Sterling Advances On Strong GDP Data; Swiss Franc Awaits Crucial Breakout

British Pound is showing notable strength in early European session today, buoyed by more robust than anticipated monthly and quarterly GDP figures. While the quarterly GDP has not yet bounced back to its pre-pandemic stature, the positive numbers come as a boon to BoE. This development supports the expectation that the BoE will maintain its prolonged tightening, as inflation remains elevated.

On the other side of the Atlantic, Dollar has displayed remarkable resilience post its CPI-induced dip. The greenback is staying as the strongest performer for the week, even though it’s still bounded in range against all but Yen. Currently, Sterling occupies the third spot in performance rankings, with a potential to surpass Euro and secure second place. Yen, however, remains at the bottom of the pile, with minimal chances of a reversal before the week concludes. Commodity-based currencies also seem to be on the weaker end.

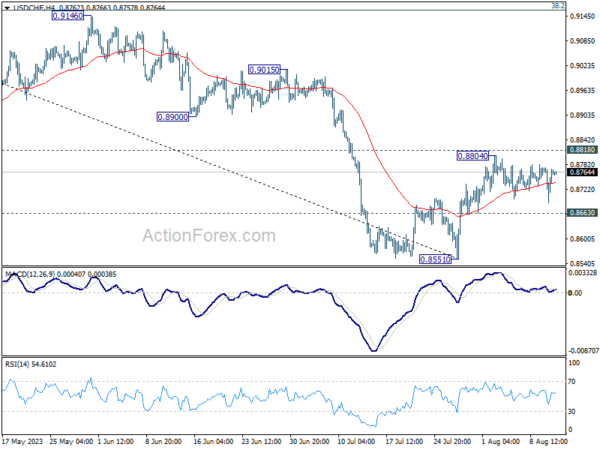

Technically, Swiss Franc is worth some attention for the near term. USD/CHF’s price actions from 0.8804 are rather corrective looking, and argues that rebound from 0.8551 is not over. Break of 0.8804 would likely push the pair through 0.8818 support turned resistance, which would then signal a stronger medium term rebound is underway, even as a corrective move. At the same time, the selloff in Franc would be solidified if EUR/CHF could break through corresponding resistance levels at 0.9647 and 0.9670 too.

In Asia, Nikkei closed up 0.84%. Hong Kong HSI is down -0.78%. China Shanghai SSE is down -1.45%. Singapore Strait Times is down -0.92%. Japan 10-year JGB yield is up 0.0241 to 0.589. Overnight, DOW rose 0.15%. S&P 500 rose 0.03%. NASDAQ rose 0.12%. 10-year yield rose 0.068 to 4.080.

Fed’s Daly on CPI: Not a Victory Yet

San Francisco Fed President, Mary Daly, offered a measured response to yesterday’s US CPI release, stating that while the figures “came in largely as expected, and that is good news,” it does not signify a comprehensive victory over the ongoing inflation challenges. “It is not a data point that says victory is ours,” Daly warned.

Highlighting the nuanced nature of the current inflation landscape, Daly noted the decrease in goods inflation and indicated promising trends in housing. However, her main concern lies with core services inflation that excludes housing.

Despite the general trend of receding inflation, core services inflation remains stubborn. Daly emphasized, “We do need to see that come back to prepandemic levels if we’re going to be confident that we can get to 2% on a sustainable basis.”

Offering insight into Fed’s future strategy, Daly was cautious: “Whether we raise another time, or hold rates steady for a longer period — those things are yet to be determined.”

She stressed the importance of upcoming data before Fed’s next meeting, suggesting it would play a critical role in shaping decisions. “It would be premature to project what I think would happen because there’s a lot of information coming in between now and our next meeting” in September, she added.

UK GDP rose 0.5% mom in Jun, up 0.2% qoq in Q2

UK GDP grew 0.5% mom in June, well above expectation of 0.2% mom. Production grew 1.8% mom. Services was up 0.2% mom. Construction also rose 1.6% mom.

