PMI Woes Shoot Euro And Sterling Down; Yen And Dollar Seize The Opportunity

Sterling and Euro faced a sharp drop today after alarming PMI readings unveiled an unanticipated rapid decline in the service sectors of both the UK and Eurozone. The days of service-driven economic growth seem to be in the rearview mirror, with signs indicating probable contractions in the third quarter for both regions. Canadian Dollar also felt the weight, taking a hit after core retail sales showed a larger-than-expected contraction, making it the day’s third weakest currency.

In a turn of events, Yen emerged as the day’s star performer, capitalizing on the notable drops in German and UK benchmark yields. Dollar, riding on the coat-tails of Yen’s performance, positioned itself as the second strongest, followed by Swiss Franc. This shift suggests a growing trend towards risk-averse sentiment in the market. Meanwhile, both Aussie and Kiwi present a mixed bag, but display vulnerability against their Dollar and Yen counterparts.

Technically, WTI crude oil’s break of 79.06 support today suggests that fall from 84.91 has resumed. Deeper decline is now expected as long as 82.15 resistance holds, to 100% projection of 84.91 to 79.06 from 82.15 at 76.30. Decisive break there will bolster that case that whole rebound from 63.67 has finished too, and target74.74 resistance turned support next. Any downside acceleration in WTI might further strain the already-pressured Canadian Dollar.

In Europe, at the time of writing, FTSE is up 0.67%. DAX is down -0.09%. CAC is down -0.06%. Germany 10-year yield is down -0.0748 at 2.570. Earlier in Asia, Nikkei rose 0.48%. Hong Kong HSI rose 0.31%. China Shanghai SSE dropped -1.34%. Singapore Strait Times rose 0.45%. Japan 10-year JGB yield is up 0.0058 at 0.677.

Canada retail sales up 0.1% mom in Jun

Canada retail sales rose 0.1% mom to CAD 65.9B in June, above expectation of 0.0% mom. Excluding gasoline stations and fuel, motor vehicle and parts dealers, sales were down -0.9% mom. In volume terms, retail sales dropped -0.2% mom.

For Q2 as a whole, sales were unchanged in value terms, and down -0.8% qoq in volume terms.

Advance estimate suggests that sales rose 0.4% mom in July.

UK PMI composite fell to 31-mth low, inflation fight carries a heavy cost

UK PMI Manufacturing fell from 45.3 to 41.5 in August, a 39-month low, and missed expectation of 45.1. PMI Services fell from 51.5 to 48.7, a 7-month low, below expectation of 50.8. PMI Composite fell from 50.8 to 47.9, a 31-month low, and first contraction since January.

Chris Williamson, S&P Global Market Intelligence’s Chief Business Economist, commented on the data’s implications: “The early PMI survey for August suggests that inflation should moderate further in the months ahead, but also indicates that the fight against inflation is carrying a heavy cost in terms of heightened recession risks.

The numbers tell a story of a stalling economy. The service sector’s earlier signs of rejuvenation are waning, and the manufacturing sector’s decline is becoming more pronounced. Williamson added that the data suggests a -0.2% contraction in GDP for Q3.”

He also alluded to the broader monetary implications, noting, “While a further hike in interest rates in September looks to be on the cards, the August PMI data will add to speculation that rates could soon peak.”

Eurozone PMI composite fell to 33-mth low, services downturn mirroring manufacturing

Eurozone PMI Manufacturing rose from 42.7 to 43.7 in August, above expectation of 42.8. However, the services sector took a hit, with its PMI descending to a 30-month low of 48.3 – the first contraction witnessed since December, and missed expectation of 50.5. Consequently, the Composite PMI declined to 47.0, its lowest in 33 months, and, excluding pandemic months, since April 2013.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, weighed in that services downturn is now mirroring the lackluster performance of manufacturing. He anticipates a -0.2% contraction in the Eurozone’s Q3 based on current indicators.

August’s data echoes ECB President Christine Lagarde’s warning about rising wages and declining productivity potentially boosting inflation. “as a result, the ECB may be more reluctant to pause the hiking cycle in September,” de la Rubia commented.

Despite the broader decline, there’s a semblance of hope for manufacturing. The sector’s PMI showed minor improvement, hinting at a potential gradual recovery by early next year.

