FOMC Uncertainty Looms Over Quiet Markets As Yen Strengthens

Market activity in Asia has been unusually subdued today, with trading volumes even quieter than expected for the first session of the week. The holiday closures in Japan and China are partly responsible for the reduced momentum, but a larger factor looms over the markets: the upcoming FOMC meeting, which is one of the most uncertain in recent memory. With just days to go, the odds of either a 25bps or 50bps rate cut remain balanced, making it a genuine 50/50 scenario that has traders on edge.

This uncertainty is contributing to the cautious tone across markets globally, and the direction for the rest of the week will hinge largely on the outcome of Wednesday’s Fed decision. It’s not just about the rate cut but also about the signals Fed will send regarding its future path of policy easing.

Among the currencies, Japanese Yen, the strongest performers this month so far, looks ready to break higher against several of its major counterparts. While Euro is showing resilience as the second best, remains vulnerable against Sterling and the Swiss Franc. Commodity currencies, including the Australian and New Zealand Dollars, have lagged behind for the month, but they may find renewed strength if US stocks rally after the Fed’s decision.

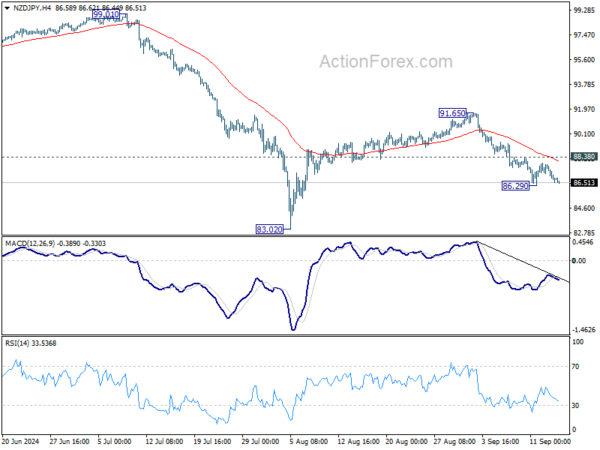

Technically, NZD/JPY is heading back towards 86.29 temporary low as recovery from there faltered ahead of 55 4H EMA. Break there will resume the fall from 91.65 towards 83.02 low. For now, deeper decline will remain in favor as long as 88.38 resistance holds even in case of recovery. In addition to FOMC, New Zealand GDP, BoJ meeting and Japan CPI release could also be the trigger of the next significant move.

In Asia, at the time of writing, Japan and China are on holiday. Hong Kong HSI is down -0.27%. Singapore Strait Times is down -0.43%.

NZ BNZ services ticks up to 45.5, longest contraction since GFC

New Zealand’s BusinessNZ Performance of Services Index edged up slightly in August, rising from 45.2 to 45.5, but still remains well below the long-term average of 53.2. The data shows that the service sector is continuing to struggle, with the index remaining in contraction for the sixth consecutive month, marking the longest period of decline since the global financial crisis.

Breaking down the numbers, activity/sales increased from 41.2 to 43.9, while employment also saw a slight rise from 47.0 to 43.9. However, new orders/business fell from 47.0 to 46.6, and stocks/inventories dropped from 45.3 to 44.6. Supplier deliveries improved marginally from 41.1 to 43.3.

The proportion of negative comments decreased to 60.8% in August, down from 67.0% in July and June. Despite the modest improvement, businesses continued to cite the high cost of living and challenging economic conditions as key concerns.

BNZ’s Senior Economist Doug Steel noted, “Smoothing through monthly volatility, the PSI’s 3-month average remains deep in contractionary territory at 43.9. The PSI has been in contraction for six consecutive months, which is the longest continuous period of decline since the GFC.”

China’s industrial production slows to 4.5%, retail sales miss at 2.1%

China’s latest economic data reveals cooling in key areas, with industrial production growing by 4.5% yoy in August, falling short of the 4.7% expected and marking a deceleration from July’s 5.1% rise.

Retail sales showed a similarly weaker-than-anticipated performance, increasing by just 2.1% yoy, compared to the 2.5% forecast and down from 2.7% in July.

The slowdown highlights ongoing imbalances in the economy, with stronger industrial production contrasted by weaker consumer demand.

Fixed asset investment also came in below expectations, rising 3.4% ytd yoy, while real estate sector continues to drag, showing a decline of -10.2% through August—the same as in July.

Liu Aihua, spokesperson for the National Bureau of Statistics, pointed to challenges, such as extreme weather and natural disasters, as factors behind last month’s slower growth.

NBS added, “the adverse impacts arising from changes in the external environment are increasing,” further noting that China’s path to recovery faces “multiple difficulties and challenges.”

Uncertainty clouds FOMC decision; BoE and BoJ to meet too

Three major central banks are scheduled to meet this week, with Fed, BoE, and BoJ at the forefront.

Among these, FOMC meeting carries the most intrigue, as markets remain sharply divided over whether Fed will deliver a 25bps or 50bps rate cut on Wednesday. The decision itself is crucial, but the same are the fresh economic projections and the updated “dot plot,” which could shape expectations for the pace of future rate cuts well into 2025.

