Euro And Dollar Await Inflation Data As Markets Tread Water

In the run-up to the close of the first half, forex markets appear to be treading water in today’s Asian session. Market responses to China’s lackluster PMI data have been tepid, while Yen remains largely unfazed by Japan’s industrial production figures and Tokyo’s CPI. Asian indexes are mixed with mild selloff in Nikkei.

Dollar and Euro are neck-and-neck in the race for this week’s top spot, with the final outcome possibly hinging on upcoming Eurozone CPI flash and US PCE inflation data. Commodity currencies, on the other hand, are languishing at the bottom of the chart, with Kiwi underperforming against its Australian and Canadian counterparts. Sterling, Swiss Franc, and Yen are stuck in a mixed performance amidst the fray.

Technically, US 10-year yield’s breach of 3.854 short term top overnight is worth a mention. Rise from 3.253 might be finally resuming. A strong close above the resistance today will solidify near term bullishness, and the case that whole correction from 4.333 has completed with three waves down to 3.253. This development could pave the way for further rally in the coming week, especially with a slew of high-impact US data on the horizon, and potentially providing a boost for USD/JPY. The lingering question for USD/JPY is when Japan might decide to step in with intervention again.

In Asia, at the time of writing, Nikkei is down -0.54%. Hong Kong HSI is up 0.02%. China Shanghai SSE is up 0.78%. Singapore Strait times is up 0.03%. Japan 10-year JGB yield is up 0.0131 at 0.397, getting close to 0.4 handle again. Overnight, DOW rose 0.80%. S&P 500 rose 0.45%. NASDAQ closed flat. 10-year yield rose 0.144 to 3.854.

Japan industrial production down -1.6% mom in May on vehicle sector

Japan’s industrial production recorded a sharper decline than anticipated, dropping by 1.6% mom in May. This marked the first contraction in four months, surpassing expectations of -1.0% decrease. According to survey by Ministry of Economy, Trade and Industry, manufacturers forecast industrial output to recover by 5.6% in June, only to fall again by -0.6% in July.

Among the 15 industrial sectors, 12 reported falling output, with only three seeing rise in production. Notably, motor vehicle sector bore the brunt of the decline, experiencing substantial -8.9% slump from the previous month, with passenger cars and auto body parts being the significant contributors.

Also released, the country’s unemployment rate remained unchanged at 2.6%, as expected. The number of jobless individuals decreased by -30k from the prior month, standing at 1.77 million. However, the Ministry of Health, Labor and Welfare revealed a slight downturn in the job market, with ratio of job openings to job seekers in May dropping to 1.31, down 0.01 point from April.

Meanwhile, Tokyo CPI edged down to 3.1% yoy in June, from 3.2% in May. Core CPI, which excludes fresh food, held steady at 3.2% yoy. Core-core CPI, excluding both food and energy, saw a mild decrease from 3.9% yoy to 3.8% yoy.

China PMI manufacturing ticked up to 49.0, still in contraction

June saw a modest uptick in China’s NBS PMI Manufacturing from 48.8 to 49.0, missing expectation of 49.5. The manufacturing sector remains in contractionary state, albeit with a slight improvement from the previous month.

In some details of PMI Manufacturing, new orders improved slightly, climbing to 48.6 from May’s 48.3. However, new export orders saw a five-month low at 46.4, suggesting weakening demand from overseas. Employment fell from 48.4 to 48.2.

In parallel, PMI Non-Manufacturing dropped from 54.5 in May to 53.2 in June, underperforming 53.7 forecast. This decline marks the weakest reading index since December. Employment sub-gauge for non-manufacturing sector fell noticeably, from 48.4 to 46.8.

Additionally, PMI Composite, which combines both manufacturing and service sector activity, declined from 52.9 to 52.3. This lower figure highlights a broader slowdown in China’s economic activity beyond manufacturing alone.

Looking ahead

The economic calendar is rather busy today. Eurozone CPI flash is the main highlight in European session while unemployment rate will be released. Other features include UK GDP final, Swiss retail sales and KOF economic barometer, France consumer spending and Germany unemployment.

Later in the day, focuses will be on Canada GDP and US PCE inflation. Chicago PMI and U of Michigan consumer sentiment final will also be published.