For Q1, GDP grew 0.2% qoq, above expectation of 0.0% qoq. But the level of quarterly GDP was -0.2% below its pre-pandemic level in Q4 2019. Services grew 0.1% on the quarter. Production grew by 0.7% with 1.6% growth in manufacturing. Construction rose 0.3%.

The implied price of GDP rose by 2.1% in Q2, which was primarily driven by higher price pressures for household consumption (1.5%) and government consumption (3.1%).

Also released, industrial production was up 1.8% mom, 0.7% yoy in June. Manufacturing production was up 2.4% mom, 3.1% yoy. Goods trade deficit narrowed to GBP -15.5B.

RBA Lowe: Possible that some further tightening will be required

Addressing the House of Representatives Standing Committee on Economics today, outgoing RBA Governor, Philip Lowe stated that the purpose behind the pauses in July and August was “to provide time to assess the impact of the (rates) increases to date and the economic outlook and the associated risks.”

He reiterated that “it is possible that some further tightening of monetary policy will be required”. But the decision would be largely based on incoming data and the Board’s evolving analysis of economic forecast and potential risks.

Lowe expressed optimism about recent economic data, remarking, “It is encouraging that the recent data are consistent with inflation returning to target over the next couple of years.”

But he also pinpointed two risks that RBA is closely monitoring. “The first is the outlook for household consumption,” he said, attributing this concern to the myriad of factors currently influencing household finances and expenditures.

The second risk highlighted was the potential persistence of high services price inflation which could lead to “prolonging the period of inflation being above target.”

Lowe emphasized the RBA’s forecast, which assumes a resurgence in productivity rates, aligning with levels seen pre-pandemic. Such growth, he suggested, would help in moderating the unit labour costs and subsequently, inflation. Yet, he cautioned, “If this pick-up in productivity does not occur, all else constant, high inflation is likely to persist, which would be problematic.”

New Zealand BNZ manufacturing slumps to Post-GFC low in July

New Zealand’s BusinessNZ Performance of Manufacturing Index has experienced a drop in July, declining from 47.4 to 46.3. Digging into the details, there was a notable dip in Production, which plummeted from 47.3 to 42.9, and Employment wasn’t far behind, decreasing from 46.8 to 44.3. On a slightly brighter note, New Orders saw a modest increase, moving from 43.8 to 45.0, and Finished Stocks slightly ticked up from 52.3 to 52.6. However, Deliveries took a sharp hit, falling from 49.9 to 42.3.

Feedback from the manufacturing sector portrayed a gloomy picture. Negative comments in July stood at 72%, a slight decrease from June’s 74.5%, but higher than May’s 66.7% and April’s 70.3%. The core concerns cited by manufacturers revolved around general market uncertainty, escalating costs, and inclement weather affecting demand, particularly during July.

Catherine Beard, BusinessNZ’s Director of Advocacy, remarked on the PMI’s July figures, indicating that they “showed very little signs of potential improvements for the sector as a whole.” Echoing this sentiment, BNZ Senior Economist, Doug Steel, highlighted the gravity of the situation, noting that “the July result was the fifth consecutive monthly sub-50 reading and, outside of Covid lockdown periods, the lowest reading since the GFC days back in June 2009.”

