No Fireworks After Fed Cut, Attention Turns To BoE

Market reactions were indecisive after Fed’s much-anticipated rate cut overnight. The initial optimism that sparked a rally in US stocks quickly fizzled out, with major indexes closing in the red, while Treasury yields staged a recovery.

The reaction was somewhat anticlimactic but understandable given the unusually high level of uncertainty surrounding this FOMC meeting. In hindsight, the market was prepared for unpredictability, making any actual surprise less impactful.

Dollar rebounded following an initial selloff, but failed to carry momentum into Asian session. The greenback remains capped below resistance levels across major currency pairs, with the exception of Yen. As such, risk remains to the downside for Dollar in the near term.

The spotlight is now on BoE’s rate decision today, with markets broadly expecting the central bank to keep its Bank Rate unchanged at 5.00%. This move comes after a closely contested 5-4 vote in August where rates were cut from a 16-year high.

The expectation now is that the MPC will return to a 7-2 split, favoring a rate hold. However, should more members advocate for another cut, this could increase the likelihood of further reductions in November.

So far this week, Aussie has been the best-performing currency, additionally supported by strong employment data released today. Kiwi is close behind, while Sterling also ranks as one of the top performers as it gears up for BoE decision. On the other end of the spectrum, Yen has been the weakest performer, reacting negatively to the recovery in Treasury yields. Loonie is also struggling, and Dollar is following suit, while Euro and Swiss Franc are trading mixed in the middle.

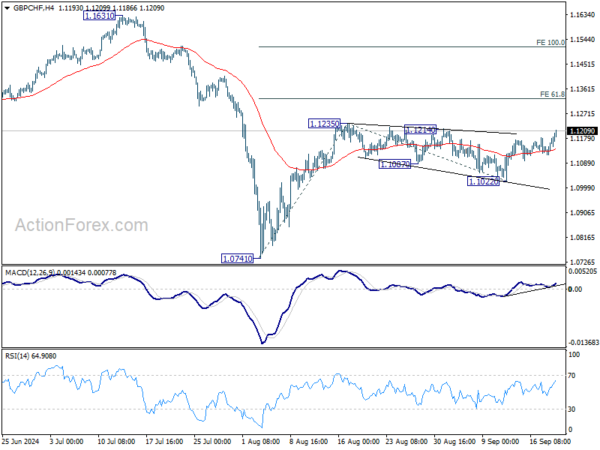

Technically, EUR/GBP has made some progress yesterday by breaking 0.8417 might support. Further break of 0.8399 will argue that larger down trend might be ready to resume through 0.8382 low. At the same time, GBP/CHF’s rebound from 1.1022 resumed after drawing support from 55 4H EMA. Immediate focus is now on 1.1235 resistance. Decisive break there will resume the rally from 1.0741 to 61.8% projection of 1.0741 to 1.1235 from 1.1022 at 1.1327, and possibly further to 100% projection at 1.1516. The moves in EUR/GBP and GBP/CHF could reinforce each other.

In Asia, at the time of writing, Nikkei is up 2.48%. Hong Kong HSI is up 1.81%. China Shanghai SSE is up 0.59%. Singapore Strait Times is up 0.72%. Japan 10-year JGB yield is up 0.0230 at 0.850. Overnight, DOW fell -0.25%. S&P 500 fell -0.29%. NASDAQ fell -031%. 10-year yield rose 0.0430 to 3.865.

Stocks end in red as Fed’s 50bps cut seen as catch-up, not new pace

Despite initial rally, major US stock indexes closed lower after Fed officially began its policy easing cycle with a 50bps rate cut, bringing the target range to 4.75-5.00%. While some may attribute the late selloff to the classic “buy the rumor, sell the fact” dynamic, Fed Chair Jerome Powell’s press conference and the new economic projections pointed to a more cautious pace ahead. These suggested that Fed’s bold move was more about catching up from July’s inaction rather than setting an aggressive pace for future cuts.

Powell acknowledged that Fed “might well have” started lowering rates back in July if the employment data had been available earlier. He emphasized that the 50bps cut was “a sign of our commitment not to get behind” the curve in normalizing rates, calling it “a strong move.” Additionally, he was quick to clarify that this cut is not indicative of a “new pace,” stating, “The economy can develop in a way that would cause us to go faster or slower.”

