Sterling A Touch Higher After UK CPI, Dollar Stays Resilient

In the wake of UK CPI data, Sterling slightly higher, but lacks clear buying momentum. As BoE had anticipated, headline inflation demonstrated pronounced deceleration. Concurrently, the evident surge in services inflation dovetails seamlessly with the week’s unprecedented data on wage growth. Given these dynamics, BoE is primed for another rate hike in the coming month, with indicators suggesting a consistent tightening trajectory. Nonetheless, pinpointing the exact juncture for the peak rate remains a matter of speculation.

Globally, Dollar, although exhibiting a subdued tone today, is firmly positioned as one of the week’s frontrunners, second only to the Pound. On the other end of the spectrum, Australian Dollar finds itself grappling with the week’s underwhelming performance. This downturn is attributed to an amalgamation of bearish trends emerging from China and a continued dip in Copper prices. On the other hand, New Zealand Dollar is mixed, with help from today’s post-RBNZ recovery. In the meantime, Canadian Dollar and Yen are charting the next in line for weaker performances, with Euro and Swiss Franc portraying a mixed picture for the time being.

Technically, WTI crude oil is in notable pull back this week. With D MACD crossed below signal line, a short term top should be in place at 84.91, after hitting 161.8% projection of 63.67 to 74.74 from 66.94 at 84.85. Break of 78.72 support will likely bring deeper pull back through 55 D EMA (now at 77.09) to 74.74 resistance turned support. Such a pronounced dip in WTI might resonate with a broader risk-off sentiment, possibly in tandem with a significant dip in equities. Such a scenario could pave the way for an invigorated US Dollar.

In Asia, Nikkei closed down -1.46%. Hong Kong HSI is down -1.38%. China Shanghai SSE is down -0.64%. Singapore Strait Times is down -0.66%. Japan 10-year JGB yield dropped -0.0094 to 0.622. Overnight, DOW dropped -1.02%. S&P 500 dropped -1.16%. NASDAQ dropped -1.14%. 10-year yield rose 0.037 to 4.221.

UK CPI slowed to 6.8% in Jul, services inflation hit highest since 1992

July saw a marked deceleration in UK’s CPI, falling from 7.9% yoy to 6.8% yoy , precisely in line with market expectations. Core CPI, which strips out variables like energy, food, alcohol, and tobacco, stood unchanged at 6.9% yoy, above the expected 6.8%.

CPI figures pertaining to goods showed a noticeable slowdown, dropping from 8.5% yoy to 6.1% yoy. On the flip side, CPI services ramped up from 7.2% yoy to 7.4% yoy , registering its peak since the staggering 9.5% yoy rate observed in March 1992.

On a month-to-month analysis for July, CPI receded by -0.4%, a figure slightly above than forecasted decline of -0.5%. Core CPI saw a monthly rise of 0.3% mom. While the CPI for goods plunged by -1.7% mom. , services CPI exhibited an increase, registering growth of 1.0% mom. .

Office for National Statistics remarked, “The slowdown in the annual CPI rate into July 2023 was driven by downward contributions to change from 8 of the 12 divisions.”

Notably, housing and household services emerged as the primary sectors applying downward pressure. Expanding on this, ONS stated, “Within this division, the downward effect came mainly from gas and electricity.”

RBNZ on hold, OCR to stay high for longer

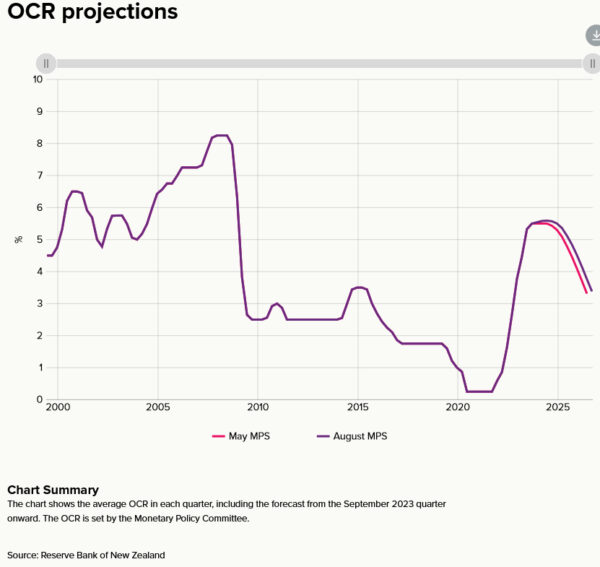

RBNZ has decided to maintain OCR unchanged at 5.50% again, aligning with broad market expectations. Making its stance clear, the bank asserted that the “OCR needs to stay at restrictive levels for the foreseeable future.”

