Markets Turning Cautious Ahead Of FOMC Minutes, 10-Year Yield Making Progress

Dollar and Japanese Yen are posting marginal gains as market attention shifts towards the release of June FOMC meeting minutes. Concurrently, major European indices are slightly down, reflecting a similar sentiment in US futures market. This development has put commodity currencies on the back foot. However, neither Dollar nor Yen has demonstrated enough strength to break free from their near-term trading range against their European counterparts. The restrained market movement signals traders’ hesitation to take a strong position ahead of Friday’s non-farm payroll data.

For the rest of the day, the primary market focus will be on minutes of June FOMC meeting. However, new revelations from the minutes are considered unlikely. The committee’s overall perspective was sufficiently conveyed through the recent dot plot. Fed Chair Jerome Powell was straightforward in expressing his view that the current monetary policy might not be restrictive enough and that it hasn’t been restrictive for an adequate period. A considerable majority of the committee anticipates two or more rate hikes this year. Yet, these decisions will be contingent on forthcoming economic data.

Technically, 10-year yield appears to be finally gathering enough momentum to break through 3.859 resistance decisively today. Sustained trading above this resistance will solidify the case that whole correction from 4.333 has completed at 3.253. Further rise should be seen towards 4.091 resistance next. Such development should give additional support to Dollar, especially against Yen.

In Europe, at the time of writing, FTSE is down -0.74%. DAX is down -0.74%. CAC is down -0.84%. Germany 10-year yield is down -0.0224 at 2.434. Earlier in Asia, Nikkei dropped -0.25%. Hong Kong HSI dropped -1.57%. China Shanghai SSE dropped -0.68%. Singapore Strait times dropped -0.57%. Japan 10-year JGB yield rose 0.0117 to 0.387.

ECB consumer expectation survey: 1-year inflation expectations fell further

According to May ECB Consumer Expectations Survey, consumers are indicating a slight easing in their inflation expectations for the near and medium term, while growth expectations stay largely cautious.

In detail, mean inflation expectations for one year ahead in May stood at 5.1%, dipping from 5.3% in April and significantly lower than March’s 6.3%. Median inflation expectations for the same period also saw a decline, registering at 3.9% in May, compared to 4.1% in April and 5.0% in March.

Furthermore, consumers’ mean inflation expectations for three years ahead were at 4.0% in May, a slight increase from April’s 3.8%, yet still lower than March’s 4.3%. The median inflation expectations for the same term remained steady at 2.5% for both May and April, below March’s 2.9%.

On the growth front, mean expectations for economic expansion over the next 12 months saw a slight uptick, registering at -0.7% in May, compared to -0.8% in April and -1.0% in March. Meanwhile, the median economic growth expectation for the next 12 months held steady at 0% for May, unchanged from April and March.

Eurozone PPI down -1.9% mom, -1.5% yoy in May

Eurozone PPI was down -1.9% mom, -1.5% yoy in May, versus expectation of -1.8% mom, -1.3% yoy. For the month, industrial producer prices decreased by -5.0% mom in the energy sector, by -1.0% mom for intermediate goods and by -0.1% mom for non-durable consumer goods, while prices remained stable for capital goods and increased by 0.3% mom for durable consumer goods. Prices in total industry excluding energy decreased by -0.4% mom.

EU PPI was down -1.8% mom, -0.5% yoy. The largest monthly decreases in industrial producer prices were recorded in Ireland (-7.4%), Italy (-3.1%) and Finland (-3.0%), while increases were observed in Cyprus (+2.8%), and Malta (+0.4%).

Eurozone PMI composite finalized at 49.9, all major euro countries lost considerable momentum

Eurozone Services PMI was finalized at a 5-month low at 52.0 from May’s 55.1, while Composite PMI was finalized at a 6-month low at 49.9, down from May’s 52.8.

Exploring some member states’ performance, a general slowdown was observed with Spain hitting a 5-month low at 52.6, Ireland at a 6-month low with 51.4, Germany at a 5-month low at 50.6, Italy hitting a 6-month low with 49.7, and France, with the most significant contraction, at a 28-month low of 47.2.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, noted that “all major euro countries have again lost considerable momentum.” Slowdown was accompanied by weaker rise in new business, lower price increases, and decline in business expectations.” Neertheless, job creation remained roughly as solid as in the previous month

While price pressure in the services sector, a key point of focus for ECB, has somewhat eased, de la Rubia cautioned that input costs are still rising robustly by historical standards. This is forcing service firms to pass on at least some of these cost increases, partially driven by higher wages, to end customers. The resulting stubbornly high core inflation suggests that the ECB may continue hiking policy rates in response.

UK PMI services finalized at 53.7, showing renewed signs of fragility

UK’s Service sector displayed signs of vulnerability in June, according to recent PMI readings. PMI Services reading was finalized at 53.7, a slight downturn from May’s 55.2, while Composite PMI eased to 52.8, down from 54.0 in May.

