Yen Rebounds Vigorously Post-160 Breach As Traders Take Profits

Japanese Yen mounted a strong comeback in Asian session today after initial dip through 160 psychological support against Dollar. While the moves are exaggerated by today’s thin trading volumes due to public holiday in Japan, the strong rebound is marked by widespread squaring of short positions. Traders are clearly on guard against intervention by Japanese authorities and opt for taking profits first. For now, there is no definitive signal of trend reversal yet. But Yen will likely enter a period of consolidation as the market anticipates the next significant move.

On the economic front, today’s calendar is relatively light, featuring only German CPI flash and Eurozone Economic Sentiment Indicator. However, the week ahead is packed with significant events and data releases that are likely to move global markets. The focal point will undoubtedly be FOMC rate decision, but other crucial data such as US ISM indexes and Non-Farm Payrolls, Eurozone CPI flash, Canadian GDP, Australian retail sales, New Zealand employment, and China’s PMIs will also command attention.

Technically, Australian Dollar’s rally is gaining momentum today. EUR/AUD’s decline is accelerating to 1.6288 so far. Current fall from 1.6742 is seen as the third leg of the pattern from 1.7062, targeting 1.6127 support, or even further to 100% projection of 1.7062 to 1.6127 from 1.6742 at 1.5807.

In Asia, at the time of writing, Hong Kong HSI is up 1.29%. China Shanghai SSE is up 0.80%. Singapore Strait Times is down -0.23%. Japan is on holiday.

Intense Focus on FOMC Meeting Amid Speculations of Hawkish Shifts by Powell

All eyes are on a series of high-stakes economic updates this week, with a central focus on FOMC meeting. Markets broadly expects that federal funds rates will hold steady at the current range of 5.25-5.50%. Given that the next set of economic projections and dot plot won’t be available until June, the focus will intensely pivot towards FOMC’s statement and particularly to Chair Jerome Powell’s press conference following the meeting.

Market participants are buzzing with speculation that Powell might adopt a more hawkish tone than previously observed. This shift is anticipated due to recent economic data that suggest stalling in the disinflationary process, a trend that complicates Fed’s pathway to easing monetary policy. Analysts are considering several possible outcomes. At the very least, Powell could indicate a consensus among FOMC members supporting fewer than three rate cuts this year. In a more pronounced hawkish shift, he might acknowledge the possibility of no rate cut in 2024 or even hint at the potential necessity for another rate hike if inflationary pressures do not subside adequately.

In addition to FOMC, the US economic calendar is packed with market-moving data releases too, including consumer confidence, ISM manufacturing and services indexes, and the critical non-farm payroll figures. ‘s

Across the Atlantic, Eurozone will also be under scrutiny with the release of its CPI flash estimate and preliminary GDP figures for Q1. While these figures are unlikely to derail ECB provisional plans for a rate cut in June, they are essential for gauging the trajectory of policy easing beyond this point.

In Canada, the spotlight will be on the upcoming GDP release, following recent BoC summary of deliberations that revealed a clear division among officials regarding the timing of the first rate cut. The decision in June will likely depend on forthcoming economic and inflation data, making this GDP release particularly significant.

Globally, other important economic data points include Swiss CPI, retail sales from Australia, employment figures from New Zealand, and notably, China’s PMI data. The latter will be especially significant as stronger figures could confirm that China’s recovery is on a firmer footing, uplifting regional market sentiment.

Here are some highlights for the week:

- Monday: Germany CPI flash

- Tuesday: Japan industrial production, retail sales, unemployment rate, housing starts; New Zealand ANZ business confidence; Australia retail sales; China NBS PMIs, Caixin PMI manufacturing; France GDP flash; Germany import prices, retail sales, GDP flash; Swiss KOF economic barometer; UK M4 money supply, mortgage approvals; Eurozone CPI flash, GDP flash; Canada GDP; US employment cost index, house price index; Chicago PMI, consumer confidence.

- Wednesday: New Zealand employment; Japan PMI manufacturing PMI final; UK PMI manufacturing final; US ADP employment; ISM manufacturing, construction spending; Canada PMI manufacturing; FOMC rate decision.

- Thursday: New Zealand building permits; Japan monetary bas, consumer confidence, BoJ minutes; Australia building permits, goods trade balance; Swiss CPI, retail sales; Eurozone PMI manufacturing final; Canada trade balance; US jobless claims, non-farm productivity, trade balance, factory orders.

- Friday: France industrial production; UK PMI services final; Eurozone unemployment rate; US non farm payrolls, ISM services.

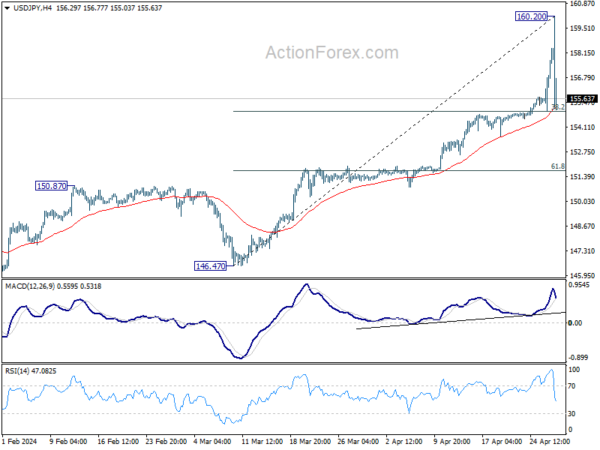

USD/JPY Daily Outlook

Daily Pivots: (S1) 156.06; (P) 157.26; (R1) 159.53; More…

Yen’s steep retreat today suggests that a short term top is already in place 160.20, close to 160 psychological level. Intraday bias is turned neutral for consolidations first. Some support might come from 38.2% retracement of 146.47 to 160.20 at 154.95 to bring recovery. But break of 160.20 is not envisaged for now. However, firm break of 154.95 will turn bias to the downside for deeper correction to 55 D EMA (now at 151.80).

In the bigger picture, current rise from 140.25 is seen as the third leg of the up trend from 127.20 (2023 low). Next target is 100% projection of 127.20 to 151.89 from 140.25 at 164.94. Outlook will remain bullish as long as 150.87 resistance turned support holds, even in case of deep pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 09:00 | EUR | Eurozone Economic Sentiment Indicator Apr | 96.3 | |||

| 09:00 | EUR | Eurozone Industrial Confidence Apr | -8.8 | |||

| 09:00 | EUR | Eurozone Services Sentiment Apr | 6.3 | |||

| 09:00 | EUR | Eurozone Consumer Confidence Apr F | -14.7 | -14.7 | ||

| 12:00 | EUR | Germany CPI M/M Apr P | 0.60% | 0.40% | ||

| 12:00 | EUR | Germany CPI Y/Y Apr P | 2.20% |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more