In its results today (16 November), the firm said that adjusted operating profits had jumped to £441m, up from £397m in September 2022.

Rathbones flows fall flat as Investec W&I merger completes

This has largely come from a surge in profits from its UK arm, Investec plc, which saw a 41.4% jump in profits, now comprising a majority of the firm's income.

Meanwhile, Investec Limited, the firm's Southern African arm, saw profits fall 10.7%, from £230m to £206m.

This was partially due to trends in its specialist banking division, where its Southern African arm saw profits fall 3% to £197m while the UK's profits surged 61.2% to £207m.

However, Investec noted the average rand/pound sterling exchange rate depreciated by approximately 18.6% over the last year, "resulting in a significant difference between reported and neutral currency performance".

Rathbones' merger with IW&I completed in September, creating one of the largest discretionary wealth managers in the UK. Investec now owns a 41.3% stake in the firm.

In its annual results last month, Rathbones revealed that its inflows had fallen from £400m to £100m, with total funds under management and administration for the group, excluding Investec W&I, saw a decline.

Meanwhile, IW&I's Southern African wealth and management business has seen funds under management increase moderately over the last six months, from £19.8bn to £20.2bn.

Investec W&I alternatives head Summers to exit for CIO role at Omnis

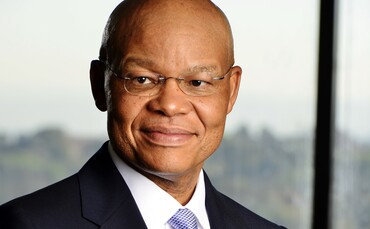

Fani Titi, group chief executive, said: "The group has delivered strong results against a difficult macroeconomic backdrop which was characterised by high inflation, elevated global interest rates and persistent market volatility.

"This performance was underpinned by continued success in our client acquisition strategies, loan book growth and the rising interest rate environment.

"Our client franchises reported solid performance while the aggregate group financial results also reflect the impact of the conclusions of the strategic actions executed over the past 18 months.

"Our balance sheet remains strong and highly liquid, positioning us well to support our clients in navigating the uncertain macroeconomic backdrop and achieve our financial targets."