EUR/USD Daily Outlook

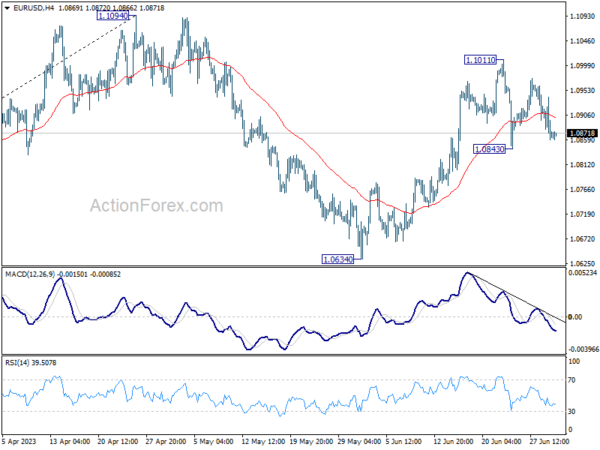

Daily Pivots: (S1) 1.0836; (P) 1.0888; (R1) 1.0917; More…

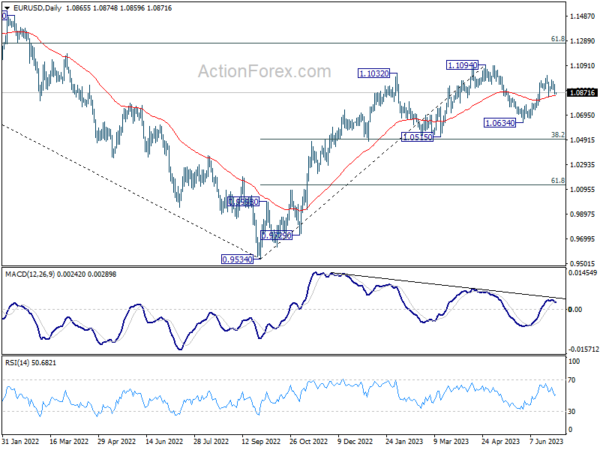

Intraday bias in EUR/USD remains neutral at this point as sideway trading continues. Further rally is mildly in favor with 1.0843 support intact. On the upside, break of 1.1011 will resume the rise from 1.0634 and target 1.1094 resistance. Decisive break there will resume larger up trend from 0.9534. However, break of 1.0843 will turn bias to the downside for 1.0634 support instead.

In the bigger picture, as long as 1.0515 support holds, rise from 0.9534 (2022 low) would still extend higher. Sustained break of 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Y/Y Jun | 3.10% | 3.80% | 3.20% | |

| 23:30 | JPY | Tokyo CPI ex Fresh Food Y/Y Jun | 3.20% | 3.30% | 3.20% | |

| 23:30 | JPY | Tokyo CPI ex Food Energy Y/Y Jun | 3.80% | 4.40% | 3.90% | |

| 23:30 | JPY | Unemployment Rate May | 2.60% | 2.60% | 2.60% | |

| 23:50 | JPY | Industrial Production M/M May P | -1.60% | -1.00% | 0.70% | |

| 01:30 | CNY | Manufacturing PMI Jun | 49.0 | 49.5 | 48.8 | |

| 01:30 | CNY | Non-Manufacturing PMI Jun | 53.2 | 53.7 | 54.5 | |

| 01:30 | AUD | Private Sector Credit M/M May | 0.40% | 0.40% | 0.60% | |

| 05:00 | JPY | Housing Starts Y/Y May | -2.20% | -11.90% | ||

| 06:00 | EUR | Germany Import Price Index M/M May | -2.00% | -1.70% | ||

| 06:00 | EUR | Germany Retail Sales M/M May | 0.20% | 0.80% | ||

| 06:00 | GBP | GDP Q/Q Q1 F | 0.10% | 0.10% | ||

| 06:00 | GBP | Current Account (GBP) Q1 | -7.7B | -2.5B | ||

| 06:30 | CHF | Real Retail Sales Y/Y May | -2.50% | -3.70% | ||

| 06:45 | EUR | France Consumer Spending M/M May | 0.70% | -1.00% | ||

| 07:00 | CHF | KOF Economic Barometer Jun | 89.2 | 90.2 | ||

| 07:55 | EUR | Germany Unemployment Change May | 15K | 9K | ||

| 07:55 | EUR | Germany Unemployment Rate May | 5.60% | 5.60% | ||

| 08:00 | EUR | Italy Unemployment May | 7.90% | 7.80% | ||

| 09:00 | EUR | Eurozone Unemployment Rate May | 6.50% | 6.50% | ||

| 09:00 | EUR | CPI Y/Y Jun P | 5.60% | 6.10% | ||

| 09:00 | EUR | CPI Core Y/Y Jun P | 5.40% | 5.30% | ||

| 12:30 | CAD | GDP M/M Apr | 0.20% | 0.00% | ||

| 12:30 | USD | Personal Income M/M May | 0.40% | 0.40% | ||

| 12:30 | USD | Personal Spending May | 0.20% | 0.80% | ||

| 12:30 | USD | PCE Price Index M/M May | 0.40% | |||

| 12:30 | USD | PCE Price Index Y/Y May | 4.40% | |||

| 12:30 | USD | Core PCE Price Index M/M May | 0.40% | 0.40% | ||

| 12:30 | USD | Core PCE Price Index Y/Y May | 4.70% | 4.70% | ||

| 13:45 | USD | Chicago PMI Jun | 44.5 | 40.4 | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Jun F | 63.9 | 63.9 |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more