Looking ahead

Italy trade balance is the only feature in European session. Later in the day, US will release PPI and U of Michigan consumer sentiment.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2624; (P) 1.2721; (R1) 1.2773; More…

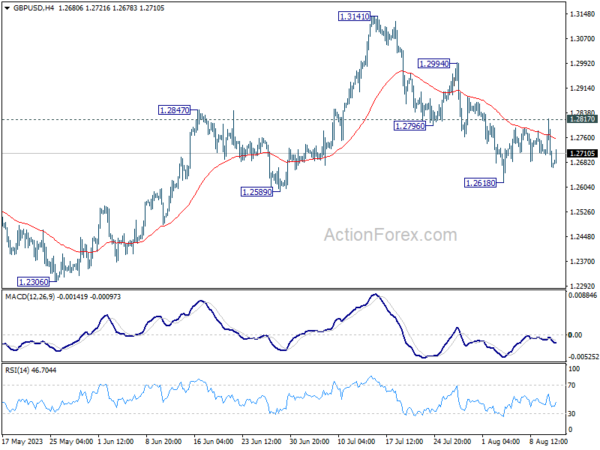

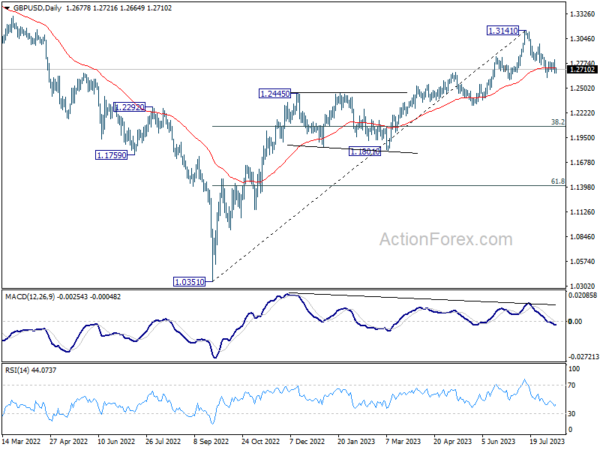

GBP/USD recovers mildly today but stays in range above 1.2618. Intraday bias stays neutral at this point. On the downside, below 1.2618, and sustained trading below 1.2678 resistance turned support will argue that it’s already in a larger correction. Deeper decline would then be seen to 1.2306 support next. Nevertheless, firm break of 1.2817 minor resistance will indicate that the pull back has completed, and turn bias back to the upside for stronger rebound.

In the bigger picture, a medium term top could be in place at 1.3141 already, on bearish divergence condition in D MACD. Sustained trading below 55 D EMA (now at 1.2726) should confirm this case, and bring deeper fall to 38.2% retracement of 1.0351 to 1.3141 at 1.2075, as a correction to up trend from 1.0351 (2022 low). For now, rise will stay mildly on the downside as long as 1.3141 resistance holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PMI Jul | 46.3 | 47.5 | 47.4 | |

| 06:00 | GBP | GDP Q/Q Q2 P | 0.20% | 0.00% | 0.10% | |

| 06:00 | GBP | GDP M/M Jun | 0.50% | 0.20% | -0.10% | |

| 06:00 | GBP | Industrial Production M/M Jun | 1.80% | -0.10% | -0.60% | |

| 06:00 | GBP | Industrial Production Y/Y Jun | 0.70% | -2.10% | -2.30% | -2.10% |

| 06:00 | GBP | Manufacturing Production M/M Jun | 2.40% | 0.10% | -0.20% | -0.10% |

| 06:00 | GBP | Manufacturing Production Y/Y Jun | 3.1% | -1.00% | -1.20% | -0.60% |

| 06:00 | GBP | Goods Trade Balance (GBP) Jun | -15.5B | -16.2B | -18.7B | -18.4B |

| 08:00 | EUR | Italy Trade Balance (EUR) Jun | 4.23B | 4.71B | ||

| 11:00 | GBP | NIESR GDP Estimate (3M) Jul | 0.00% | |||

| 12:30 | USD | PPI M/M Jul | 0.20% | 0.10% | ||

| 12:30 | USD | PPI Y/Y Jul | 0.70% | 0.10% | ||

| 12:30 | USD | PPI Core M/M Jul | 0.20% | 0.10% | ||

| 12:30 | USD | PPI Core Y/Y Jul | 2.30% | 2.40% | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Aug P | 70.9 | 71.6 |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more