A notable contributor to the downturn was Germany’s swift service sector contraction which fuels the discussion of “Germany being the sick man of Europe.”

Germany PMI Manufacturing ticked up from 38.8 to 39.1 in August. PMI Manufacturing Output fell from 41.0 to 39.7, a 39-month low. PMI Services tumbled sharply from 52.3 to 47.3, a 9-month low. PMI Composite dropped from 48.5 to 44.7, a 39-month low.

France’s Manufacturing PMI rose to 46.4 in August, up from 45.1. However, Services sector presented concerns, declining to a 30-month low at 46.7, with the Composite PMI holding steady at 46.6.

Japan PMI manufacturing ticked up to 49.7, services rose to 54.3

In August, Japan’s Service PMI climbed from 53.8 to 54.3, while the Manufacturing PMI saw a slight increase from 49.6 to 49.7, just above anticipated figures. The Composite PMI also edged up from 52.2 to 52.6.

Andrew Harker, from S&P Global Market Intelligence, pointed out the robust performance of the service sector, driven by consistent new order growth. In contrast, manufacturing only marginally rebounded but remained below the growth threshold.

Despite the overall rise in new orders, manufacturing employment remained flat, ending its 28-month growth streak. Additionally, heightened oil prices impacted both sectors, causing the steepest rise in input costs in four months. Notably, business confidence dwindled in both domains due to longer-term economic uncertainties.

Australian PMI hits 19-month low, but concerns on inflation and strong employment rise

Australia’s August PMI data showed a concerning decline across sectors. The Manufacturing PMI slightly decreased from 49.6 to 49.4, while Services PMI dropped to a 19-month low of 46.7. Composite PMI, reflecting both sectors, also declined to a 19-month low of 47.1.

Warren Hogan, Chief Economic Advisor at Judo Bank, drew attention to the employment sector’s resilience. He noted, “Despite weakening PMI figures, the employment index remains positive, indicating robust labour demand across both manufacturing and services.”

With businesses maintaining optimism, they might resist workforce reductions even amidst economic slowdowns. “As aggregate demand is supported by ongoing employment growth… it might mean a further substantial lift in interest rates could be required at some stage in the next 6-12 months,” he added.

Inflation remains a key concern. After 2022 disinflation trend, 2023 has shown a halt in the falling price indexes. The current data suggests an inflation rate of about 4%, overshooting the RBA’s 2-3% target range.

Hogan also noted wage growth concerns. Even with modest official growth figures, he cautioned that wage pressures might exceed RBA’s forecasted 4% annual growth for 2023. “This may mean firm tightening bias to the RBA’s policy deliberations for the rest of the year.”

NZ retail sales volume down -1.0% qoq in Q2, value down -0.2% qoq

New Zealand’s retail sales volume for Q2 plummeted by -1.0% qoq, settling at NZD 25B. This decline starkly contrasts with market forecasts which had anticipated a milder contraction of just -0.2% qoq. A broad-based slump was evident, as 11 out of 15 industries reported reduced seasonally adjusted sales volumes.

Highlighting the sectors that bore the brunt of this downturn, food and beverage services saw a sharp decline of -4.4%. Hardware, building, and garden supplies trailed closely, recording a -4.8% drop. These sectors emerged as the primary drags on the overall sales volume for the quarter.

While sales volume took a hit, retail sales value also showed signs of weakness, contracting -0.2% qoq to land at NZD 30B. Once again showcasing the breadth of the downturn, seven out of 15 industries registered a fall.

