Euro Pressured By Weak Investor Confidence Sentiment, Dollar Edges Higher

Dollar strengthened modestly in today’s quiet trading as market participants continued to scale back expectations for a more aggressive 50bps rate cut by Fed this month. However, the greenback’s momentum remains modest as it awaits a crucial test from the upcoming US CPI data this week. Stabilizing risk sentiment is also keeping a lid on further gains for Dollar for now.

Euro, on the other hand, is on the defensive after Eurozone investor sentiment plummeted to its lowest level this year. Germany, the region’s economic powerhouse, is at the center of the downturn, with data signaling that the country may already be in recession. Investor confidence continues to erode, with expectations index showing little sign of improvement, casting doubt on a near-term recovery for Germany and the broader Eurozone.

In terms of currency performance today, Yen and Swiss Franc have emerged as the weakest performers, with Kiwi trailing closely behind. Loonie leads the market, followed by Dollar and Aussie. Euro and British Pound are positioned in the middle of the pack. With no major data releases from the US and Fed in its blackout period ahead of its next meeting, market activity is expected to remain subdued through the remainder of the day.

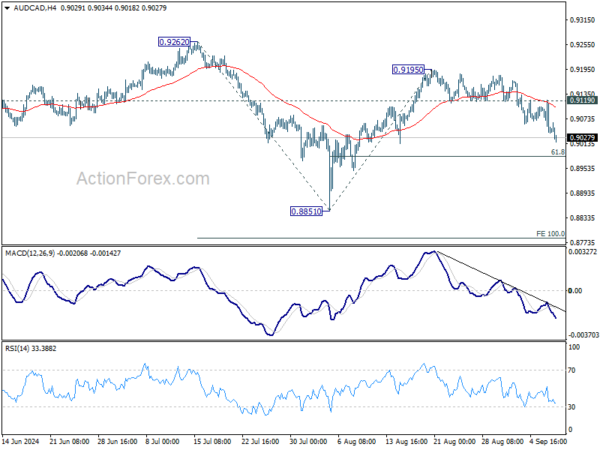

Technically, AUD/CAD’s fall from 0.9195 extends lower today. Prior rejection by 55 4H EMA suggests that rebound from 0.8851 has completed already. Deeper fall is now expected as long as 0.9119 resistance holds, towards 61.8% retracement of 0.8851 to 0.9195 at 0.9064. Strong support could be seen there to bring rebound. However, decisive break of 0.9064 will raise the chance that fall from 0.9262 is resuming through 0.8851 to 100% projection of 0.9262 to 0.8851 from 0.9195 at 0.8784.

In Europe, at the time of writing, FTSE is up 0.55%. DAX is up 0.36%. CAC is up 0.52%. UK 10-year yield is up 0.0088 at 3.907. Germany 10-year yield is up 0.032 at 2.211. Earlier in Asia, Nikkei fell -1.42%. Hong Kong HSI fell -1.42%. China Shanghai SSE fell -1.06%. Singapore Strait Times rose 1.22%. Japan 10-year JGB yield rose 0.0449 to 0.895.

Eurozone Sentix investor confidence falls to -15.4, deepening German recession concerns,

Eurozone Sentix Investor Confidence fell sharply again in September, dropping from -13.9 to -15.4, significantly below the expected -11.7. This marks the third consecutive month of declines and the lowest reading since January. The Current Situation Index also weakened, falling to -22.5, its lowest point since December 2023. Meanwhile, the Expectations Index offered a slight improvement, rising from -8.8 to -8.0, but it remains deep in negative territory.

Germany’s outlook painted an even bleaker picture. Investor confidence in Europe’s largest economy plunged from -31.1 to -34.7, its lowest point since October 2022. Current Situation Index dropped significantly from -42.8 to -48.0, reaching levels not seen since June 2020. Meanwhile, Expectations Index dipped further from -18.5 to -20.3, hitting its lowest since October 2023.

Sentix analysts described the situation as increasingly dire, stating that the German economy is approaching a new “climax” in its deepening recession. The report emphasized that the recession is “raging ever stronger,” with expectations continuing to fall, highlighting the “hopelessness” felt by investors.

The report also highlighted that the broader Eurozone is grappling with “dangerous recessionary tendencies,” driven largely by Germany’s economic struggles. The prospect of a more accommodative monetary policy is now the key hope for market participants, as the ECB is widely expected to announce another rate cut in its upcoming meeting this week.

