Markets Resist Feds Outlook Of Multiple Hikes: Bonds And Stocks Disagree, Dollar Rally Halted

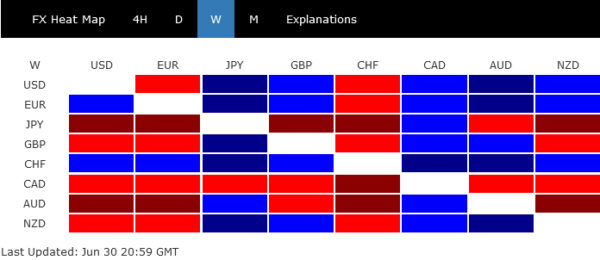

Dollar bulls experienced a somewhat disheartening week, as the initial rally supported by hawkish remarks from Fed Chair was halted by subsequent inflation data release. Consequently, the greenback managed to secure only the third position for the week, trailing behind Swiss Franc and Euro.

The vigorous late-week rally in US stocks, coupled with the sluggishness of benchmark yield, indicates that the markets remain unconvinced by FOMC’s projection of two or more rate hikes this year. However, with the tightening cycle at its current phase, all outcomes are highly data-dependent, and the week ahead is packed with significant data releases that traders will need to navigate.

Back to the currency markets, Canadian Dollar emerged as the worst performer of the past week, though this appears to be more a result of a slowing down and consolidation of its strong gains from June, rather than a bearish signal. Yen, as the second-worst performer, confirms its ongoing weakness with little doubt. Risk-sensitive currencies the Aussie, Kiwi, and Sterling delivered mixed results, reflecting the prevailing uncertainties in the global financial markets.

Slowing inflation offset hawkish Fed Powell, S&P 500 resumed up trend

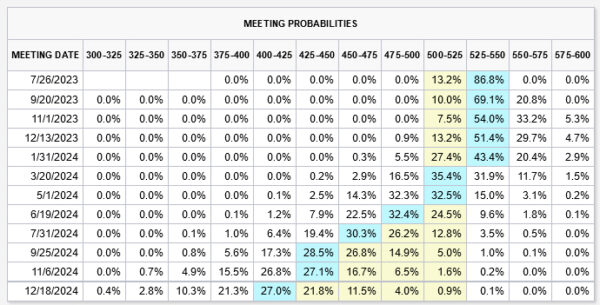

Fed Chair Jerome Powell struck a decidedly hawkish tone at the ECB Forum last week. Referring to the latest economic projections, Powell noted that a “strong majority” of FOMC anticipates “two or more” rate hikes by year’s end. Further, he did not rule out the possibility of rate hikes at “consecutive meetings”. However, market’s response suggested a different interpretation, particularly following Friday’s economic data which revealed a slowdown in both headline and PCE inflation.

The prospect of a 25 bps hike at the upcoming meeting on July 26 has admitted surged to 86.8%, up from 71.9% just a week ago. However, the likelihood of another subsequent hike this year does not exceed 40%. The expectation for the first rate cut, on the other hand, has been pushed further out, with only around a 55% chance priced in for March 2024.

The robust rally in the S&P 500 on Friday, marked by a gap up and a strong close above prior resistance at 4448.47, attests to the bullish momentum in US stocks following PCE data release. This strong performance confirms resumption of the uptrend from 3491.58. Near-term outlook will remain bullish as long as 4328.08 support holds. Next target stands at 161.8% projection of 3491.58 to 4100.51 from 3808.86 at 4794.11, which is close to 2022 high of 4818.62.

10-year yield struggled for momentum, but stays near term bullish

The rally in 10-year yield has been far less convincing, facing challenges to maintain its momentum in the aftermath of PCE inflation data. Despite breaching 3.859 resistance level, TNX failed to close above this mark. Nonetheless, near-term outlook remains bullish as long as 3.679 support level holds firm.