Tim Moore, Economics Director at S&P Global Market Intelligence, said, “The service sector showed renewed signs of fragility in June as rising interest rates and concerns about the UK economic outlook took their toll on customer demand.” He pointed out that business activity saw the slowest expansion in three months, and rate of new order growth slid further from the peak recorded in April.

Despite the tepid pace of activity, Moore observed that labor market conditions remained relatively buoyant. He highlighted that job creation reached a nine-month high, with an improvement in candidate availability enabling firms to fill vacancies and rebuild business capacity.

On the price front, service providers experienced deceleration in overall input price inflation. Business expenses climbed at the most modest pace since May 2021. Nonetheless, cost pressures ranked among the most substantial seen since the survey began in July 1996. Salary payments continued to surge across the board, offsetting the decline in fuel bills and energy prices. This situation underscores the ongoing challenge of inflationary pressures in the UK economy.

China Caixin PMI services fell to 53.9, recovery losing steam

China’s Caixin Services PMI for June plunged to 53.9, down from 57.1 in the previous month and significantly below the expectation of 56.2. The composite PMI also tumbled from 55.6 to a discouraging 52.5, marking the lowest readings since the growth cycle kick-started in January.

Wang Zhe, a senior economist at the Caixin Insight Group, commented on the less-than-promising data: “A slew of recent economic data suggests that China’s recovery has yet to find a stable footing, with prominent issues including a lack of internal growth drivers, weak demand, and dimming prospects persisting.”

Zhe emphasized the disparity between the manufacturing and services sectors, noting that “In June, Caixin China PMIs showed that conditions in the manufacturing sector lagged far behind services. Employment contracted, deflationary pressure mounted, and optimism waned in the manufacturing sector.”

Despite the ongoing post-Covid rebound of the services sector, Zhe expressed concerns about the sustainability of the recovery, adding that “the services sector continued a post-Covid rebound, but the recovery was losing steam.”

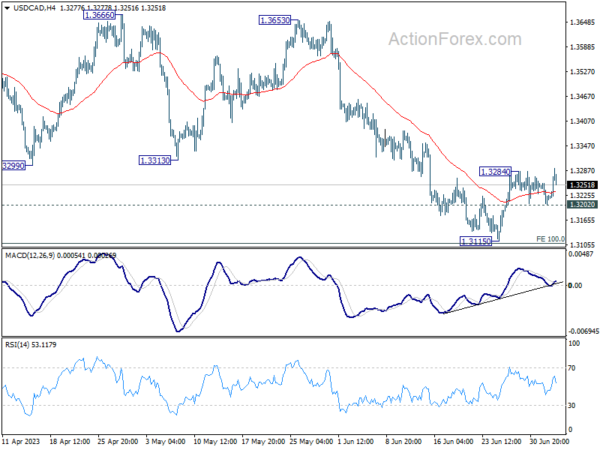

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.3198; (P) 1.3228; (R1) 1.3252; More….

USD/CAD’s rebound from 1.3115 is trying to resume by breaching 1.3284 temporary top. Intraday bias is back on the upside for 55 D EMA (now at 1.3369). On the downside, break of 1.3202 minor support will turn bias back to the downside for retesting 1.3115 low instead.

In the bigger picture, price actions from 1.3976 are still viewed as a correction to up trend from 1.2005 (2021 low). Risk will stay on the downside as long as 1.3299 support turned resistance holds. Next target is 61.8% retracement of 1.2005 to 1.3976 at 1.2758. However, sustained trading above 1.3229 will raise the chance that the correction has completed and turn focus back to 1.3653 resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:45 | CNY | Caixin Services PMI Jun | 53.9 | 56.2 | 57.1 | |

| 06:45 | EUR | France Industrial Output M/M May | 1.20% | -0.20% | 0.80% | |

| 07:45 | EUR | Italy Services PMI Jun | 52.2 | 53 | 54 | |

| 07:50 | EUR | France Services PMI Jun F | 48 | 48 | 48 | |

| 07:55 | EUR | Germany Services PMI Jun F | 54.1 | 54.1 | 54.1 | |

| 08:00 | EUR | Eurozone Services PMI Jun F | 52 | 52.4 | 52.4 | |

| 08:30 | GBP | Services PMI Jun F | 53.7 | 53.7 | 53.7 | |

| 09:00 | EUR | Eurozone PPI M/M May | -1.90% | -1.80% | -3.20% | |

| 09:00 | EUR | Eurozone PPI Y/Y May | -1.50% | -1.30% | 1.00% | 0.90% |

| 14:00 | USD | Factory Orders M/M May | 0.60% | 0.40% | ||

| 18:00 | USD | FOMC Minutes |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more