EUR/USD Mid-Day Outlook

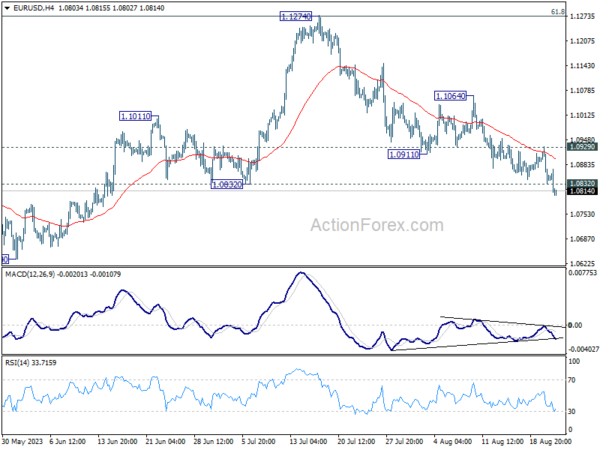

Daily Pivots: (S1) 1.0809; (P) 1.0870; (R1) 1.0907; More…

EUR/USD’s fall from 1.1274 resumes today by breaking 1.0832 support. Intraday bias is back on the downside for 1.0609/34 cluster support next. For now, break of 1.0929 resistance is needed to indicate short term bottoming. Otherwise, outlook will stay mildly bearish in case of recovery.

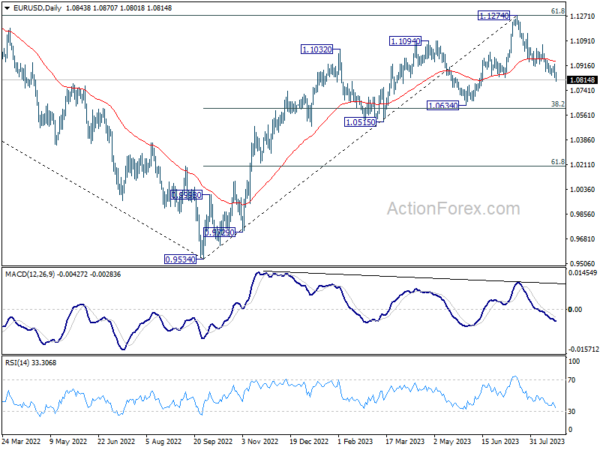

In the bigger picture, a medium term top should be formed at 1.1274, after failing to break through 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 decisively, on bearish divergence condition in D MACD. Fall from there is seen as a correction to the uptrend from 0.9534 (2022 low). Deeper decline would be seen to 1.0634 cluster support (38.2% retracement of 0.9534 to 1.1274 at 1.0609). Strong support could be seen there, at least on first attempt, to set the range for consolidation. Yet, medium term outlook will be neutral for now, as long as 1.1274 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Retail Sales Q/Q Q2 | -1.00% | -0.20% | -1.40% | -1.60% |

| 22:45 | NZD | Retail Sales ex Autos Q/Q Q2 | -1.80% | -0.10% | -1.10% | -1.60% |

| 23:00 | AUD | Manufacturing PMI Aug P | 49.4 | 49.6 | ||

| 23:00 | AUD | Services PMI Aug P | 46.7 | 47.9 | ||

| 00:30 | JPY | Manufacturing PMI Aug P | 49.7 | 49.6 | 49.6 | |

| 07:15 | EUR | France Manufacturing PMI Aug P | 46.4 | 45.2 | 45.1 | |

| 07:15 | EUR | France Services PMI Aug P | 46.7 | 47.3 | 47.1 | |

| 07:30 | EUR | Germany Manufacturing PMI Aug P | 39.1 | 38.7 | 38.8 | |

| 07:30 | EUR | Germany Services PMI Aug P | 47.3 | 51.5 | 52.3 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Aug P | 43.7 | 42.8 | 42.7 | |

| 08:00 | EUR | Eurozone Services PMI Aug P | 48.3 | 50.5 | 50.9 | |

| 08:30 | GBP | Manufacturing PMI Aug P | 42.5 | 45.1 | 45.3 | |

| 08:30 | GBP | Services PMI Aug P | 48.7 | 50.8 | 51.5 | |

| 12:30 | CAD | Retail Sales M/M Jun | 0.10% | 0.00% | 0.20% | 0.10% |

| 12:30 | CAD | Retail Sales ex Autos M/M Jun | -0.80% | 0.30% | 0.00% | -0.30% |

| 13:45 | USD | Manufacturing PMI Aug P | 48.9 | 49 | ||

| 13:45 | USD | Services PMI Aug P | 52.4 | 52.3 | ||

| 14:00 | USD | New Home Sales Jul | 708K | 697K | ||

| 14:00 | EUR | Eurozone Consumer Confidence Aug P | -14 | -15 | ||

| 14:30 | USD | Crude Oil Inventories | -2.9M | -6.0M |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more