Kiwi Rallies On RBNZs Hawkish Hold; US CPI And BoC Next

New Zealand Dollar rises broadly in Asian session following RBNZ’s decision to keep interest rates steady. The central bank’s “limited tolerance” for delaying the achievement of its inflation target conveyed a hawkish tone. Rate cuts are off the table until the central bank is confidence that inflation would sustainably return to the target band. This is clear indication of priority over inflation control, even amidst a slowing economy. However, strength of Kiwi remains measured, with traders likely awaiting next week’s Q1 inflation data for a more decisive bet

Now, the financial world turns its attention to three significant events of the day: BoC rate decision, US CPI release, and the minutes from FOMC meeting. The focus for BoC lies in whether Governor Tiff Macklem or the economic projections would start preparing the markets for a June rate cut. Meanwhile, expectations set US headline CPI to increase to 3.4% for March, with core CPI anticipated to decelerate to 3.7%. Any upside surprises in today’s data could upend expectations for a June Fed rate cut, sending stocks and bonds lower while pushing Dollar higher.

For the week so far, New Zealand Dollar leads in strength, followed by Australian Dollar and Sterling, while Swiss Franc, Yen, and Dollar lag behind. Euro and Canadian Dollar find themselves in the middle of the performance spectrum.

Technically, NZD/USD’s rebound from 0.5938 short term bottom is still in progress, but it’s struggling to rises through 55 D EMA (now at 0.6077). While further rally cannot be ruled out, strong resistance should be seen from channel resistance (now at 0.6140) to cap upside. Below 0.5894 minor support will argue that fall from 0.6368 is ready to resume through 0.5938.

In Asian, at the time of writing, Nikkei is down -0.42%. Hong Kong HSI is up 1.87%. China Shanghai SSE is down -0.77%. Singapore Strait Times is up 0.67%. Japan 10-year JGB yield is up 0.0135 at 0.798. Overnight, DOW fell -0.02%. S&P 500 rose 0.14%. NASDAQ rose 0.32%. 10-year yield rose 0.069 to 4.378.

RBNZ holds OCR steady, no room for delay in bring down inflation to target band

RBNZ maintained Official Cash Rate unchanged at 5.50%, aligning with market expectations. This decision comes with reiterated commitment to “restrictive monetary policy stance,” deemed necessary to alleviate capacity pressures and guide inflation back within the target range of 1 to 3 percent within “this calendar year”.

During the recent meeting, members concurred that there has been “no material change in economic outlook” since their February Statement. There remains a “limited tolerance” for prolonging the timeframe to meet the inflation target, especially with inflation expectations and pricing intentions continuing to “remain elevated”.

The “persistence of services inflation” and “elevated” goods price inflation were identified as continuous risks, with expected near-term increases in local government rates, insurance, and utility costs potentially decelerating the reduction in headline inflation.

On the flip side, RBNZ acknowledges potential downside risks to the inflation outlook, notably the impact of continued restrictive monetary policy amid weak global growth. This environment could precipitate a quicker than anticipated reduction in inflation. Weak business and consumer confidence, coupled with potential increases in unemployment and financial stress, are areas of concern. Additionally, structural economic challenges in China are highlighted as significant, given its critical role in the global economy and as a major trading partner for New Zealand.

Will BoC’s Macklem Pave the Way for June Rate Reduction?

BoC is widely expected to keep interest rate unchanged at 5.00% today and the main focus is whether Governor Tiff Macklem would start to change the tune to lay down the groundwork for a June rate cut. With new economic projections on the table, this meeting presents an opportune moment for such indications.

A recent Reuters poll revealed a consensus among economists, with 27 out of 38 forecasting a 25 bps cut by BoC in June. Meanwhile, 7 expected the cut in July and 4 in September. By the year’s end, the expectation is for a 100 bps cumulative reduction, bringing the rate down to 4.00%.

Despite these anticipations, a noteworthy portion of economists — 13 out of 16 — who responded to an additional query, suggested that the timing of the first rate cut is more likely to be delayed than they expected. Moreover, 11 of them believe there’s a heightened risk of fewer rate cuts than initially forecasted.

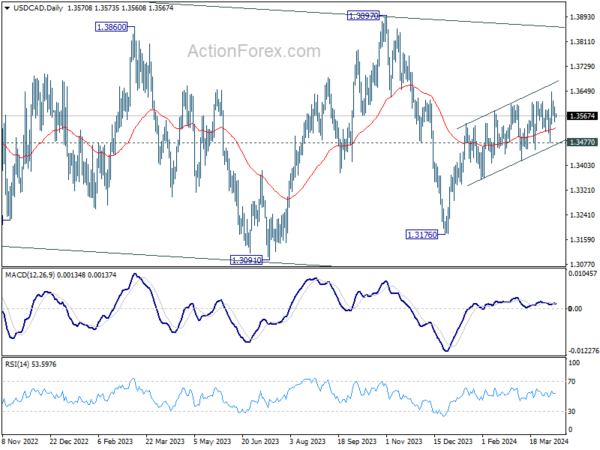

While USD/CAD’s rebound from 1.3176 has persisted in the last few months, momentum is clearly lacking as seen in both the structure of the rise, as well as in D MACD. Break of 1.3477 support the first signal that such rebound has completed as a corrective move. Nevertheless, firm break of the upper channel line will likely prompt upside acceleration towards 1.3897 resistance. Today’s BoC decision is poised to significantly influence the currency’s next move.

