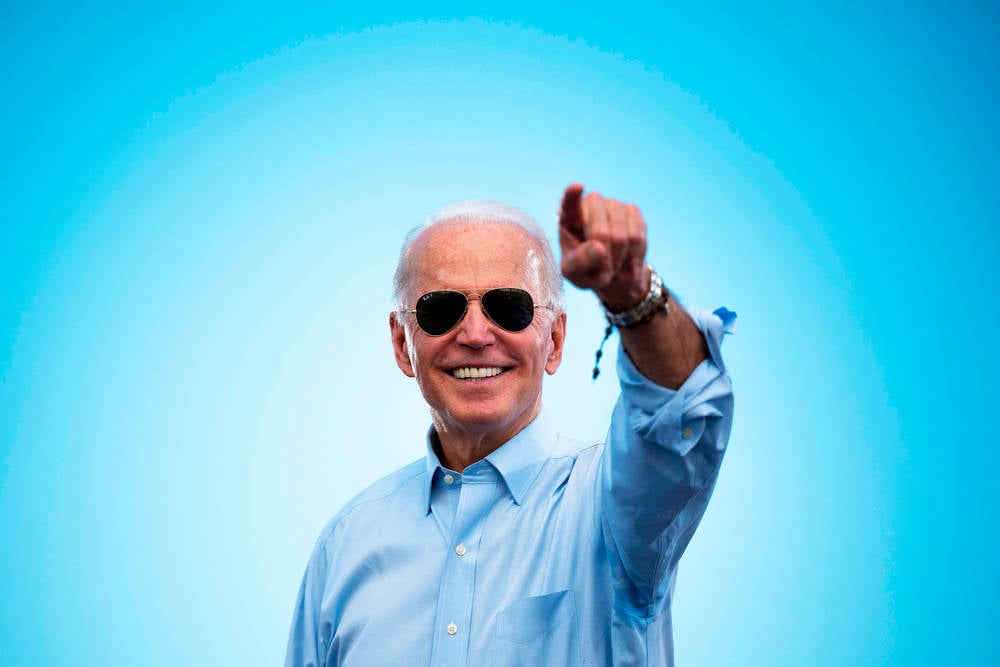

A Lot Of Things Will Have Changed With Biden As US President, But An Easier Ride For Huawei Is Not One Of Them

A change in occupancy at 1200 Pennsylvania Avenue hasn't done much for Huawei's fortunes as the Biden administration looks set to toughen restrictions against the battered Chinese telecoms outfit.

Per Reuters, the US government has amended existing license agreements to prohibit shipments of components that could be used in 5G devices. This has the potential to disrupt pre-existing contracts.

Although Huawei is able to access components for 4G smartphones and conventional PCs, its ability to source parts for 5G smartphones and carrier equipment remains tenuous at best. This latest tightening of the screws looks set to complicate matters further by including components with a dual use. That is to say, components that could be used in both LTE and 5G devices, even if the intended device doesn't actually come with 5G connectivity.

Last year, the firm was cut off from its long-time contract fab, TSMC, which had previously produced chips for its HiSilicon sub-unit. Attempts to shift production to local contract fab SMIC are unlikely to fill this gap. SMIC's processes lag behind those used by TSMC and Samsung, and the company was itself added to a US Commerce Department entity last year. These new sanctions prevent SMIC from obtaining equipment required to produce advanced semiconductors on nodes of 10 nanometers and below.

Additionally, Samsung and SK Hynix, who had historically provided NAND and DRAM products to Huawei, have been forced to cut ties, with shipments halted in early September. Both companies have requested waivers.

As Huawei's supply chain continues to suffer, the firm has reportedly scaled back its manufacturing plans for 2021 to produce 60 per cent fewer smartphones this year, according to Nikkei Asia.

In November, the company sold its youth-oriented Honor sub-brand to a consortium of dealers and state-owned enterprises. As an independent business, Honor has been able to resume ties with external suppliers, inking deals with Intel, MediaTek, Qualcomm, Micron, and others. And its sale will depress Huawei's shipment figures further.

These factors have led analyst Trend Force to predict that Huawei will drop out of the top six smartphone vendors this year to be replaced by Xiaomi in third and budget vendor Transsion entering the top tier of the leader board for the first time.

Although Biden has not adopted the same rhetoric in US dealings with China, few expected to see a major reversal from Trump's policies on Huawei. Last year, a former company board member, Sir Kenneth Olisa, described a "bipartisan dislike" of China. Politically, any softening against Huawei could reinforce fears from Republicans that Biden is soft on China.

Separately, much of the lobbying against the UK, and its previous decision to allow limited use of Huawei-made equipment in the country's 5G equipment, came from both aisles of the political divide. This is one of the few areas in which Republican and Democrats are in communion.

The Register has asked Huawei to comment. We will update this article if we hear back. ®

From Chip War To Cloud War: The Next Frontier In Global Tech Competition

The global chip war, characterized by intense competition among nations and corporations for supremacy in semiconductor ... Read more

The High Stakes Of Tech Regulation: Security Risks And Market Dynamics

The influence of tech giants in the global economy continues to grow, raising crucial questions about how to balance sec... Read more

The Tyranny Of Instagram Interiors: Why It's Time To Break Free From Algorithm-Driven Aesthetics

Instagram has become a dominant force in shaping interior design trends, offering a seemingly endless stream of inspirat... Read more

The Data Crunch In AI: Strategies For Sustainability

Exploring solutions to the imminent exhaustion of internet data for AI training.As the artificial intelligence (AI) indu... Read more

Google Abandons Four-Year Effort To Remove Cookies From Chrome Browser

After four years of dedicated effort, Google has decided to abandon its plan to remove third-party cookies from its Chro... Read more

LinkedIn Embraces AI And Gamification To Drive User Engagement And Revenue

In an effort to tackle slowing revenue growth and enhance user engagement, LinkedIn is turning to artificial intelligenc... Read more