Yens Strong Rally Reflects Broader Shifts In Global Monetary Policy Expectations

Japanese Yen’s remarkable rally has become a focal point in the currency markets today. It’s strength is extending into US session. This surge is not an isolated event but a reflection of broader shifts in global monetary policy expectations. A crucial factor propelling Yen upwards is the increasing speculation that BoJ would finally abandon its negative interest rates policy in the coming year. This potential policy shift represents a significant reversal from BoJ’s longstanding accommodative monetary stance, which has been a defining feature of Japan’s economic policy recent years.

Simultaneously, there’s a contrasting trend emerging in other parts of the world. Market participants are increasingly betting on the likelihood of rate cuts by other major global central banks in the next year. This anticipation points to a narrowing of the interest rate differentials between Japan and other major economies. It’s a noteworthy reversal from the trend observed over the past two years, where the gap in interest rates had been widening. Should these market predictions come to fruition, the sustainability of Yen’s strength could be reinforced, supported by realignment in global interest rate policies.

As of now, Australian Dollar and New Zealand Dollar are following Yen’s lead, ranking as the next strongest currencies for the day. However, their rallies have been somewhat tempered by the stabilization of risk sentiment in European session. These currencies, typically sensitive to changes in risk appetite, have shown moderated movements in response to the evolving market mood. On the other end of the spectrum, Dollar is languishing at the bottom of the performance chart, with Canadian Dollar, Sterling, and Euro trailing behind. Swiss Franc finds itself in a mixed position, reflecting a more nuanced market response.

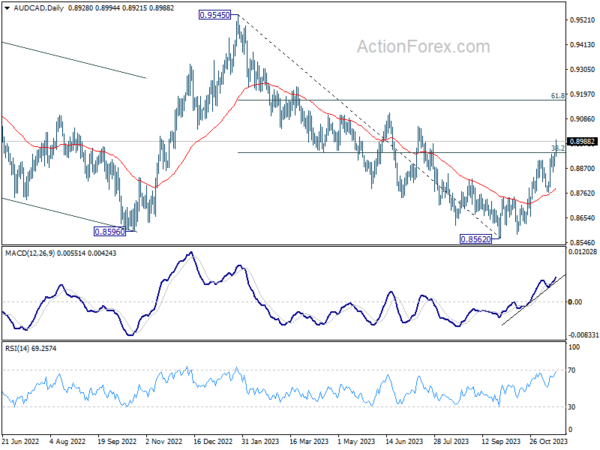

From a technical standpoint, AUD/CAD’s rally from 0.8652 accelerates higher today, and hit as high as 0.8990 so far. The strong break of 38.2% retracement of 0.9545 to 0.8562 at 0.8938, and the strong upside momentum affirm the case that it’s reversing whole down trend from 0.9545. Further rally should be seen to 61.8% retracement at 0.9169 next. The forthcoming RBA minutes and Canada’s CPI data tomorrow will be critical in determining the pair’s trajectory, potentially acting as catalysts for the next significant move.

In Europe, at the time of writing, FTSE is down -0.37%. DAX is down -0.40%. CAC is up 0.04%. Germany 10-year yield is up 0.0351 at 2.624. Earlier in Asia, Nikkei lost -0.49%. Hong Kong HSI gained 1.86%. China Shanghai SSE rose 0.46%. Singapore Strait Times fell -0.42%. Japan 10-year JGB yield dropped -0.0040 to 0.744.

Bundesbank report: Inflation likely to hover around current level

The latest monthly report from Bundesbank presents a mixed outlook for the German economy, highlighting persistently high inflation and a slow yet expected recovery.

According to the report, headline inflation at 3.0% and core inflation at 4.2% are “still well above historical average.” The Bundesbank anticipates that the inflation rate is “likely to fluctuate around its current value in the coming months,” indicating ongoing price stability concerns.

The report forecasts that a slight economic recovery is “only expected after the turn of the year”. This recovery is expected to be driven by an increase in real net income of private households, buoyed by significant wage hikes a reduction in price pressures. Despite anticipated cautious approach to spending by private households, there is expectation of gradual expansion in real consumption, which could bolster domestic economy.

The industrial sector, however, continues to face challenging conditions. The Bundesbank’s report points to weak foreign demand and the lingering effects of previous energy price shocks as factors hampering production. Yet, there are initial signs of improvement on the horizon. The report notes that the basic trend in incoming orders suggests a potential stabilization in foreign demand.