A decisive break above 3.859 will confirm resumption of the overall rise from 3.253, and would further reinforce the view that correction from 4.333 peak has concluded with a three-wave decline to 3.253, upon hitting the 55 W EMA. In this event, next target would be 4.091 structural resistance.

Dollar index failed to build upside momentum

Dollar Index gyrated higher last week but failed to build upside momentum. Dollar’s sluggishness against Euro was offset by its rally against Yen and others. Technically speaking, fall from 104.69 is likely not over yet. Break through last week’s low at 101.92 is mildly in favor to retest 100.78 low. But even in this bearish case, based on the current momentum, firm break of 100.78 is unlikely on first attempt. At least, the greenback’s downside momentum would be capped as long as Yen doesn’t stage a strong bullish reversal.

Meanwhile, extended rally and sustained trading above 55 D EMA would argue that consolidation from 100.82 is extending with another rising leg, with prospect of rise breaking through 104.69. The next move inside the recent range would very much depend on forthcoming economic data including ISM indexes and non-farm payrolls, and their impact on stocks and yields.

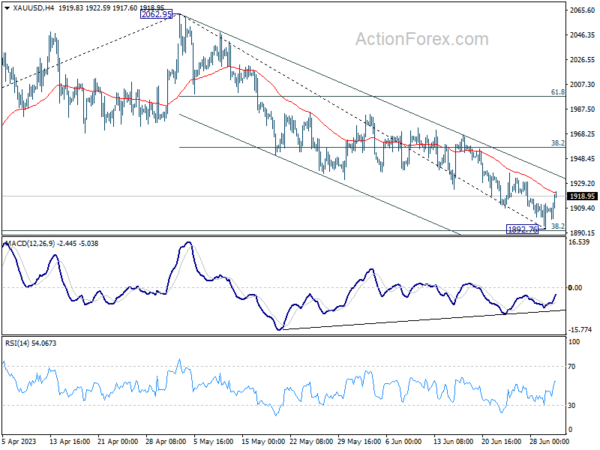

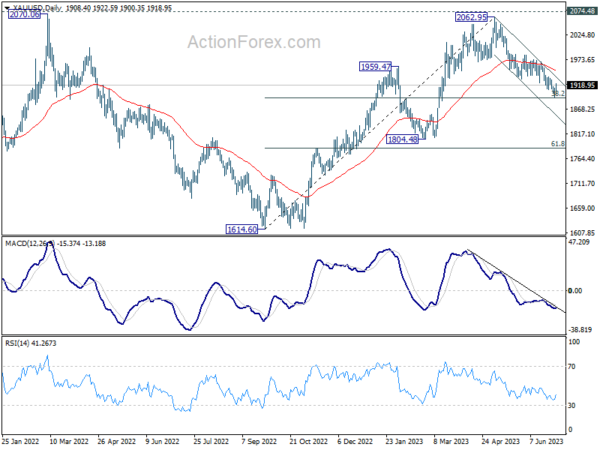

Gold’s decline slows as it nears key fibonacci Level

The indecisiveness surrounding Dollar’s trajectory is echoed in Gold’s development. Gold’s slide from its peak of 2062.95 continued last week, which saw it hitting as low as 1892.76. However, decrease in downward momentum is apparent, as suggested by bullish convergence in 4H MACD, as Gold approaches 38.2% retracement of 1614.60 to 2062.95 at 1891.68.

A robust rebound from the current level, followed by decisive break above 55D EMA (now at 1950.30), would suggest completion of the correction from 2062.95. In this bullish scenario, further rise could be expected to 61.8% retracement of the decline from 2062.95 to 1892.76 at 1997.93, with prospect of at least a brief breach of 2000 handle. This move could accompany a descent in Dollar Index towards the aforementioned 100.78 support.

Conversely, if sellers could display some conviction and pushes Gold through 1891.68 fibonacci level sustainably, deeper slump would be seen to 1084.48 support, even still as part of a corrective move. In this case, Dollar index could finally pick up some upside momentum towards 104.69 resistance.

