Sluggish Forex Markets On Hold For Direction From US Non-Farm Payrolls

Forex markets remain directionless as the week’s highly anticipated central bank activities. The rate cuts by both BoC and ECB failed to provide the expected catalysts for significant currency movements. Neither Canadian Dollar nor Euro managed to break out of their recent trading ranges following these policy adjustments. Similarly, Dollar continues to gyrate within its familiar boundaries. All eyes are now on the upcoming non-farm payroll report, which market participants hope will provide the momentum needed for more sustainable movements.

As we approach the week’s end, the Swiss Franc remains the standout performer among major currencies, closely followed by Japanese Yen and New Zealand Dollar. On the other end of the spectrum, Canadian Dollar finds itself as the week’s weakest link, exacerbated by BoC’s dovish turn. Euro and British Pound continue to hover in middle positions

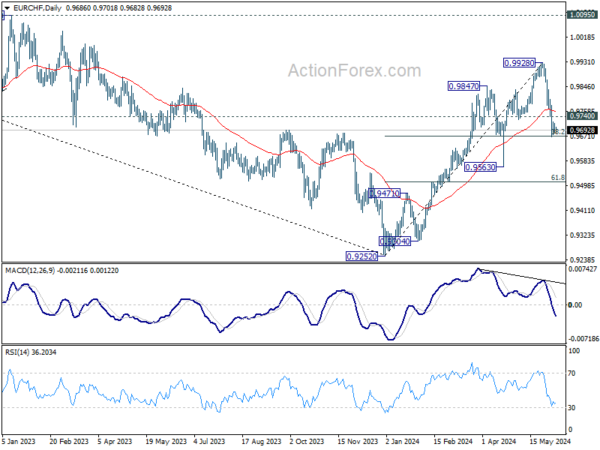

From a technical analysis standpoint, the Swiss Franc’s impressive run might soon encounter a significant challenge. As it approaches a key Fibonacci resistance level in the EUR/CHF pair at the 38.2% retracement of 0.9252 to 0.9928 at 0.9670, a crucial juncture is at hand. A potent rebound from this level, particularly if it surpasses the 0.9740 mark, could signal a short-term bottoming out. This would potentially lead to a pronounced recovery. Such a technical move could precipitate a broader selloff in the Franc across various currency pairs, dramatically altering its current position as a top performer.

From a technical perspective, while the focus remains predominantly on Dollar due to today’s non-farm payroll report, Swiss Franc also deserves attention. Franc is currently facing critical Fibonacci resistance level after its near term rally.

EUR/CHF is now pressing 38.2% retracement of 0.9252 to 0.9928 at 0.9670. Strong rebound from current level, followed by break of 0.9740 support will indicate short term bottoming, and bring stronger rebound. If realized, that could be accompanied by selloff in the Franc in other pairs, and push it down the performance ladder notably.

In Asia, at the time of writing, Nikkei is down -0.21%. Hong Kong HSI is down -0.48%. China Shanghai SSE is down -0.35%> Singapore Strait Times is up 0.45%. Japan 10-year JGB yield is up 0.0131 at 0.979. Overnight, DOW rose 0.20%. S&P 500 fell -0.02% NASDAQ fell -0.09%. 10-year yield fell -0.008 to 4.281.

Attention Shifts to US NFP as Dollar Index Seeks Fresh Momentum

As the week draws to a close, market attention is squarely on the upcoming US non-farm payroll employment report. The sluggish Dollar is in need of a catalyst from the jobs report to spark a meaningful and sustainable breakout from its recent range against major currencies.

Market expectations are set for NFP to show 180k growth o May, with the unemployment rate steady at 3.9%. Average hourly earnings are expected to increase by 0.3% mom.

Recent related economic data offers mixed signals. ISM Services employment index rose from 45.9 to 47.1, but still indicating contraction. Conversely, ISM Manufacturing employment index turned to expansion, rising from 48.6 to 51.1. ADP private employment showed a growth of only 152k. Additionally, the four-week moving average of initial jobless claims rose from 210k to 222k, suggesting some softening in the labor market.

While there may be some upside surprises in headline job growth, it is unlikely to significantly exceed expectations. The critical variable remains wage growth, which is essential for gauging underlying domestic inflation pressures, and an important factor influencing the timing of Fed’s first rate cut.

