Yen And Nikkei Tumble As Japan Prepares For Snap Election, Dollar Extends Its Dominance

Japanese Yen and the Nikkei index have both been hammered this week as political uncertainty ahead of Japan’s snap election seemed to be rattling investor confidence. Yen accelerated its slide against Dollar through 153 mark while Nikkei ended the day with a sharp loss of over 300 points. Prime Minister Shigeru Ishiba’s dissolution of the lower house of parliament earlier this month has set the stage for the House of Representatives election on October 27. Concerns are rising that the ruling Liberal Democratic Party and its coalition partner, Komeito, could lose their majority, injecting more political instability into an already fragile market.

Adding to the Yen’s weakness is the apparent political vacuum regarding currency intervention. Despite the Yen’s rapid depreciation, Japanese authorities have remained unusually silent, offering no verbal intervention to stem the decline. Traders have interpreted this silence as a tacit approval to continue selling Yen without fear of official pushback. Unless there’s a significant shift in policy communication from Japanese officials, the Yen may face further downside pressure throughout the week, at least until the election results provide clearer direction on Japan’s politics.

Across the broader forex market, Dollar continues to extend its broad-based gains, benefiting from rising yields and expectations of a slower pace of Fed easing. The Canadian Dollar is the second strongest performer, with markets awaiting the Bank of Canada’s interest rate cut, updated economic projections, and any signals regarding future policy easing. Yen, by far the worst performer this week, faces steep losses. Australian and New Zealand Dollars are also under pressure, with their declines gaining momentum, while Euro and Sterling remain stuck in the middle of the pack.

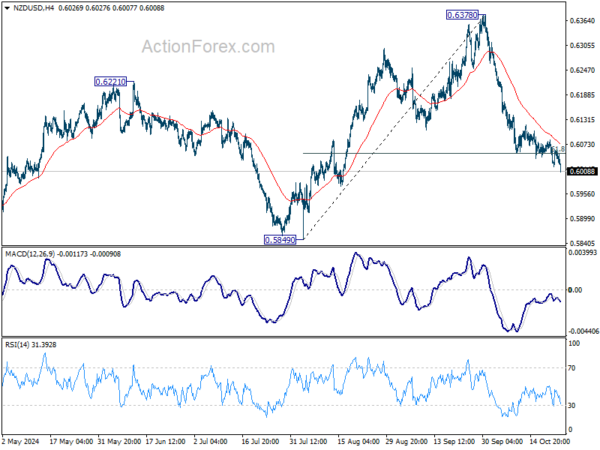

Technically, NZD/USD is picking up downside momentum as fall from 0.6378 extends. As long as 4H EMA (now at 0.6073) holds, there is risk of further downside acceleration towards 0.5849 low next.

In Europe, at the time of writing, FTSE is down -0.54%. DAX is down -0.15%. CAC is down -0.58%. UK 10-year yield is up 0.040 at 4.210. Germany 10-year yield is down -0.005 at 2.317. Earlier in Asia, Nikkei fell -0.80%. Hong Kong HSI rose 1.27%. China Shanghai SSE rose 0.52%. Singapore Strait Times rose 0.37%. Japan 10-year JGB yield fell -0.001 to 0.979.

In Europe, at the time of writing, FTSE is down -0.54%. DAX is down -0.15%. CAC is down -0.58%. UK 10-year yield is up 0.040 at 4.210. Germany 10-year yield is down -0.005 at 2.317. Earlier in Asia, Nikkei fell -0.80%. Hong Kong HSI rose 1.27%. China Shanghai SSE rose 0.52%. Singapore Strait Times rose 0.37%. Japan 10-year JGB yield fell -0.001 to 0.979.

BoC to Slash Rates by 50bps

BoC is widely anticipated to lower its policy rate by 50bps to 3.75% today, marking the fourth consecutive rate cut. The central bank is stepping up its monetary easing, as policymakers are increasingly worried that the current high level of interest rates is causing additional economic pain.

Recent economic indicators support the case for the more aggressive adjustment. Unemployment rate surged to a seven-year high (excluding the pandemic period) of 6.6% in August before dipping slightly to 6.5% in September. Even at 6.5%, unemployment remains a full percentage point higher than a year earlier. Additionally, per capita GDP has contracted for five consecutive quarters. With inflation falling more rapidly to 1.6% in September, the BoC has room to act swiftly.

The key question now is the pace of future policy easing. There are firm expectations that the interest rate will fall to a neutral range between 2.25% and 3.25% by the end of next year. Among major financial institutions, Scotiabank is forecasting a more conservative year-end policy rate of 3.00%, while National Bank and RBC anticipate a more aggressive path to 2.00% by the end of 2025. These projections will likely be reassessed based on BoC’s new economic forecasts released today.

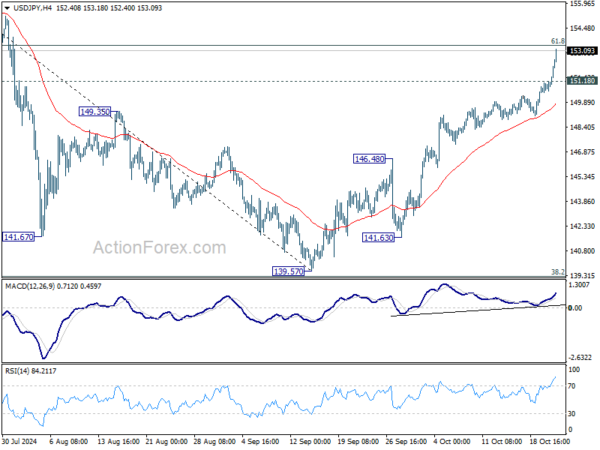

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 150.66; (P) 150.93; (R1) 151.36; More…

USD/JPY accelerates to as high as 153.18 so far and intraday bias stays on the upside. Decisive break of 61.8% retracement of 161.94 to 139.57 at 153.39 will pave the way to retest 161.94 high. On the downside, below 151.18 minor support will turn intraday bias neutral first. But further rally will now remain in favor as long as 55 D EMA (now at 147.85) holds, in case of retreat.

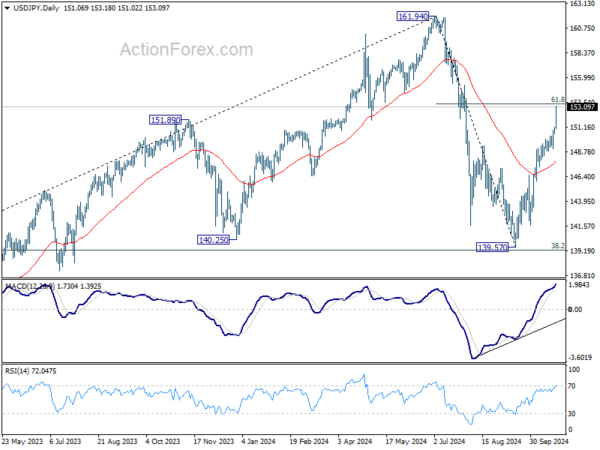

In the bigger picture, price actions from 161.94 are seen as a corrective pattern to rise from 102.58 (2021 low). The range of medium term consolidation should be set between 38.2% retracement of 102.58 to 161.94 at 139.26 and 161.94. Nevertheless, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more