China’s CPI inches up to 0.6% yoy in Aug, but deflationary pressures persist as PPI declines again

China’s inflation data for August showed a slight rise in consumer prices, but deflationary pressures continue to weigh on the economy. CPI increased from 0.5% yoy in July to 0.6% yoy, falling short of market expectations of 0.7% yoy.

Food prices saw a notable rise, jumping 2.8% yoy, driven by a 16.1% yoy surge in pork prices and a 21.8% yoy increase in vegetable prices. However, non-food inflation eased significantly, dropping from 0.7% yoy to just 0.2%. Core CPI also fell slightly, rising only 0.3% yoy compared to 0.4% yoy in July.

On a month-over-month basis, China’s CPI rose by 0.4% mom , following a 0.5% mom increase in the prior month. While positive, this figure also came in below expectations of 0.5% mom.

Producer prices, on the other hand, extended their negative streak for the 23rd consecutive month. PPI fell from -0.8% yoy in July to -1.8% yoy in August, worse than the anticipated decline of -1.4% yoy.

This persistent deflation in factory-gate prices is being attributed to weak market demand and a continued decline in international commodity prices, according to NBS statistician Dong Lijuan.

Dong also noted that the slight rise in consumer prices in August was largely influenced by seasonal factors, such as high temperatures and rainfall, which boosted food prices.

However, the underlying weakness in both consumer and producer prices points to broader structural issues in China’s economy. Economists warn that the ongoing deflationary pressures are a result of production outpacing demand, contributing to a growing surplus and continued challenges for the manufacturing sector.

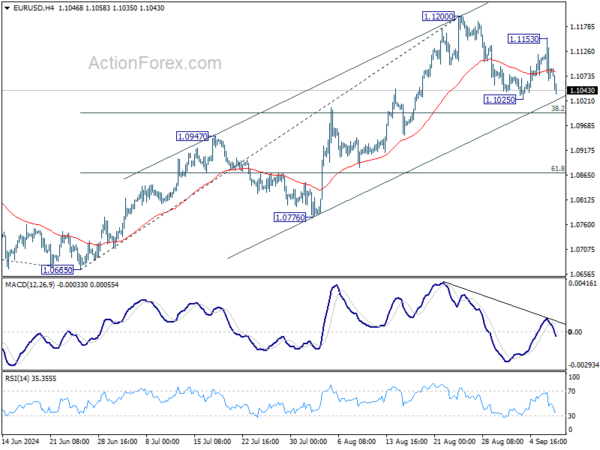

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1049; (P) 1.1102; (R1) 1.1138; More….

EUR/USD dips notably today but stays in range above 1.1025. Intraday bias remains neutral for the moment. Consolidation from 1.1200 could extend with deeper pull back, but downside should be contained by 38.2% retracement of 1.0665 to 1.1200 at 1.0996 to bring rebound. Break of 1.1200 will resume larger rise towards 1.1274 high. However, sustained break of 1.0996 will indicate reversal and turn bias to the downside.

In the bigger picture, prior break of 1.1138 resistance indicates that corrective pattern from 1.1274 might have completed at 1.0665 already. Decisive break of 1.1274 (2023 high) will confirm whole up trend from 0.9534 (2022 low). Next target will be 61.8% projection of 0.9534 to 1.1274 from 1.0665 at 1.1740. This will now be the favored case as long as 1.0947 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Bank Lending Y/Y Aug | 3.00% | 3.20% | 3.20% | |

| 23:50 | JPY | Current Account (JPY) Jul | 2.80T | 2.10T | 1.78T | |

| 23:50 | JPY | GDP Q/Q Q2 F | 0.70% | 0.80% | 0.80% | |

| 23:50 | JPY | GDP Deflator Y/Y Q2 F | 3.20% | 3.00% | 3.00% | |

| 01:30 | CNY | CPI Y/Y Aug | 0.60% | 0.70% | 0.50% | |

| 01:30 | CNY | PPI Y/Y Aug | -1.80% | -1.40% | -0.80% | |

| 05:00 | JPY | Eco Watchers Survey: Current Aug | 49 | 47.6 | 47.5 | |

| 08:30 | EUR | Eurozone Sentix Investor Confidence Sep | -15.4 | -11.7 | -13.9 | |

| 14:00 | USD | Wholesale Inventories Jul F | 0.30% | 0.30% |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more