Euro Softens Slightly On Growth Downgrade, Yen Rally Short-Lived

Trading in the European session has been relatively muted, with the primary contributor to the quietness being a notably thin economic calendar. Euro experienced a mild dip following European Commission’s downgrade of growth projections for Eurozone for the current year and next. While Euro displayed pronounced weakness against commodity-linked currencies, its descent was restricted against other major peers. As market participants await ECB’s interest rate announcement set for this Thursday, it seems that Euro traders are preserving their substantial positions for the time being.

Early trading saw Yen surged, primarily fueled by remarks from BoJ Governor Kazuo Ueda, stirring market chatter about a potential departure from negative interest rates by early next year. However, Yen’s ascent was short-lived, with the currency giving up most of its gains by the onset of US session. Presently, the Yen ranks as the day’s second-best performer, sitting behind Australian Dollar and just ahead of New Zealand Dollar.

In contrast, US Dollar has been the day’s laggard, giving up some ground following its gains from the past week. Swiss Franc and Euro trail close behind in underperformance. Meanwhile, Sterling and Canadian Dollar are showing mixed performance.

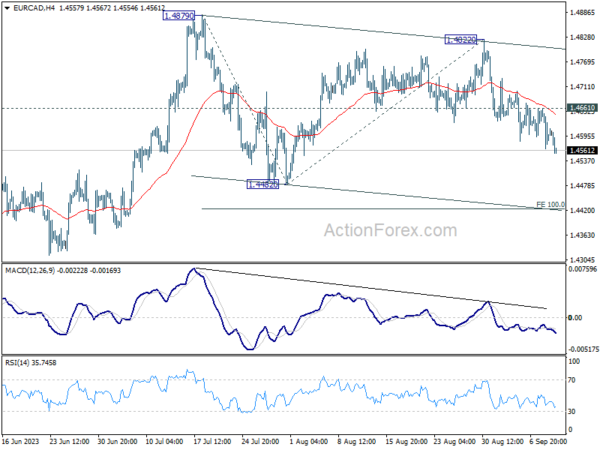

From technical perspective, EUR/CAD’s bearish run from 1.4822 continues, marking a decline to 1.4554 today so far. As long as 1.4661 resistance remains intact, further downside is anticipated. The ongoing fall from 1.4822 is perceived as the third leg of the corrective pattern from 1.4879. The forthcoming targets are set at 1.4482 support, and then 100% projection of 1.4879 to 1.4482 from 1.4822 at 1.4425.

In Europe, at the time of writing, FTSE is up 0.06%. DAX is up 0.48%. CAC is up 0.59%. Germany 10-year yield is up 0.0316 at 2.644. Earlier in Asia, Nikkei dropped -0.43%. Hong Kong HSI dropped -0.58%. China Shanghai SSE rose 0.84%. Singapore Strait Times rose 0.33%. Japan 10-year JGB yield is up 0.0546 at 0.705.

EU downgrades Eurozone growth forecasts, Germany in contraction this year

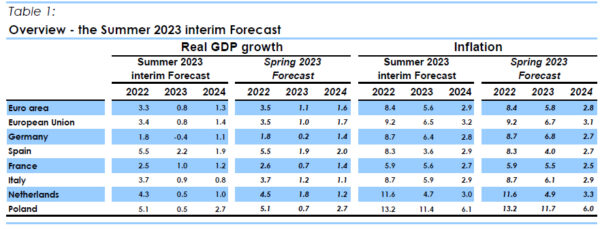

European Commission, in its Summer 2023 interim forecast, revised down its growth projections for Eurozone. For 2023, growth outlook was cut from 1.1% to 0.8%, while 2024 projection was trimmed from 1.6% to 1.3%. On the inflation front, expectations for 2023 was adjusted downward from 5.8% to 5.6%, yet 2024 forecast saw a minor uptick from 2.8% to 2.9%.

Delving into individual nations, Germany’s economic forecast has been dampened significantly. Growth projection for 2023 is now set at a contraction of -0.4%, a stark difference from prior 0.2% growth prediction. 2024 projection has been revised down from 1.4% to 1.1%.

On the contrary, France has seen a boost in its 2023 growth projection, raised from 0.7% to 1.0%. However, its 2024 growth forecast was trimmed slightly, from 1.4% to 1.2%.

