Sterling Climbs As UK Core Inflation Accelerates, Dollar Softens Ahead Of FOMC Decision

Sterling strengthened across the board today after UK CPI data revealed reacceleration in core inflation. The uptick in core CPI provides additional support for hawkish members of the BoE’s MPC, bolstering the case for a rate hold at tomorrow’s decision. A rate cut is still expected in November, when new economic projections will be available. But for the near term, the question is whether Sterling can maintain its momentum and extend its rally against the Euro before then.

On the other hand, Dollar is weakening as markets await the much-anticipated FOMC rate decision later today. With just hours to go, market sentiment remains split, with a 60% probability of a 50bps rate cut and a 40% chance of a 25bps reduction. US stock markets are treading water in early trading as traders exercise caution ahead of this pivotal event.

In addition to the rate decision, Fed will also release updated economic projections and the dot plot. While the size of the rate cut will grab headlines, the broader outlook—especially the projected path of easing for the remainder of this year and next, along with the terminal interest rate—will also be key drivers of market reactions.

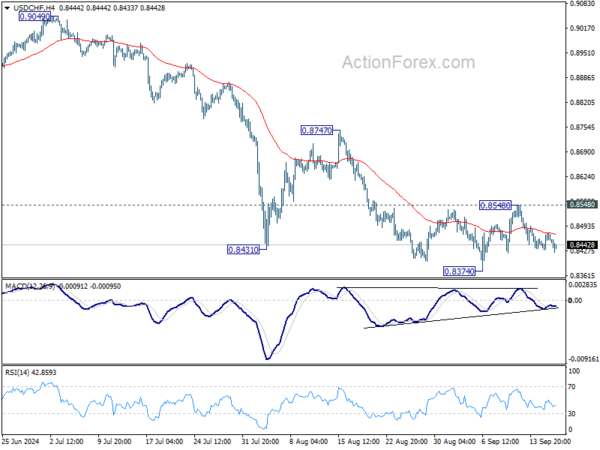

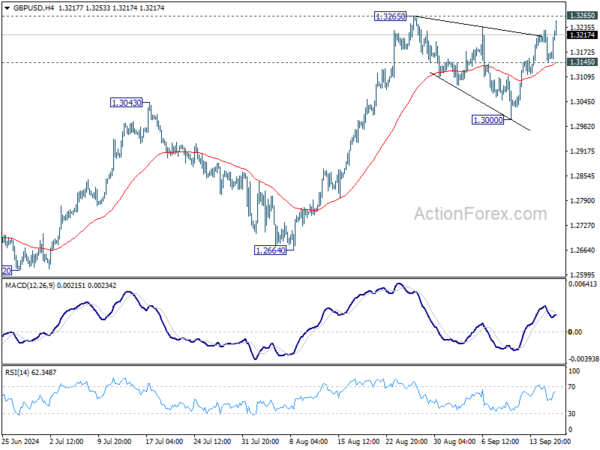

Technically, in the event of a Dollar rebound, several support levels need to be watched closely: 1.1072 in EUR/USD, 1.3145 in GBP/USD, 0.6730 in AUD/USD, and 0.8548 resistance in USD/CHF. As long as these levels hold, there’s no confirmation of significant underlying strength in the greenback.

In Europe, at the time of writing, FTSE is down -0.64%. DAX is down -0.08%. CAC is down -0.50%. UK 10-year yield is up 0.078 at 3.852. Germany 10-year yield is up 0.045 at 2.193. Earlier in Asia, Nikkei rose 0.49%. Hong Kong was on holiday. China Shanghai SSE rose 0.49%. Singapore Strait Times fell -0.03%. Japan 10-year JGB yield fell -0.0032 to 0.827.

Eurozone CPI finalized at 2.2% in Aug, core CPI at 2.8%

Eurozone CPI was finalized at 2.2% yoy in August, down from July’s 2.6% yoy. Core CPI (ex-energy, food, alcohol & tobacco) was finalized at 2.8% yoy, down from prior month’s 2.9% yoy.

The highest contribution to the annual Eurozone inflation rate came from services (+1.88 percentage points, pp), followed by food, alcohol & tobacco (+0.46 pp), non-energy industrial goods (+0.11 pp) and energy (-0.29 pp).

EU CPI was finalized at 2.4% yoy. The lowest annual rates were registered in Lithuania (0.8%), Latvia (0.9%), Ireland, Slovenia and Finland (all 1.1%). The highest annual rates were recorded in Romania (5.3%), Belgium (4.3%) and Poland (4.0%). Compared with July 2024, annual inflation fell in twenty Member States, remained stable in one and rose in six.

UK CPI unchanged at 2.2%, core CPI rises to 3.6%, services accelerates to 5.6%

UK inflation data for August came in as expected, with headline CPI remaining unchanged at 2.2% yoy, in line with forecasts. Meanwhile, core CPI, which excludes volatile items such as energy, food, alcohol, and tobacco, showed accelerated from 3.3% yoy to 3.6% yoy.

The breakdown of the data reveals a mixed picture. Goods prices continued to decline, with CPI for goods falling from -0.6% yoy to -0.9% yoy. However, services inflation moved higher, rising from 5.2% yoy to 5.6% yoy, indicating persistent domestic price pressures.