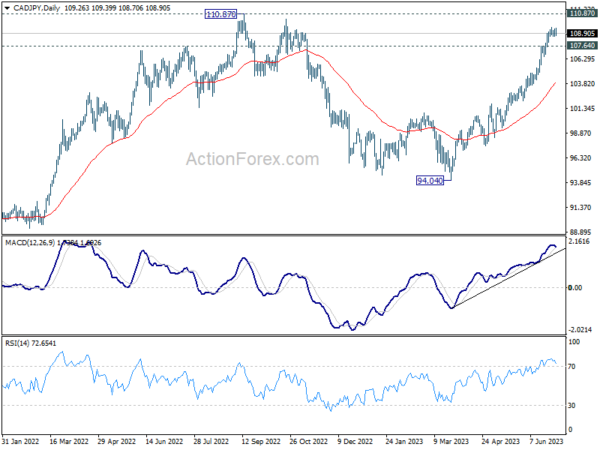

CAD/JPY ended as June’s top winner, but a top is near?

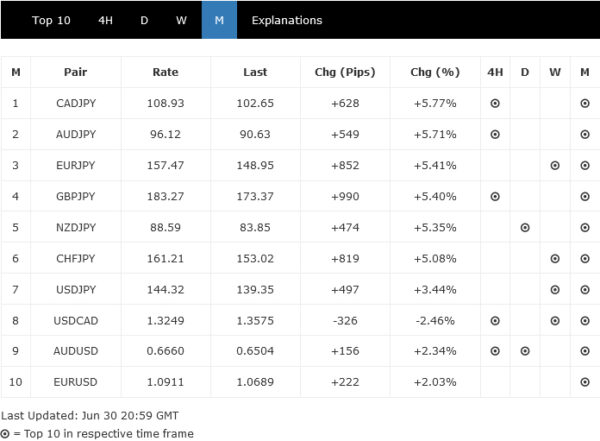

CAD/JPY ended as the biggest mover in June, gaining 5.77%, but others were not too far way, with AUD/JPY, EUR/JPY, GBP/JPY, NZD/JPY and CHF/JPY all rose more than 5%.

Divergence in monetary policy was a clear factor in driving the selloff in Yen. On the one hand, BoJ is still no where near exiting its ultra-loose monetary policy. BoJ Governor Kazuo Ueda was clear that inflation is going to slow later this year, and then bounces in 2024. If the second phase, the re-acceleration in inflation, materialize, there would be “good reason to shift policy”.

On the other hand, BoC and RBA surprised the markets this month by raising interest rates. While headline inflation has generally slowed, it remained too high in all major countries and regions, and core inflation showed larger than expected persistence. Tightening is not finished with Fed, ECB, BoE, and likely not even SNB and RBNZ.

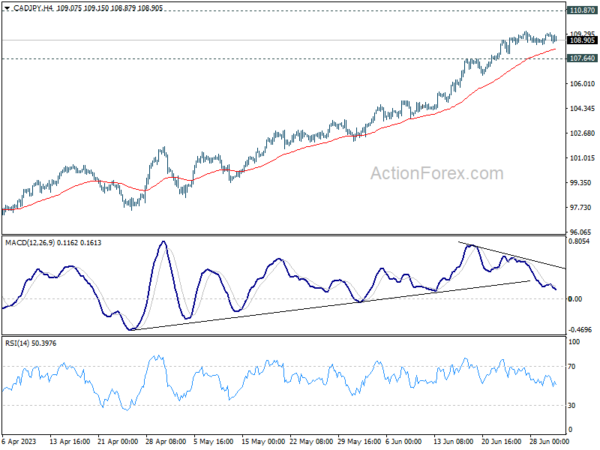

While CAD/JPY’s up trend continued last week, upside momentum is waning, as seen in bearish divergence condition in 4 H MACD. The cross might be ready to peak around 110.87 key resistance (2022 high). Break of 107.64 resistance turn support will argue that it’s already starting to correct the rally from 94.04, and target 55 D EMA (104.00).

