Dollar Strengthens As Treasury Yields Surge, Anticipating A Hawkish Fed Shift?

Dollar rebounded strongly overnight along with rally in treasury yields, and maintained its strength in Asian session. This resurgence is largely attributed to traders recalibrating their expectations for Fed’s monetary policy, in light of this week’s inflation data that surpassed forecasts. Both CPI and PPI reports for this week have painted a picture of persistent inflationary pressures, prompting speculation of a hawkish shift in FOMC’s dot plot at the upcoming meeting next week.

With the inflation narrative gaining momentum, eyes are on University of Michigan’s consumer sentiment index and inflation expectations in US session. Any surprises to the upside in these figures could further cement the Dollar’s position, propelling it to end the week on a strong note.

In the broader forex markets, the Dollar is currently the best performer of the week, with Canadian Dollar and the trailing behind in strength. New Zealand Dollar is the worst, following the sharp selloff following manufacturing data that, despite showing improvements, continued to highlight the sector’s struggles. Sterling and the Yen are also lagging, with Australian Dollar and Swiss Franc mixed in the middle.

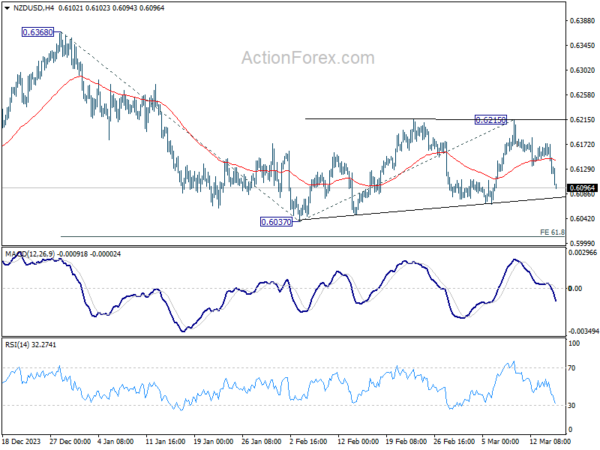

Technically, today’s steep decline in NZD/USD affirms the case that consolidation pattern from 0.6037 has completed with three waves to 0.6215. And fall from 0.6368 is ready to resume. Further decline is now expected as long as 55 4H EMA (now at 0.6143) holds. Next targets are 0.6037, and the 61.8% projection of 0.6368 to 0.6037 from 0.6215 at 0.6010, which is close to 0.6 psychological support.

In Asia, at the time of writing, Nikkei is down -0.33%. Hong Kong HSI is down -2.27%. China Shanghai SSE is down -0.31%. Singapore Strait Times is down -0.25%. Japan 10-year JGB yield up 0.0109 at 0.787. Overnight, DOW fell -0.35%. S&P 500 fell -0.29%. NASDAQ fell -0.30%. 10-year yield rose 0.106 to 4.298.

US treasury yields leap as markets question Fed’s easing path

US Treasury yields surged overnight and pulled Dollar higher, in reaction to February’s stronger than expected PPI data. Despite prevailing expectations for the Fed to initiate rate cuts in June, the persistence of “sticky” inflation has led a reassessment of the loosening path throughout the year.

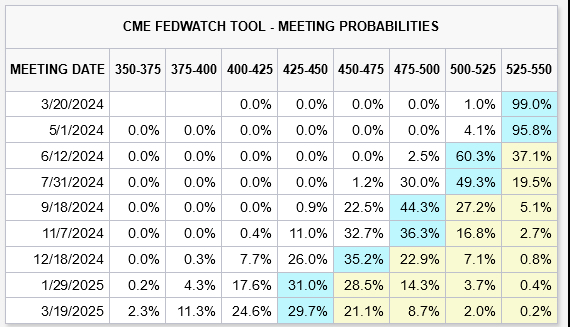

Currently, Fed fund futures reflect diminished confidence, with the likelihood of three rate cuts by year-end, from current 5.25-5.50% down to 4.25-4.50%, falling below 70%. Some market participants appears to be speculating on a less dovish stance in Fed’s updated dot plot, set to be unveiled next week.

Technically, 10-year yield’s strong rise overnight suggests that corrective rebound from 3.785 is still in progress. Break of 4.354 is possible. But for now, strong resistance is expected between 4.391 ad 4.534 (50% and 61.8% retracement of 4.997 to 3.785) to limit upside to complete the rebound.

NZ BNZ manufacturing climbs to 49.3, a glimmer of hope in ongoing recession

New Zealand BusinessNZ Performance of Manufacturing Index rose from 47.5 to 49.3 , marking the highest point in a year. However, the sub-50 reading indicates that the sector remains in contraction for the twelfth consecutive month.