The main driver of the inflationary uptick was airfares, which rose this year after a drop in prices during the same period last year. On the downside, motor fuels, restaurants, and hotels contributed to the moderation of price pressures.

On a monthly basis, CPI increased by 0.3% mom, also meeting expectations.

Japan’s exports rise for ninth month, but auto sector weighs on growth

Japan’s export growth continued in August, rising 5.6% yoy to JPY 8,442B, marking the ninth consecutive month of growth. However, this increase fell significantly short of market expectations of 10% yoy growth. The weaker export performance was largely driven by -9.9% yoy decline in auto exports.

In terms of regional performance, exports to the US fell -0.7% yoy, marking the first decline in nearly three years, with auto sales slumping -14.2% yoy. Exports to Europe also suffered, falling -8.1% yoy. In contrast, exports to China were a bright spot, rising by 5.2% yoy.

On the import side, Japan saw 2.3% yoy increase, reaching JPY 9,137B, but this was also far below the expected growth of 13.4% yoy. Despite this, the import figure was the second-largest on record for the month of August.

The country’s trade balance recorded a deficit of JPY -695B, remaining in the red for the second consecutive month.

In seasonally adjusted terms, both exports and imports declined on a month-over-month basis. Exports dropped -3.9% to JPY 8,759B, while imports fell -4.4% to JPY 9,354B. This left Japan with a seasonally adjusted trade deficit of JPY -596B.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3127; (P) 1.3178; (R1) 1.3211; More…

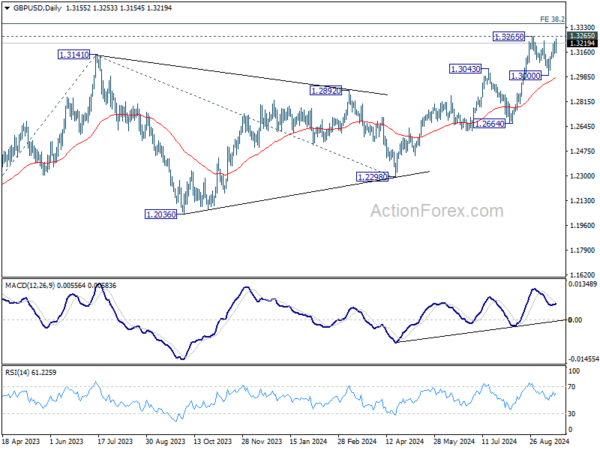

Immediate focus is now on 1.3265 resistance as GBP/USD’s rise from 1.3000 extends today. Decisive break of 1.3265 will resume larger rally 1.3364 projection level next. On the downside, however, break of 1.3145 support will turn bias to the downside, to extend the corrective pattern from 1.3265 with another leg.

In the bigger picture, up trend from 1.0351 (2022 low) is in progress. Next target is 38.2% projection of 1.0351 to 1.3141 from 1.2298 at 1.3364. For now, outlook will stay bullish as long as 1.2664 support holds, even in case of deep pullback.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Current Account (NZD) Q2 | -4.83B | -3.90B | -4.36B | -3.83B |

| 23:50 | JPY | Trade Balance (JPY) Aug | -0.60T | -0.97T | -0.76T | -0.68T |

| 23:50 | JPY | Machinery Orders M/M Jul | -0.10% | 0.40% | 2.10% | |

| 01:00 | AUD | Westpac Leading Index M/M Aug | -0.10% | -0.04% | ||

| 06:00 | GBP | CPI M/M Aug | 0.30% | 0.30% | -0.20% | |

| 06:00 | GBP | CPI Y/Y Aug | 2.20% | 2.20% | 2.20% | |

| 06:00 | GBP | Core CPI Y/Y Aug | 3.60% | 3.60% | 3.30% | |

| 06:00 | GBP | RPI M/M Aug | 0.60% | 0.50% | 0.10% | |

| 06:00 | GBP | RPI Y/Y Aug | 3.50% | 3.40% | 3.60% | |

| 06:00 | GBP | PPI Input M/M Aug | -0.50% | -0.30% | -0.10% | |

| 06:00 | GBP | PPI Input Y/Y Aug | -1.20% | -0.90% | 0.40% | |

| 06:00 | GBP | PPI Output M/M Aug | -0.30% | 0.00% | 0.00% | |

| 06:00 | GBP | PPI Output Y/Y Aug | 0.20% | 0.50% | 0.80% | |

| 06:00 | GBP | PPI Core Output M/M Aug | 0.10% | 0.00% | ||

| 06:00 | GBP | PPI Core Output Y/Y Aug | 1.30% | 1.00% | ||

| 09:00 | EUR | Eurozone CPI Y/Y Aug F | 2.80% | 2.80% | 2.80% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Aug F | 2.20% | 2.20% | 2.20% | |

| 12:30 | USD | Housing Starts Aug | 1.36M | 1.32M | 1.24M | |

| 12:30 | USD | Building Permits Aug | 1.475M | 1.41M | 1.40M | |

| 14:30 | USD | Crude Oil Inventories | -0.2M | 0.8M | ||

| 17:30 | CAD | BoC Summary of Deliberations | ||||

| 18:00 | USD | Fed Interest Rate Decision | 5.25% | 5.50% | ||

| 18:30 | USD | FOMC Press Conference |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more