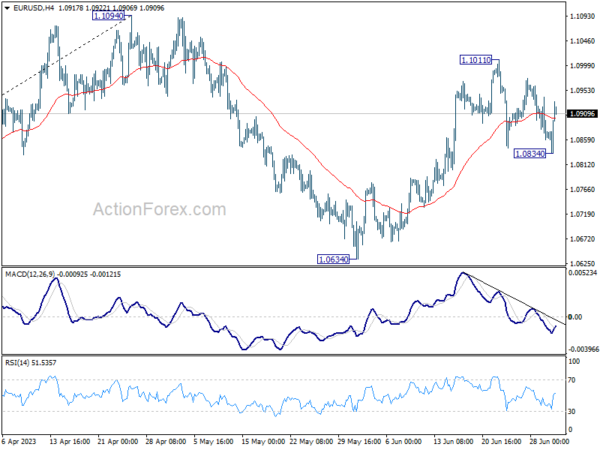

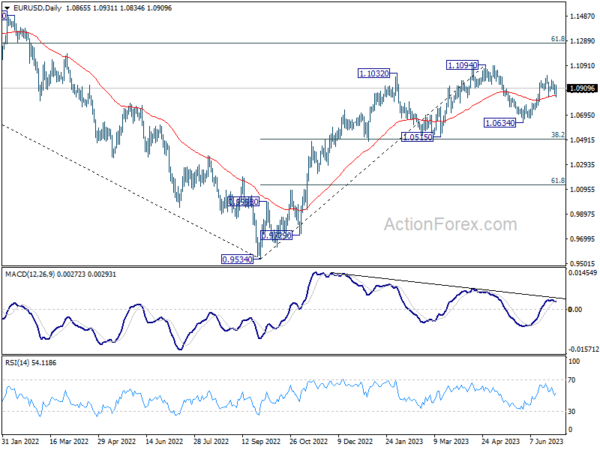

EUR/USD’s consolidation from 1.1011 short term top continued last week but drew strong support from 55 D EMA (now at 1.0805) again. Initial bias stays neutral this week first. On the upside, break of 1.1011 will resume the rise from 1.0634 and target 1.1094 resistance. Decisive break there will resume larger up trend from 0.9534 to 1.1273 fibonacci level. However, firm break of 1.0834 will turn bias to the downside for 1.0634 support instead.

In the bigger picture, as long as 1.0515 support holds, rise from 0.9534 (2022 low) would still extend higher. Sustained break of 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high).

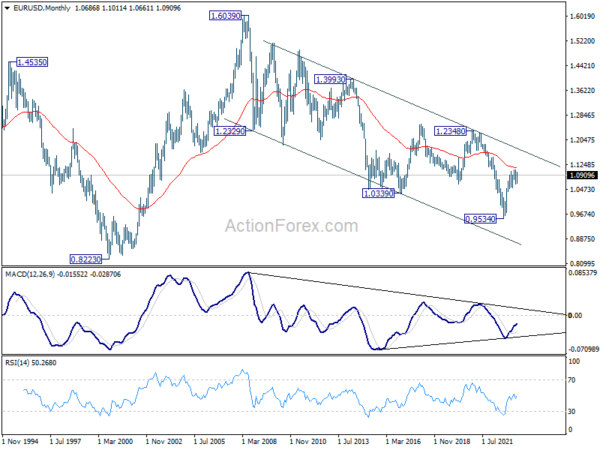

In the long term picture, focus stays on 55 M EMA (now at 1.1131). Rejection by this EMA will revive long term bearishness. However, sustained break above here will be affirm the case of long term bullish reversal and target 1.2348 resistance for confirmation.

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more