BoJ’s Ueda: Accommodative monetary policy to continue

In today’s parliamentary address, BoJ Governor Kazuo Ueda reaffirmed the Bank of Japan’s stance on continuing its accommodative monetary policy, underscoring the short-term interest rate as the “primary policy tool.”

A key focus for BoJ, as Ueda noted, is the scrutiny of trend inflation’s progress towards 2% target in judging “appropriate degree of monetary support.”

Meanwhile, Ueda clarified that BoJ would not alter its monetary policy solely in response to FX fluctuations. However, he acknowledged that significant FX movements, if they lead to an unexpected increase in import prices and thereby risk elevating trend inflation beyond projections, could necessitate a reassessment of monetary policy.

Fed’s Bostic: Rate cuts may have to move further out

Atlanta Fed President Raphael Bostic recently highlighted the possibility that rate cuts May have “to move further out” given that the US economy economy has been “so robust, and so strong, and so resilient”.

Further elaborating on his perspective in a Yahoo Finance interview, Bostic referred to his previous dot-plot submission, where he initially projected two rate cuts for the year, influenced by the rapid inflation decline in the latter half of 2023.

However, “What happened for me is that it slowed down and the pace went back to the pace that I had expected initially, which had me at one cut,” Bostic explained.

SNB’s Schlegel: Interventions contributes to price stability

SNB Vice Chairman Martin Schlegel defended the central bank’s use of foreign exchange interventions, highlighting their effectiveness in maintaining price stability within Switzerland.

“Have foreign exchange interventions contributed to achieving price stability? Yes, they have,” he said at an event in Geneva overnight.

He further elaborated that without utilizing foreign currency sales, SNB would have faced the necessity to escalate the policy rate significantly higher.

Schlegel also noted a modest average of 0.3% over the last fifteen years. He argued that, in the absence of foreign exchange purchases, inflation rates would have dipped considerably lower, potentially entering deflationary territory.

“Estimates suggest that it would have been significantly below zero without the purchases; we would thus not have fulfilled our mandate,” Schlegel pointed out.

Looking ahead

Italy retail sales will be released in European session. Later in the day, US CPI and BoC rate decisions are the main feature.

EUR/USD Daily Outlook

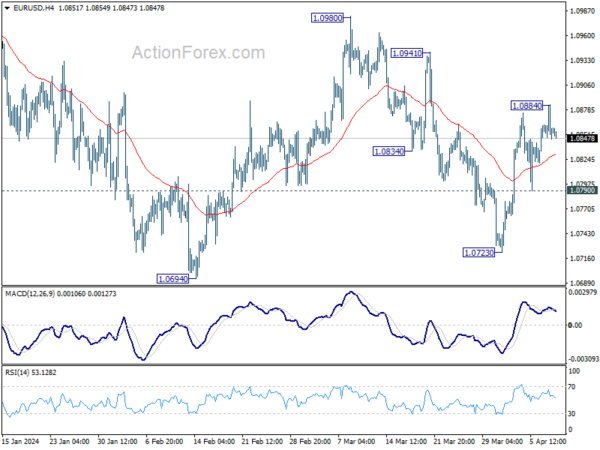

Daily Pivots: (S1) 1.0842; (P) 1.0863; (R1) 1.0879; More…

EUR/USD retreated after edging higher to 1.0884 and intraday bias is turned neutral again. Further rise would be mildly in favor as long as 1.0790 minor support holds. Above 1.0884 will resume the rebound form 1.0723 to 1.0941 resistance first. However, break of 1.0790 will turn bias back to the downside for 1.0723 instead.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0694 support will argue that the third leg has already started for 1.0447 and possibly below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Bank Lending Y/Y Mar | 3.20% | 3.10% | 3.00% | |

| 23:50 | JPY | PPI Y/Y Mar | 0.80% | 0.80% | 0.60% | 0.70% |

| 02:00 | NZD | RBNZ Rate Decision | 5.50% | 5.50% | 5.50% | |

| 08:00 | EUR | Italy Retail Sales M/M Feb | 0.20% | -0.10% | ||

| 12:30 | CAD | Building Permits M/M Feb | -3.50% | 13.50% | ||

| 12:30 | USD | CPI M/M Mar | 0.30% | 0.40% | ||

| 12:30 | USD | CPI Y/Y Mar | 3.40% | 3.20% | ||

| 12:30 | USD | CPI Core M/M Mar | 0.30% | 0.40% | ||

| 12:30 | USD | CPI Core Y/Y Mar | 3.70% | 3.80% | ||

| 13:45 | CAD | BoC Rate Decision | 5.00% | 5.00% | ||

| 14:00 | USD | Wholesale Inventories Feb F | 0.50% | 0.50% | ||

| 14:30 | USD | Crude Oil Inventories | 0.9M | 3.2M | ||

| 15:30 | CAD | BoC Press Conference | ||||

| 18:00 | USD | FOMC Minutes |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more