Reflecting a neutral stance, the central bank emphasized its confidence in the current monetary policy, “that with interest rates remaining at a restrictive level for some time, consumer price inflation will return to within its target range of 1 to 3% per annum, while supporting maximum sustainable employment.”

Adding depth to its economic perspective, “The nominal neutral OCR has increased by 25 basis points to 2.25% within the projections,” the Committee noted. They were in consensus that the existing OCR level was contractionary, asserting that it’s effectively curbing domestic spending as intended.

Shifting the lens to future projections, the forecasts in the Monetary Policy Statement hint at the OCR potentially reaching a peak of 5.6% in the first quarter of 2024. This marks a slight shift from the earlier prediction of 5.5% in Q3 2023, hinting at the possibility of an additional rate hike. As for subsequent rate cut expectations are now set for the second quarter of 2025, a slight delay from the previously anticipated period between Q4 2024 and Q1 2025.

Australia’s Westpac leading index ticks up, but below-par growth set to persist

Australia’s Westpac Leading Index figures reveals that growth rate has shown a marginal uptick, moving from -0.67% to -0.60% in July. But alarmingly, this marks the twelfth consecutive month in red, representing the longest stretch of such negative prints in a span of seven years, barring the COVID-affected period.

The subdued, below-par growth momentum witnessed throughout 2023 seems set to persist into the subsequent year. Westpac predicts deceleration in GDP growth to a mere 1% for the current year. Any potential rebound is anticipated to be minimal, with projections indicating a slight rise to 1.4% annually in 2024 – with the bulk of this growth concentrated towards the year-end.

Regarding RBA meeting on September 5, Westpac sets its expectations clear. The institution foresees cash rate remaining stable at 4.10%, denoting the zenith of this current tightening phase.

Referring the recent remarks of RBA Governor before the House of Representatives Standing Committee on Economics, the note emphasized, “Policy is now in a ‘calibration’ phase with small adjustments still possible if the data starts to show clear risks of a slower return to low inflation.”

Nevertheless, given the evident frailty in growth momentum – as underscored by the most recent Leading Index update – coupled with the broader dynamics of price and wage inflation aligning with RBA’s forecasts, “the threshold for additional tightening is high and unlikely to be met.”

Looking ahead

Eurozone GDP revision and industrial production will be released in European session. Later in the day, housing data from Canada and US will be release. US will also release industrial production, and FOMC minutes.

EUR/GBP Daily Outlook

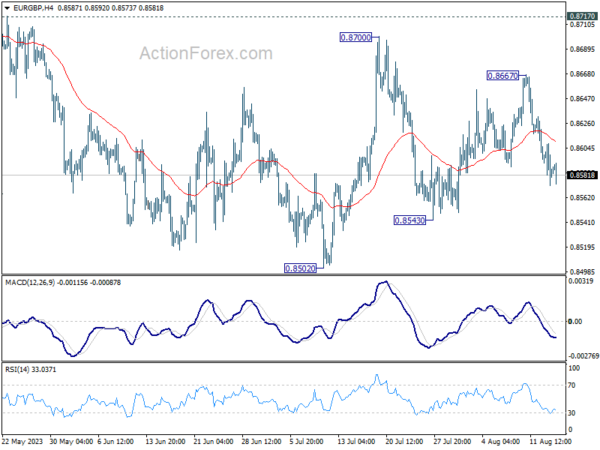

Daily Pivots: (S1) 0.8569; (P) 0.8589; (R1) 0.8605; More…

EUR/GBP dips mildly mildly today but stays in established range. Outlook is unchanged. On the downside, below 0.8543 will target a test on 0.8502 low. Decisive break there will resume larger decline from 0.8977. On the upside firm break of 0.8717 resistance will suggest larger reversal and target 0.8874 resistance next.