A closer examination of the components reveals a mixed bag of progress and setbacks. Production saw a significant leap from 42.9 to 49.1, reaching its peak since January 2023. Contrarily, employment edged down to the breakeven point of 50.0 from 51.3. New orders continued to struggle, remaining unchanged at 47.8 and indicating contraction for the ninth month in a row, reflecting the ongoing difficulty in securing new business. Finished stocks and deliveries both saw improvements, with deliveries crossing into expansion territory at 51.4, the highest since March 2023.

Despite these developments, the sector’s sentiment remains cautious, with 62% of comments being negative in February, marginally less pessimistic than January’s 63.2% but more so than December’s 61%. The primary concerns among respondents were a lack of orders, both domestically and internationally, and a general slowdown in the economy.

Stephen Toplis, BNZ’s Head of Research acknowledged that while New Zealand’s manufacturing sector “is still in recession”, the latest PMI data signals “there is light at the end of the tunnel”. The proximity of the PMI to the “breakeven” threshold and the positive differential between new orders and inventory suggest an upcoming increase in production.

Looking ahead

UK consumer inflation and Italy retail sales will be released in European session. Later in the day, Canada will release housing starts and wholesale sales. US will publish Empire State manufacturing, import prices, industrial production, and U of Michigan consumer sentiment.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6557; (P) 0.6594; (R1) 0.6619; More…

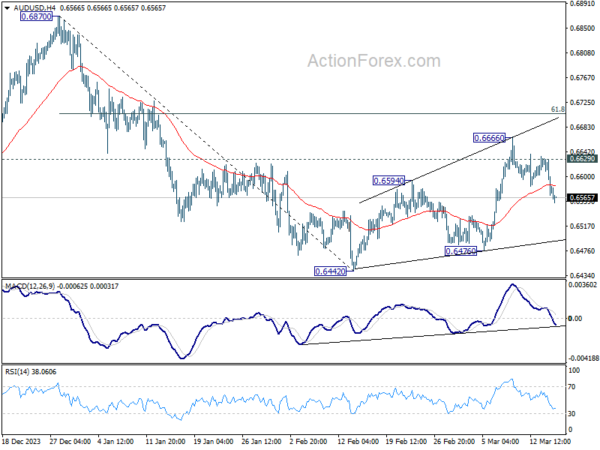

AUD/USD’s break of 55 4H EMA (now at 0.6585) argues that corrective recovery from 0.6442 has completed with three waves up to 0.6666. Intraday bias is back on the downside for 0.6476 support first. Break there will argue that decline from 0.6870 is ready to resume. On the upside, break of 0.6629 minor resistance will turn bias back to the upside to extend the rebound from 0.6442 instead.

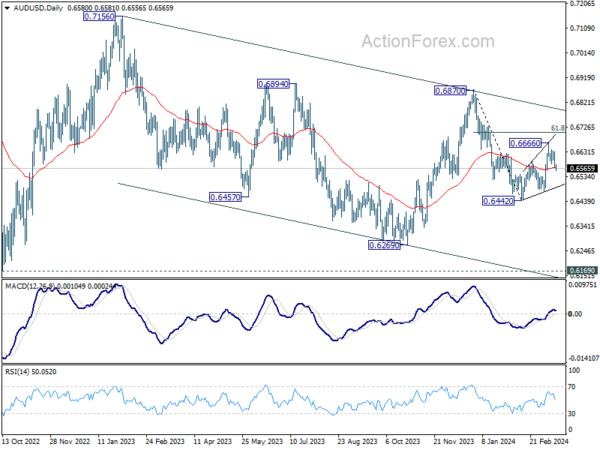

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which might still be in progress. Overall, sideway trading could continue in range of 0.6169/7156 for some more time. But as long as 0.7156 holds, an eventual downside breakout would be mildly in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PMI Feb | 49.3 | 47.3 | 47.5 | |

| 04:30 | JPY | Tertiary Industry Index M/M Jan | 0.30% | 0.10% | 0.70% | |

| 09:30 | GBP | Consumer Inflation Expectations | 3.30% | |||

| 10:00 | EUR | Italy Retail Sales M/M Jan | 0.20% | -0.10% | ||

| 12:15 | CAD | Housing Starts Y/Y Feb | 227K | 224K | ||

| 12:30 | CAD | Wholesale Sales M/M Jan | -0.60% | 0.30% | ||

| 12:30 | USD | NY Empire State Manufacturing Index Mar | -6.5 | -2.4 | ||

| 12:30 | USD | Import Price Index M/M Feb | 0.20% | 0.80% | ||

| 13:15 | USD | Industrial Production M/M Feb | 0.00% | -0.10% | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Mar P | 77.3 | 76.9 |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more