Following these events, Redington has seen a significant increase in liquidity needs from pension fund clients, triggering related questions among other asset owners and intermediaries over their own fixed income exposures.

This is happening across the whole spectrum of fixed income sub-asset classes, but for the purposes of this article, and given the large amount of capital allocated across them, we are going to focus on two: absolute return credit and multi-class credit (MCC).

Both asset classes tend to have a sizeable exposure to emerging market debt securities, determined by the portfolio managers' skillset and alpha generation capabilities.

Absolute return credit

From a firmwide perspective, we continue to like this space for the following reasons:

- Provides a large diversification benefit via exposure to multiple fixed income asset classes

- Highly liquid profile

- Stable source of returns (relative to many other credit strategies)

This was one of the asset classes where it quickly became clear in early October not only that liquidity matters, but that the settlement period does as well. One of the main lessons learnt after the LDI concerns in late September is that, going forward, we anticipate far more appetite for funds with no notice terms.

Deep Dive: Active fixed income managers set to seize 'attractive' bond yields

Changing requirements

In terms of settlement periods, in the absolute return credit space, the industry standard is three days from the trade date (T+3).

But in an ideal world our preference from a manager research perspective would be for T+1.

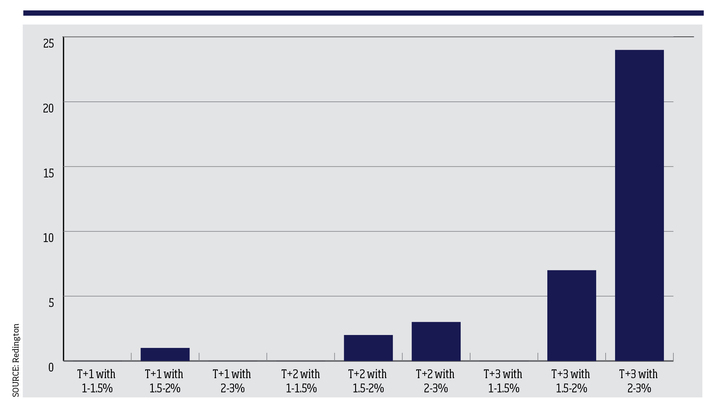

We are conscious that the risk-return profile of investment strategies might be hindered by shorter settlement periods. For instance, delivering cash +3.0% would be practically impossible for an absolute return bond fund with a T+1 settlement, but we think that cash +1.0 to 2.0% might still be feasible.

To this end, we asked a large group of asset managers with absolute return credit products about their preference in terms of settlement periods, and while the majority is willing to offer solutions with a T+3 settlement and a cash +2.0 to 3.0% return, we were pleased to see that at least one can provide a T+1 strategy with a cash +1.5 to 2.0% return profile.

Managers answer which terms they would offer

Multi-class credit

Redington's definition of this asset class consists in a combination of 50% high yield credit and 50% leveraged loans, invested across multiple geographies and sub-asset classes. In this space, after the collateral-related difficulties in the pensions industry, we have also seen a drastic increase in liquidity needs; hence, going forward we anticipate a much higher demand for daily multi-class credit products.

Redington: ESG, stewardship and sustainability principles in EM sovereign debt

In a view that is aligned with what we saw in absolute return credit funds, many asset owners and intermediaries are no longer comfortable with multi-class strategies with notice terms, while their expectation in terms of settlement periods in daily products is T+3, aiming for a return range of 4% to 6%.

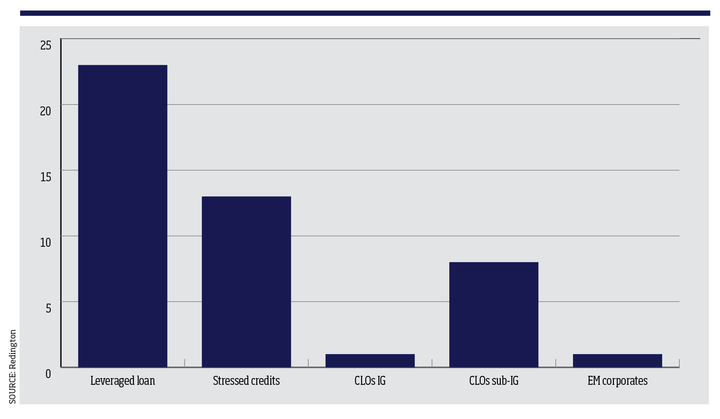

To further understand the targeted opportunity set in strategies that meet this investment criteria, we also asked a universe of investment managers which asset classes they considered would not be a good fit in this type of product.

Managers answer which asset is not favourable

It came as no surprise that most of the surveyed asset manages selected leveraged loans as the main product they would avoid in a daily multi-class credit solution, given that the guidelines of a UCITS vehicle (the most widely used regulatory framework for the sale of daily pooled funds in Europe) limit the amount of leveraged loan exposure.

The recent change in liquidity needs from our pension client base has forced us to rethink how portfolio allocation could work for other investors in multi-class credit funds going forward.

It has forced investors, managers and selectors alike to reconsider how we think about liquidity and construct investment solutions.

For example, one alternative we are considering is implementing a barbell approach to multi-class creditCC investing, in such a way that we can have one manager with a quarterly liquidity profile offering high single-digit returns while, at the same time, having another strategy with a daily liquidity profile and a modest pickup to cash in terms of performance target.

Moreover, we have also begun looking for strategies with a diversified client base, as we learnt that the strategies that got hit the hardest with outflows in September were those with an identical client profile, namely DB pension schemes.

Javier Arias is vice-president in Redington's manager research team