Dollar index dipped to 103.99 this week but struggled to find decisive selling momentum. Further decline is still in favor as long as 105.18 resistance holds. Fall from 106.51 is seen as developing into the third leg of the pattern from 107.34. Any downside acceleration could push DXY through 102.35 support towards 100.61.

However, strong bounce from current level followed by break of 105.18 will revive near term bullishness. Rise from 100.61 would then be ready to resume through 106.51 before reversing.

China’s exports rises 7.6% yoy in May, trade surplus exceeds expectations

In May, China’s exports rose by 7.6% yoy, surpassing the expectation of 6.0% yoy growth. Notably, exports to US increased by 4.8% yoy, marking the highest growth in three months. Exports to ASEAN countries saw a significant jump of 25% yoy, while exports to the EU declined by -0.7% yoy.

On the import side, growth was more subdued, with imports rising by only 1.8% yoy, falling short of the expected 4.2% yoy increase.

China’s trade balance for May reported a surplus of USD 82.6B, well above the anticipated USD 72.2B.

Looking ahead

Germany industrial productions and trade balance; Frane trade balance; Swiss foreign currency reserves, and Eurozone GDP revision wil be released in European session. Later in the day, Canada employment data is another important one beside US NFP.

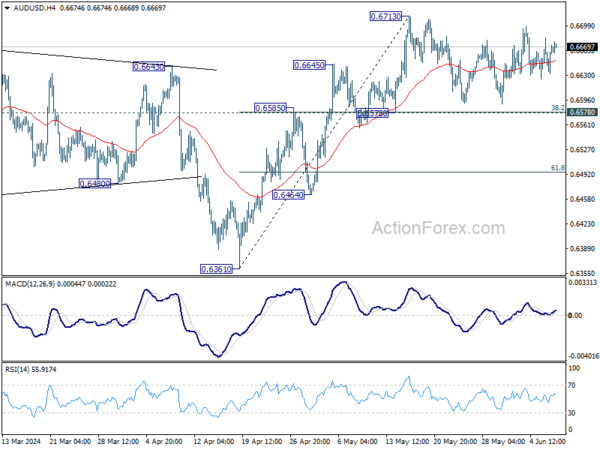

AUD/USD Daily Report

Daily Pivots: (S1) 0.6639; (P) 0.6661; (R1) 0.6689; More….

AUD/USD is still extending sideway trading below 0.6713 and intraday bias stays neutral. As long as 0.6578 cluster support (38.2% retracement of 0.6361 to 0.6713 at 0.6579) holds, further rally remains in favor. On the upside, firm break of 0.6713 will resume whole rise from 0.6361 to 0.6870 resistance next. However, sustained break of 0.6578 will dampen this bullish view, and bring deeper fall to 61.8% retracement at 0.6495.

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which could have completed at 0.6269 already. Rise from there is seen as the third leg which is now trying to resume through 0.6870 resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Trade Balance (AUD) May | 6.55B | 5.50B | 5.02B | 4.84B |

| 05:45 | CHF | Unemployment Rate May | 2.40% | 2.30% | 2.30% | |

| 06:00 | EUR | Germany Factory Orders M/M Apr | -0.20% | 0.50% | -0.40% | |

| 08:00 | EUR | Italy Retail Sales M/M Apr | -0.10% | 0.30% | 0.00% | |

| 08:30 | GBP | Construction PMI May | 54.7 | 52.5 | 53 | |

| 09:00 | EUR | Eurozone Retail Sales M/M Apr | -0.50% | -0.20% | 0.80% | 0.70% |

| 12:15 | EUR | ECB Rate On Deposit Facility | 3.75% | 3.75% | 4.00% | |

| 12:15 | EUR | ECB Main Refinancing Operations Rate | 4.25% | 4.25% | 4.50% | |

| 12:30 | USD | Trade Balance (USD) Apr | -74.6B | -69.8B | -69.4B | -68.6B |

| 12:30 | USD | Initial Jobless Claims (May 31) | 229K | 215K | 219K | |

| 12:30 | USD | Nonfarm Productivity Q1 | 0.20% | 0.30% | 0.30% | |

| 12:30 | USD | Unit Labor Costs Q1 | 4.00% | 4.70% | 4.70% | |

| 12:30 | CAD | Trade Balance (CAD) Apr | -1.05B | -2.2B | -2.3B | |

| 12:45 | EUR | ECB Press Conference | ||||

| 14:00 | CAD | Ivey PMI May | 65.2 | 63 | ||

| 14:30 | USD | Natural Gas Storage | 89B | 84B |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more