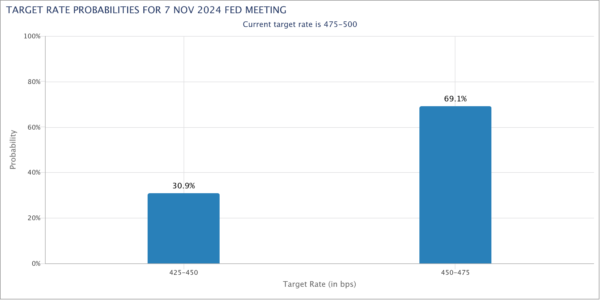

The updated dot plot also revealed a divided Fed. Of the 19 participants, 10 penciled in another 50bps cut by year-end, bringing rates down to 4.25-4.50%, while 9 saw only a 25bps cut to 4.50-4.75%. This suggests Fed would revert to smaller cuts in the coming months, with November likely seeing a 25bps reduction, followed by another 25bps cut in December, or even a few cuts if inflation risks persist.

This sentiment is reflected in market pricing, with fed funds futures currently indicating around 70% chance of a 25bps cut in November and 30% chance of a larger 50bps move.

Technically, while S&P 500 struggled to sustain above 5669.67 key resistance, and some retreat might be seen in the near term, outlook will stay bullish as long as 5402.62 support holds. Sustained trading above 5669.67 will extend the long term up trend to 61.8% projection of 4103.78 to 5669.67 from 5119.26 at 6086.98 later in the year.

New Zealand GDP contracts – 0.2% qoq in Q2, manufacturing offers some resilience

New Zealand’s GDP contracted by -0.2% qoq in Q2, slightly better than the expected -0.4% qoq decline. Despite the overall negative figure, 7 out of 16 industries posted increases, with manufacturing leading the growth.

GDP per capita also saw a decline, falling by -0.5%, marking the fourth consecutive quarter of contraction in this metric. The last time GDP per capita increased was back in Q3 2022.

On the expenditure side, GDP was flat for the quarter, showing no growth or contraction at 0.0%. Household spending, however, provided a small positive with a 0.4% increase. Real gross national disposable income was also flat at 0.0%, reflecting limited income growth in the face of economic headwinds.

Australia’s employment grows 47.5k in Aug, labor market remains tight

Australia’s employment grew by a robust 47.5k in August, significantly exceeding expectations of 25.3k. While full-time employment declined slightly by -3.1k, part-time jobs saw a sharp increase of 50.6k, boosting the overall figure. The employment-to-population ratio edged up by 0.1% to 64.3%, just shy of the record high of 64.4% set in November 2023.

Unemployment rate held steady at 4.2%, as anticipated, with the number of unemployed individuals falling by -10.5k, a -1.6% mom decline. Participation in the labor force remained strong, with the participation rate unchanged at 67.1%. Additionally, monthly hours worked rose by 0.4% mom, reflecting continued labor demand.

Kate Lamb, head of labor statistics at ABS, commented: “The employment and participation measures remain historically high, while unemployment and underemployment measures are still low, especially compared with what we saw before the pandemic. This suggests the labor market remains relatively tight.”

USD/JPY Daily Outlook

Daily Pivots: (S1) 140.89; (P) 141.80; (R1) 143.16; More…

USD/JPY’s break of 143.03 resistance suggests short term bottoming at 139.57, on bullish convergence condition in 4H MACD. That also came just ahead of 139.26 fibonacci level. Intraday bias is back on the upside for stronger rebound to 55 D EMA (now at 147.58), and possibly further to 38.2% retracement of 161.94 to 139.57 at 148.11.

In the bigger picture, fall from 161.94 medium term top is seen as correcting whole up trend from 102.58 (2021 low). Strong support could be seen from 38.2% retracement of 102.58 to 161.94 at 139.26 to contain downside, at least on first attempt. But in any case, risk will stay on the downside as long as 149.35 resistance holds. Sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 22:45 | NZD | GDP Q/Q Q2 | -0.20% | -0.40% | 0.20% | 0.10% |

| 01:30 | AUD | Employment Change Aug | 47.5K | 25.3K | 58.2K | 48.9K |

| 01:30 | AUD | Unemployment Rate Aug | 4.20% | 4.20% | 4.20% | |

| 06:00 | CHF | Trade Balance (CHF) Aug | 5.05B | 4.89B | ||

| 07:00 | CHF | SECO Economic Forecasts | ||||

| 08:00 | EUR | Eurozone Current Account (EUR) Jul | 40.3B | 50.5B | ||

| 11:00 | GBP | BoE Interest Rate Decision | 5.00% | 5.00% | ||

| 11:00 | GBP | MPC Official Bank Rate Votes | 0–2–7 | 0–5–4 | ||

| 12:30 | USD | Initial Jobless Claims (Sep 13) | 232K | 230K | ||

| 12:30 | USD | Philadelphia Fed Manufacturing Survey Sep | 2.4 | -7 | ||

| 12:30 | USD | Current Account (USD) Q2 | -260B | -238B | ||

| 14:00 | USD | Existing Home Sales Aug | 3.85M | 3.95M | ||

| 14:30 | USD | Natural Gas Storage | 53B | 40B |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more