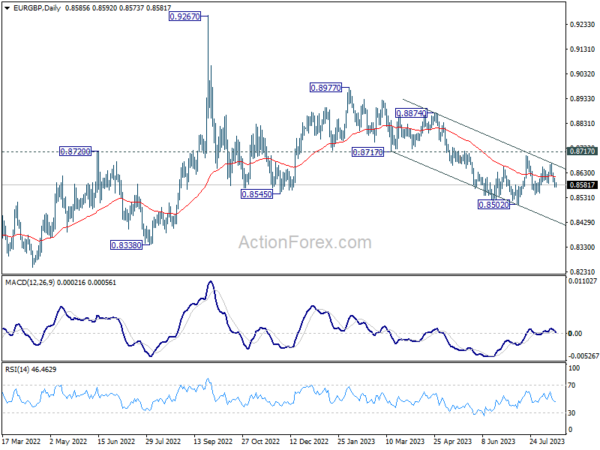

In the bigger picture, the down trend from 0.9267 (2022 high) is seen as part of the long term range pattern from 0.9499 (2020 high). Firm break of 0.8717 support turned resistance will argue that it has completed with three waves down to 0.8502. Further break of 0.8977 will bring retest of 0.9267 high. Nevertheless, rejection by 0.8717, followed by break of 0.8502 will resume the decline towards 0.8201 (2022 low).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Westpac Leading Index M/M Jul | 0.00% | 0.12% | ||

| 02:00 | NZD | RBNZ Interest Rate Decision | 5.50% | 5.50% | 5.50% | |

| 03:00 | NZD | RBNZ Press Conference | ||||

| 06:00 | GBP | CPI M/M Jul | -0.40% | -0.50% | 0.10% | |

| 06:00 | GBP | CPI Y/Y Jul | 6.80% | 6.80% | 7.90% | |

| 06:00 | GBP | Core CPI Y/Y Jul | 6.90% | 6.80% | 6.90% | |

| 06:00 | GBP | RPI M/M Jul | -0.60% | -0.70% | 0.30% | |

| 06:00 | GBP | RPI Y/Y Jul | 9.00% | 9.00% | 10.70% | |

| 06:00 | GBP | PPI Input M/M Jul | -0.40% | 0.00% | -1.30% | |

| 06:00 | GBP | PPI Input Y/Y Jul | -3.30% | -5.10% | -2.70% | -2.90% |

| 06:00 | GBP | PPI Output M/M Jul | 0.10% | -0.40% | -0.30% | -0.20% |

| 06:00 | GBP | PPI Output Y/Y Jul | -0.80% | -1.20% | 0.10% | 0.30% |

| 06:00 | GBP | PPI Core Output M/M Jul | 0.10% | -0.30% | -0.20% | |

| 06:00 | GBP | PPI Core Output Y/Y Jul | 2.30% | 1.60% | 3.00% | 3.10% |

| 09:00 | EUR | Eurozone GDP Q/Q Q2 P | 0.30% | 0.30% | ||

| 09:00 | EUR | Employment Change Q/Q Q2 P | 0.40% | 0.60% | ||

| 09:00 | EUR | Eurozone Industrial Production M/M Jun | 0.10% | 0.20% | ||

| 12:15 | CAD | Housing Starts Y/Y Jul | 260K | 281.4K | ||

| 12:30 | CAD | Wholesale Sales M/M Jun | -4.40% | 3.50% | ||

| 12:30 | USD | Housing Starts Jul | 1.45M | 1.43M | ||

| 12:30 | USD | Building Permits Jul | 1.47M | 1.44M | ||

| 13:15 | USD | Industrial Production M/M Jul | 0.30% | -0.50% | ||

| 13:15 | USD | Capacity Utilization Jul | 79.00% | 78.90% | ||

| 14:30 | USD | Crude Oil Inventories | -2.4M | 5.9M | ||

| 18:00 | USD | FOMC Minutes |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more