Valdis Dombrovskis, Executive Vice-President for an Economy that Works for People,said: “The persistently high inflation rate has exacted a heavy cost, although signs of its abating are visible. Following a spell of economic slack, we anticipate a modest rebound in growth in the coming year. This optimism is driven by a resilient labor market, historical lows in unemployment, and diminishing price pressures. Nonetheless, the economic trajectory remains uncertain, necessitating vigilant risk monitoring.”

Echoing these sentiments, Paolo Gentiloni, Commissioner for Economy, stated, “Our economies have been battling numerous challenges this year, culminating in softer growth than our spring projections had indicated. While inflationary pressures are waning, the rate varies across the EU. Furthermore, Russia’s aggressive actions against Ukraine persist, leading not just to human distress but also significant economic upheaval.”

10-year JGB yield hits 9-year high on BoJ Ueda, Yen rebounds

Yen saw a notable uptick in Asian session, buoyed by hawkish sentiments by BoJ Governor Kazuo Ueda. Concurrently, 10-year JGB yield scaled its highest level in nine years, breaking 0.7% mark.

In an interview with Yomiuri newspaper published over the weekend, Ueda hinted at the possibility that BoJ might have sufficient data by the close of the year to contemplate ending its negative interest rate policy. Such remarks from Ueda have spurred speculation among market analysts, with some interpreting them as early signals for the markets, suggesting a potential end to negative interest rates by Q1 2024. Before this step, there also are anticipations of yield curve control being phased out later this year.

On the flip side, certain analysts, referencing recent data which highlights decelerating wage growth, argue that the transition from negative rates might not be imminent. They believe Ueda’s remarks might be more of a countermeasure to Yen’s recent depreciation.

Ueda, during the interview, emphasized the need for Japan to witness a consistent rise in inflation, complemented by wage growth, before implementing changes. “If we judge that Japan can achieve its inflation target even after ending negative rates, we’ll do so,” Ueda asserted. However, he also reiterated the central bank’s stance on maintaining its ultra-loose policy for now, until there’s firm confidence that inflation will consistently hover around the 2% mark, bolstered by robust demand and wage growth.

He cautioned, “While Japan is showing budding positive signs, achievement of our target isn’t in sight yet.” Looking ahead, Ueda underscored the importance of wage trajectories in the coming year, indicating that conclusive decisions would be data-driven. “We can’t rule out the possibility we’ll get enough information and data by year-end,” Ueda added.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 146.93; (P) 147.40; (R1) 147.76; More…

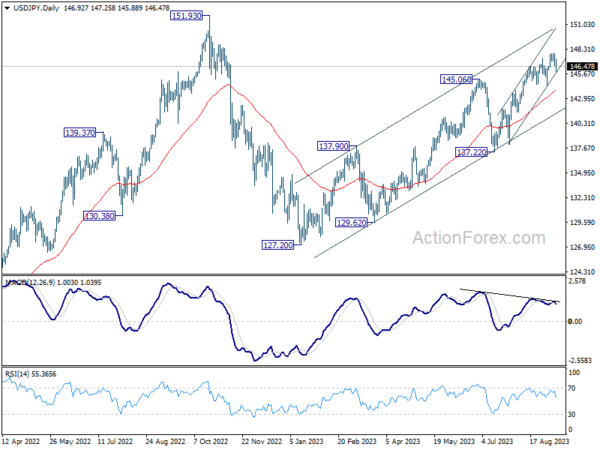

USD/JPY recovered after dipping to 145.88 today, drawing support from near term rising channel. Intraday bias remains neutral for the moment as consolidation form 147.88 could extend. But outlook remains bullish with 144.43 support intact. On the upside, above 147.88 will resume larger rise from 127.20, to retest 151.93 high.

In the bigger picture, while rise from 127.20 is strong, it could still be seen as the second leg of the corrective pattern from 151.93 (2022 high). Rejection by 151.93, followed by break of 137.22 support will indicate that the third leg of the pattern has started. However, sustained break of 151.93 will confirm resumption of long term up trend.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Money Supply M2+CD Y/Y Jul | 2.50% | 2.50% | 2.40% | 2.50% |

| 06:00 | JPY | Machine Tool Orders Y/Y Aug P | -17.60% | -19.80% | -19.70% | |

| 08:00 | EUR | Italy Industrial Output M/M Jul | -0.70% | -0.30% | 0.50% |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more