The stakes are high. In June, Fed’s median projections indicated just one 25bps cut by year-end, followed by 100bps of cuts through 2025, and another 100bps in 2026, with a longer-term terminal rate of 2.8%. But these outdated forecasts will certainly be changed.

Now, markets are buzzing with speculation that Fed could take a more aggressive stance. A faster pace of policy easing is surely expected from the new projections. But how fast could that be? And where and when is the end-point of the cycle? These details will likely trigger complex market reactions as traders dissect multiple scenarios.

Turning to the UK, BoE is widely expected to leave its policy rate unchanged at 5.00%. A Reuters poll of economists unanimously predicted this outcome, with markets pricing in only a small, one-in-five chance of a surprise 25bps cut. However, the key to watch will be the voting patterns that could offer clues on whether a rate cut is likely at November meeting, as the market now expects.

Over in Japan, BoJ is also expected to hold rates steady at 0.25%. But with inflationary pressures and wage growth starting to gain traction, the bank’s outlook for tightening is becoming more of a question of “when” rather than “if.” According to a Bloomberg survey, 87% of economists predict a rate hike before end of January, with 53% expecting this as early as December. BoJ’s challenge will be to remain patient while weighing incoming economic data.

The data calendar this week is also loaded with important releases. US retail sales, UK inflation and retail sales, Germany’s ZEW economic sentiment, Japan’s CPI, Canada’s CPI, New Zealand GDP, and Australian employment numbers will factor into the market’s volatility this week.

Here are some highlights for the week:

- Monday: New Zealand BusinessNZ services index; Swiss PPI; Eurozone trade balance; Canada manufacturing sales; US Empire state manufacturing index.

- Tuesday: Japan tertiary industry index; Germany ZEW economic sentiment; Canada housing starts, CPI; US retail sales, industrial production, business inventories, NAHB housing index.

- Wednesday: New Zealand current account; Japan trade balance, machine orders; UK CPI, PPI; Eurozone CPI final; US FOMC rate decision, housing starts and building permits; BoC summary of deliberations.

- Thursday: New Zealand GDP; Australia employment; Swiss trade balance, SECO economic forecasts; Eurozone current account; BoE rate decision; US jobless claims, Philly Fed survey, current account, existing home sales.

- Friday: UK Gfk consumer confidence; Japan CPI, BoJ rate decision; UK retail sales; Canada retail sales, IPPI and RMPI; Eurozone consumer confidence.

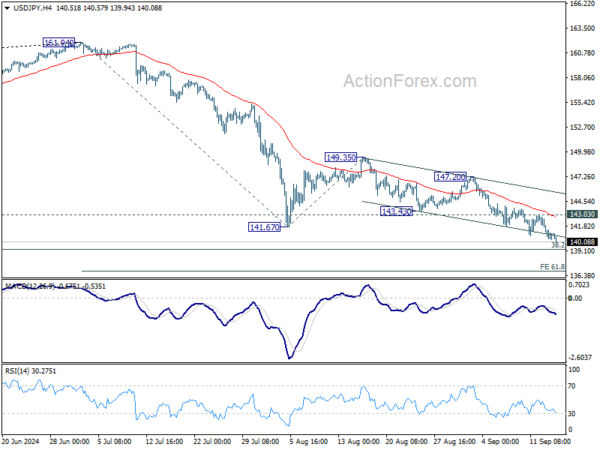

USD/JPY Daily Outlook

Daily Pivots: (S1) 140.08; (P) 140.99; (R1) 141.69; More…

Intraday bias in USD/JPY remains on the downside for 139.26 fibonacci level. Some support could be seen there to bring rebound. But outlook will remain bearish as long as 143.03 resistance holds. Decisive break of 139.26 would carry larger bearish implications, and target 61.8% projection of 161.94 to 141.67 from 149.35 at 136.82.

In the bigger picture, fall from 161.94 medium term top is seen as correcting whole up trend from 102.58 (2021 low). Deeper decline could be seen to 38.2% retracement of 102.58 to 161.94 at 139.26, which is close to 140.25 support. Strong support could be seen there to bring rebound. But in any case, risk will stay on the downside as long as 149.35 resistance holds. Sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PSI Aug | 45.5 | 44.6 | 45.2 | |

| 23:01 | GBP | Rightmove House Price Index M/M Sep | 0.80% | -1.50% | ||

| 06:30 | CHF | Producer and Import Prices M/M Aug | 0.10% | 0.00% | ||

| 06:30 | CHF | Producer and Import Prices Y/Y Aug | -1.70% | |||

| 09:00 | EUR | Eurozone Trade Balance (EUR) Jul | 20.3B | 17.5B | ||

| 12:30 | CAD | Manufacturing Sales M/M Jul | 0.70% | -2.10% | ||

| 12:30 | USD | Empire State Manufacturing Index Sep | -3.9 | -4.7 |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more