Euro Underperforms Amid Weak German Consumer Sentiment; Gold Gains Momentum

Euro is trading lower across the board today, additionally dragged down by weaker-than-expected consumer sentiment data out of Germany. This latest indicator has added fuel to concerns that Eurozone’s largest economy may become a drag on the broader region, heightening risk of a looming recession. Meanwhile, Dollar and Swiss Franc also demonstrated weakness, but this appears to be more related to a mildly positive risk sentiment permeating the market.

In contrast, Australian and New Zealand Dollars are holding their ground as relatively better performers, followed by British Pound. Yen displayed mixed performance; although Japan’s unemployment rate rose, the currency hasn’t shown any clear recovery momentum.

Market participants should expect subdued trading conditions to continue for the day, particularly due to an empty economic calendar in Europe. However, upcoming US consumer confidence data could serve as a potential catalyst to awaken market activity.

On the technical side, Gold is attempting to build momentum for an extension of its rebound from 1884.83. For now, further upside appears likely as long as 1902.57 minor support holds. Sustained trading above falling trendline resistance (now at 1949) would strengthen the case that whole correction from 2062.95 has completed, and bring further rally to 1987.22 resistance confirmation.

Based on current market developments, extended rally in Gold might not necessarily mean selloff in Dollar. But that could still be seen as a sign of capped momentum for the greenback.

In Asia, Nikkei closed up 0.18%. Hong Kong HSI is up 2.00%. China Shanghai SSE is up 1.12%. Singapore Strait Times is up 0.34%. Japan 10-year JGB yield is down -0.0139 at 0.654. Overnight, DOW rose 0.62%. S&P 500 rose 0.63%. NASDAQ rose 0.84%. 10-year yield dropped -0.0027 to 4.212.

German consumer sentiment slides to -25.5, dashing hopes for a late-year recovery

Consumer sentiment in Germany continues to languish as the GfK Consumer Sentiment Index for September slipped to -25.5, missing market expectations of -24.3 and marking a decline from last month’s -24.6.

“The consumer sentiment is currently not showing a clear trend, neither downward nor upward – and that at a very low level overall,” stated Rolf Bürkl, consumer expert at GfK.

Adding to the gloom, Bürkl warned, “The chances that consumer sentiment can sustainably recover before the end of this year are dwindling more and more.”

He cited “persistently high inflation rates, especially for food and energy supplies,” as the main obstacles hindering any meaningful advance in consumer sentiment.

The sub-components of the index painted an equally disheartening picture. Economic expectations in August plummeted from 3.7 to a worrying -6.2, marking the lowest level since last December’s -10.3. Meanwhile, income expectations saw a significant drop from -5.1 to -11.5. The propensity to buy, another crucial sub-index, also declined, falling from -14.3 to -17.0.

Japan’s unemployment rate up to 2.7%, first rise in four months

Japan’s job market showed unexpected signs of weakening in July, as the unemployment rate rose to 2.7%, defying expectations of remaining steady at June’s 2.5% level. This marks the first uptick in unemployment in four months. The data reveals that the number of employed workers decreased by -100k during the month, while the ranks of those without jobs swelled by 110k.

Adding to the concern, jobs-to-applicants ratio—a leading indicator of labor market health—dipped to 1.29 in July from 1.30. This is the third consecutive monthly decline, counter to median economist forecasts that predicted the ratio would remain flat. These figures indicate that there were only 129 job openings for every 100 applicants, a metric that is closely watched for signs of labor market tightness or slack.

Looking ahead

US house price index and consumer confidence will be released later in the day.

EUR/GBP Daily Outlook

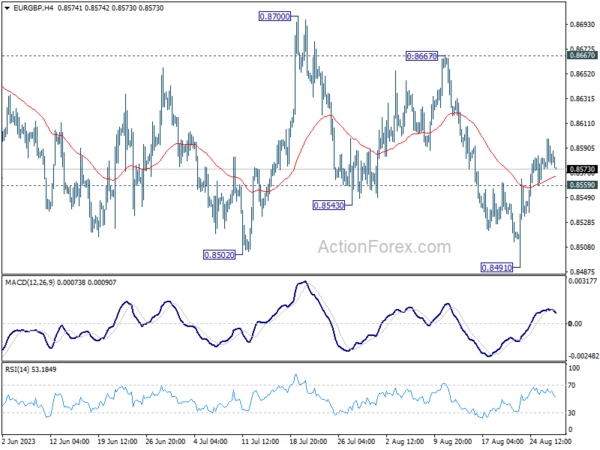

Daily Pivots: (S1) 0.8548; (P) 0.8573; (R1) 0.8586; More…

Intraday bias in EUR/GBP is turned neutral first with 4H MACD crossed below signal line. Overall outlook stays bearish with 0.8667 resistance holds. On the downside, below 0.8559 minors support will turn bias to the downside for retesting 0.8491 low first. Firm break there will resume larger down trend.

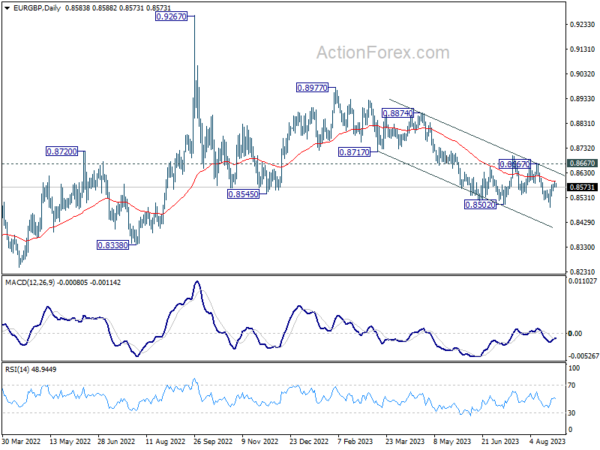

In the bigger picture, the down trend from 0.9267 (2022 high) is seen as part of the long term range pattern from 0.9499 (2020 high). Further decline is in favor as long as 0.8667 resistance holds. Break of 0.8502 will resume the fall towards 0.8201 (2022 low).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Unemployment Rate Jul | 2.70% | 2.50% | 2.50% | |

| 06:00 | EUR | Germany Gfk Consumer Sentiment Sep | -25.5 | -24.3 | -24.4 | -24.6 |

| 13:00 | USD | S&P/Case-Shiller Home Price Indices Y/Y Jun | -1.50% | -1.70% | ||

| 13:00 | USD | Housing Price Index M/M Jun | 0.20% | 0.70% | ||

| 14:00 | USD | Consumer Confidence Aug | 116.5 | 117 |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more