ECB’s Wunsch: Early rate cut bets may trigger opposite action

ECB Governing Council member Pierre Wunsch today expressed skepticism regarding market expectations of an early easing of monetary policy. His comments highlight a crucial divergence between market forecasts and ECB’s potential policy path in the face of ongoing inflationary pressures.

Wunsch described the market’s anticipation of a reduction in ECB’s deposit rate from the current 4% by April as “optimistic.” He pointed out the necessity for ECB to either continue with the current rate or possibly increase it, contrary to market expectations.

He raised concerns about the implications of market bet on rate cuts. “Is it a problem if everybody believes we’re going to cut?” he questioned. This could lead to “less restrictive monetary policy” which may then be insufficient, and eventually, “it increases the risk that you have to correct in the other direction.”

Wunsch emphasized the ECB’s readiness to adapt its strategy based on inflation trends. “If we arrive at the conclusion that inflation is not going down fast enough, we’ll communicate it through our projection and through our communication,” he stated.

China maintains 1-yr and 5-yr LPR

As reported by the National Interbank Funding Center today, China’s one-year loan prime rate retains is unchanged 3.45%. Similarly, the over-five-year LPR, a critical determinant of mortgage rates, is also steady at 4.2%.

The LPR, derived from the quotations by various banks with adjustments based on the open-market operation rates, serves as a pivotal indicator for loan pricing. This stability comes in the wake of PBoC’s substantial liquidity injection of CNY 1.45 into the market through the medium-term lending facility last week, maintaining an interest rate of 2.5%.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 148.91; (P) 149.85; (R1) 150.49; More…

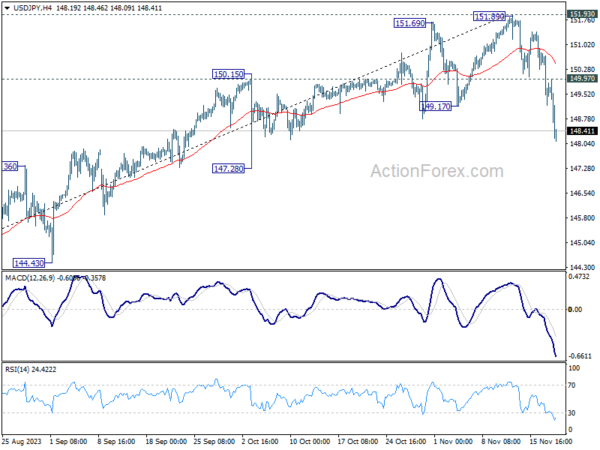

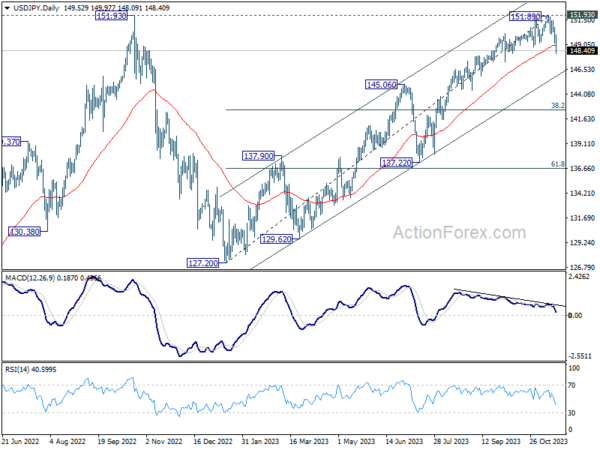

USD/JPY’s fall from 151.89 extends to as low as 148.00 so far, and there is no sign of bottoming yet. Intraday bias stays on the downside for medium term channel support at 145.80 next. On the upside, break of 149.97 resistance is needed to indicate completion of the decline. Otherwise, risk will stay on the downside in case of recovery.

In the bigger picture, rise from 127.20 (2023 low) is seen as the second leg of the pattern from 151.93 resistance (2022 high). Decisive break of 145.06 resistance turned support will confirm that this second leg has completed, after rejection by 151.93. Deeper fall would be seen through 38.2% retracement of 127.20 to 151.89 at 142.45 to 61.8% retracement at 136.63. Nevertheless strong bounce from 145.06 will retain medium term bullishness for another test on 151.93 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 07:00 | EUR | Germany PPI M/M Oct | -0.10% | -0.10% | -0.20% | |

| 07:00 | EUR | Germany PPI Y/Y Oct | -11.00% | -11.00% | -14.70% | |

| 11:00 | EUR | German Buba Monthly Report |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more