Despite the fundamental asset being residential property, it has very little correlation with the housing market due to its use and the unique income model.

The need for this type of supported housing is only growing. The Personal Social Services Research unit has predicted 30% growth in the demand for specialist supported housing in England by 2030 and 55% in respect of learning disability alone. Meanwhile, the National Audit Office has forecast a 29% increase in adults aged 18 to 64 requiring care by 2038, compared to 2018.

Meanwhile, the cost-of-living crisis is only going to exacerbate the homelessness crisis in the UK. Since the start of the Covid-19 pandemic a total of 222,360 households have been tipped into homelessness - equivalent to the population of the city of Liverpool, according to government figures. While homelessness charity Crisis estimates that the number of homeless people in England will increase by a third before 2024.

A change in the law in 2018 placed a legal obligation on local authorities to house homeless people, or those at risk of becoming homeless. A severe shortage in supply of fit-for-purpose homeless accommodation has meant local authorities have been forced to house people in expensive temporary housing such as B&Bs and guesthouses, which in some cases are 70% more expensive than what Home REIT, the £904m homeless accommodation fund, provides.

Chrysalis contagion: Analysts warn PE trusts' perception may suffer

Substantial savings are also available to local authorities if they can rehome a person in need of specialist supported living (for example, people with learning disabilities, autism, mental health issues or physical disabilities) from a hospital into a property adapted to their needs.

Housing benefit paid by local authorities to care providers, housing associations or charities typically provides 100% of the funding of rent for social housing, making the income effectively 100% government backed.

This income is also typically linked to inflation. Civitas Social Housing's (the largest investor in specialised supported housing) leases, for example, have an annual rental uplift, the majority linked to the Consumer Prices Index and a smaller proportion by CPI plus 1%, while Home REIT's inflation-linked income is capped at 4% per annum.

Social impact

The positive social impact of putting a roof over the head of the most vulnerable people in society is obvious. In monetary terms, The Good Economy partnership calculated that Civitas's portfolio produces £127m of social value per year - split between £51.2m of social impact (this is the value of the improved personal outcomes for residents) and £75.9m of fiscal savings to the public purse - equating to £3.51 of social value for every £1 of investment. Home REIT expects to bring out its social impact report later this year.

Homeless individuals housed in accommodation let to specialist housing associations, as opposed to private landlords, have been found to be substantially less likely to return to homelessness, according to a King's College London report.

The security of tenure that Home REIT will provide housing associations and registered charities allows them to make a sustained impact on the lives of individual tenants. Instead of flitting between the streets and/or homeless shelters, it provides people with a long-term programme of training and rehabilitation, which takes place at the properties, and the skills and confidence to find long-term accommodation and to reintegrate back into society.

Research has also shown that social housing tenants have an improved quality of life and better medical outcomes.

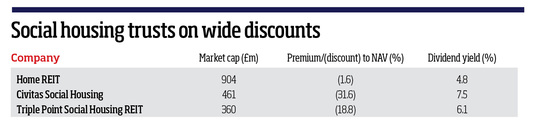

Social housing trusts on wide discounts

Given the strong investment and social case, why then are some of the social housing specialists struggling? Civitas's share price has fallen 37% since its peak last August, while Triple Point Social Housing REIT has dropped 21% in the same period. Both share prices are languishing on wide discounts to NAV.

Most of the share price performance can be attributed to legacy issues with the Regulator of Social Housing, which has repeatedly raised concerns about the leased-based social housing model - namely the financial weakness of the housing association tenants and the mismatch of long-term lease liabilities and short-term income streams.

Fidelity platform restricts fund of investment trusts following changes to charge disclosures

All housing associations have to produce a long-term business plan and the regulator stress tests them to see what could go wrong. One of its criticisms was that the income coming into housing associations from local authorities and the obligation to pay rent weren't matched: the lease is long but the payments made by local authorities are only agreed every year.

To help achieve regulatory compliance, Civitas is looking to introduce a clause that matches the two together more closely by adding a new clause to leases that would allow a housing association to temporarily stop paying rent in certain circumstances, such as if it had not received housing benefit from a local authority.

The homeless accommodation sector has not come under the same regulatory gaze as specialised supported housing due to the lesser care requirements needed. Home REIT's share price has performed strongly, and the fund recently raised £263m in a substantially oversubscribed equity raise. As it gets to work deploying the capital into acquiring more properties to help get people off the streets (its portfolio now stands at 9,554 beds across 1,951 properties), it is only a shame that the social housing funds are unable to raise equity to fund the acquisition of much-needed property for vulnerable people.

Given that the fundamentals that support growth in the sector remain strong, the obvious social impact and the insulation from the wider economic challenges, the discount to NAV that Civitas trades on seems unjustified and looks like a real opportunity.

Richard Williams is a property analyst at QuotedData