Yen Stabilizes Amid Political Speculation As Wage Growth Hits Record Levels

While Yen remains the weakest performer today, it has managed to recover part of its initial losses following the weekend’s inconclusive election. Investor sentiment stabilized somewhat on hopes that Japan’s Liberal Democratic Party could still secure a majority in the lower house through a coalition with Komeito and smaller parties. Reports suggest that the government and ruling coalition are preparing to convene a special Diet session on November 11, leaving room for further political developments in the coming weeks.

Adding to Japan’s economic backdrop, average monthly wages in Japanese businesses reached a record 11,961 Yen this year, surpassing the 10,000-Yen mark for the first time. The 4.1% increase, the highest since 1999, reflects successful spring wage negotiations between management and labor unions, signaling a shift in Japan’s traditionally conservative pay culture. This sustained wage growth suggests that Japanese companies are responding to rising inflation, marking a third consecutive year of increases.

In the broader currency markets, Canadian Dollar follows Yen as the day’s second weakest currency, while Dollar ranks third after giving up early gains. Meanwhile, Euro is leading as the strongest, trailed by British Pound and New Zealand Dollar, with Swiss franc and Australian Dollar positioned in the middle.

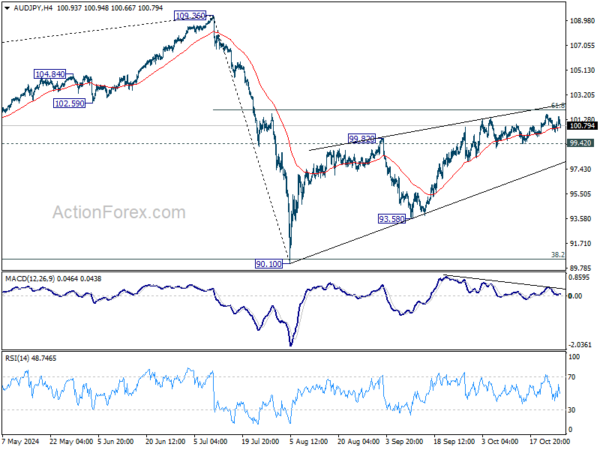

Technically, AUD/JPY has been a laggard in the rallies in Yen crosses today. Bearish divergence condition indicates continuous loss of upside momentum. While another rise cannot be ruled out, strong resistance could emerge at 61.8% retracement of 109.36 to 90.10 at 102.00 to limit upside. Break of 99.42 support should indicate short term topping, and bring deeper fall back towards 93.58 support.

In Europe, at the time of writing, FTSE is down -0.47%. DAX is down -0.25%. CAC is up 0.05%. UK 10-year yield is down -0.0243 at 4.215. Germany 10-year yield is down -0.0029 at 2.266. Earlier in Asia, Nikkei rose 1.92%. Hong Kong HSI rose 0.04%. China Shanghai SSE rose 0.68%. Singapore Strait Times fell -0.26%. Japan 10-year JGB yield rose 0.0227 at 0.975.

ECB’s Wunsch: Soft landing likely, no immediate need to accelerate rate cuts

In an interview with Reuters, Belgian ECB Governing Council member Pierre Wunsch emphasized the importance of patience regarding monetary policy adjustments, pointing to strong employment figures and rising real wages as signals of economic resilience.

Wunsch remarked that with the economy likely headed for a “soft landing,” there is “no urgency in further accelerating the easing of monetary policy.”

Wunsch downplayed temporary inflation undershooting, and warned against “overdramatize such an event”. He added, “Being a bit below 2% is not a big event if the medium term continues to point to 2%,” especially if driven by a favorable terms of trade shock.

Wunsch further cautioned against making premature decisions ahead of December’s ECB meeting, noting that several high-stakes developments are expected in the coming weeks.

“We’ll have so much information until then, including two more inflation readings and new staff projections,” he said. “There will be a U.S. election, and we also need to see how the conflict in the Middle East develops, so discussing precise levels is premature.”

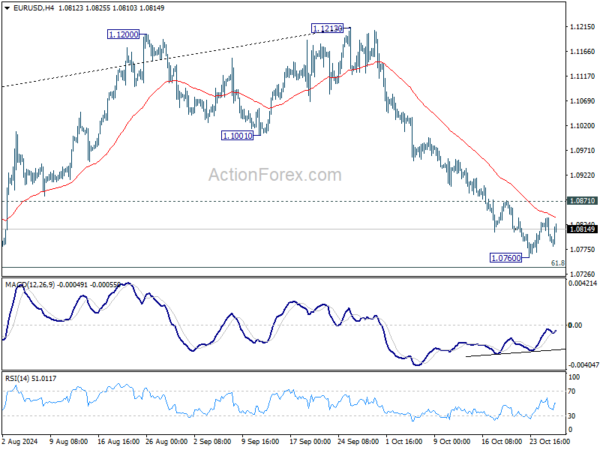

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0780; (P) 1.0809; (R1) 1.0826; More…

EUR/USD is extending consolidations above 1.0760 and intraday bias stays neutral. Further decline is expected as long as 1.0871 resistance holds. Below 1.0760 will target 61.8% retracement of 1.0447 to 1.1213 at 1.0740. Firm break there will target 1.0601 support next. However, considering bullish convergence condition in 4H MACD, break of 1.0871 will indicate short term bottoming, and turn bias back to the upside for 55 D EMA (now at 1.0956).

In the bigger picture, price actions from 1.1274 (2023 high) are seen as a consolidation pattern to up trend from 0.9534 (2022 low), with fall from 1.1213 as the third leg. Downside should be contained by 50% retracement of 0.9534 (2022 low) to 1.1274 at 1.0404, to bring up trend resumption at a later stage.

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more