, pays £925 per month to privately rent a room in a two-bed flat in east London.

He had hoped to buy a place of his own and had saved up £15,000 towards a deposit.

He jumped at the chance to apply for a rental flat in an affordable housing scheme - a so-called London Living Rent property aimed at people who want to save long-term for a deposit.

The advert he saw stated a maximum income of £60,000 but he says it failed to mention a minimum figure.

During the application process he asked to change to another flat at a different development run by the same housing association - L&Q.

The rent for the second property, in Newham, was similar to what he was paying for a single room. It also offered the security of a three-year tenancy, and the option to buy if he wanted.

But he missed out because of his "low income". L&Q told Sam he'd need a minimum income of £36,000.

"It just makes me feel quite hopeless," says Sam, who works at a university's science department.

He says he feels stuck in a paradox. He doesn't qualify for social rent - council housing - but at the same time doesn't earn enough to be eligible for affordable rental schemes.

"I feel like I'm in this invisible range."

When he asked the housing association for more feedback he discovered that renting the property was always going to be a non-starter because of the savings he already had.

"To be told that I don't earn enough money, but at the same time have too much, was confusing," Sam says.

What is affordable housing to rent?

Affordable housing to rent is provided by housing associations and local authorities - but it has several forms:

- Social rent - known as council or housing association homes - renters are prioritised on their needs. In 2011, this accounted for nearly all new affordable housing rental properties, now it's just 20%. Rents, based on local incomes and property values, are about half that in the private rented sector

- Affordable rent - introduced in 2011. It was part of austerity measures by the UK coalition government which cut social rent funding by more than 60%. To help offset some financial losses, councils and housing associations were able to charge higher rents, up to 80% of local market levels

- Intermediate rent - for renters wanting to save towards buying a home. Rents are capped at 80% of local market levels. London Living Rent is an example

- London Affordable Rent - capped at levels set by the Greater London Authority, which are lower than affordable and intermediate rents

The London Living Rent property Sam applied for is, in-part, funded by the Mayor of London's office.

The mayor's website describes the Living Rent properties as "genuinely affordable".

A spokesperson for the mayor's team said it "encourages all housing providers to be clear and transparent" about how tenants are allocated properties.

Sam says he has now given up on trying to rent through any affordable housing scheme - and also his dream of becoming a homeowner.

He has decided to stay on at his flat. His landlord has put up his rent.

Sam's story was put to L&Q. The company's director of strategic sales, John Lumley, told us: "Demand for these schemes is very high, and our processes are designed to make sure that we are matching customers with the best possible home for them."

He added that there is eligibility information on L&Q's website and that its advisers "work with prospective customers to support them to make an informed choice about applying for these schemes or, where appropriate, other options."

The housing association apologised if any customers "have not had a positive experience" and said it always welcomed feedback.

'Very precise investigation'

Responding to our findings, Labour MP Clive Betts, who chairs Parliament's housing select committee, called on the Regulator of Social Housing to do a "very precise investigation" on how tenants are being selected for affordable housing.

Currently, the regulator oversees the majority of providers, but does not monitor affordability checks or the way people are chosen for tenancies.

"It seems to me that if the associations are regulated and their tenancies are regulated, then how the tenancies are set up and how they are advertised should be regulated as well," said Mr Betts.

He also said the government needed to look at its guidance on affordable housing "with a degree of urgency".

Have you tried to access affordable housing but have been rejected because of your income? Has some other criteria made you ineligible? You can share your experiences by emailing haveyoursay@bbc.co.uk.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at HaveYourSay@bbc.co.uk. Please include your name, age and location with any submission.

What are your renting rights?

- How much can my landlord increase the rent? It depends on your agreement but rises must be fair, realistic and in line with local properties and there's usually a month's notice

- Can my landlord evict me? Landlords need to follow strict rules such as giving written notice. Once the notice period ends, the landlord can start eviction proceedings through court.

- Can a landlord refuse people on benefits? No. DSS policies are unlawful discrimination, says charity Shelter. Some councils have lists of private landlords who rent to tenants claiming benefits.

There's more on your renting rights and where to go for help here.

From Chip War To Cloud War: The Next Frontier In Global Tech Competition

The global chip war, characterized by intense competition among nations and corporations for supremacy in semiconductor ... Read more

The High Stakes Of Tech Regulation: Security Risks And Market Dynamics

The influence of tech giants in the global economy continues to grow, raising crucial questions about how to balance sec... Read more

The Tyranny Of Instagram Interiors: Why It's Time To Break Free From Algorithm-Driven Aesthetics

Instagram has become a dominant force in shaping interior design trends, offering a seemingly endless stream of inspirat... Read more

The Data Crunch In AI: Strategies For Sustainability

Exploring solutions to the imminent exhaustion of internet data for AI training.As the artificial intelligence (AI) indu... Read more

Google Abandons Four-Year Effort To Remove Cookies From Chrome Browser

After four years of dedicated effort, Google has decided to abandon its plan to remove third-party cookies from its Chro... Read more

LinkedIn Embraces AI And Gamification To Drive User Engagement And Revenue

In an effort to tackle slowing revenue growth and enhance user engagement, LinkedIn is turning to artificial intelligenc... Read more