Dollar Recovers As US Stock Rally Stalls, Import Prices Pose Challenge

The strong rally in US stocks seen yesterday appears to lack follow-through momentum, with futures indicating a flat open today. The benchmark 10-year yield is fluctuating within a tight range, and Dollar is broadly recovering as selling momentum wanes. The strong increase in import prices serves as a reminder that, although disinflation in the US is making progress again, the journey will be “bumpy”, as many Fed officials have emphasized.

Despite today’s recovery, Dollar remains the worst performer of the week, followed by Swiss Franc and Canadian Dollar. New Zealand Dollar continues to lead the pack, followed by British Pound and Australian Dollar. Euro and Japanese Yen are in the middle, although the Yen is showing signs of weakening again today.

Technically, EUR/JPY recovers notably after drawing support from 55 4H EMA. With 166.73 minor support intact, the rebound from 164.01 could still extend higher. Above 169.38 will target 171.58 high. However, as this rebound is seen as the second leg of the corrective pattern from 171.58, strong resistance should emerge there to limit upside even in case of another rally.

In Europe, at the time of writing, FTSE is up 0.04%. DAX is down -0.35%. CAC is down -0.41%. UK 10-year yield is up 0.0003 at 4.070. Germany 10-year yield is up 0.021 at 2.446. Earlier in Asia, Nikkei rose 1.39%. Hong Kong HSI rose 1.59%. China Shanghai SSE rose 0.08%. Singapore Strait Times rose 0.47%. Japan 10-year JGB yield fell -0.0284 to 0.926.

US import price index rises 0.9% mom in Apr, highest since Mar 2022

US import price index rose 0.9% mom in April, well above expectation of 0.2% mom. That’s also the highest 1-month increase since March 2022. Over the past 12 months, import prices rose 1.1% yoy, highest since December 2022.

Export price rose 0.5% mom, 1.0% yoy.

US initial jobless claims falls to 222k, slightly above expectations

US initial jobless claims fell -10k to 222k in the week ending May 11, slightly above expectation of 219k. Four-week moving average of initial claims rose 2.5k to 218k.

Continuing claims rose 13k to 1794k in the week ending May 4. Four-week moving average of continuing claims fell -750 to 1779k.

Fed’s Williams: Monetary policy in a good place, no need to tighten today

In a Reuters interview, New York Fed President John Williams expressed confidence in the current state of monetary policy, stating that it is “in a good place.” He highlighted the positive mix of economic data, noting strong consumer spending, business investment, and GDP growth. He emphasized that the economy is “not really at a near-term risk” and remains robust, supported by a strong labor market.

Williams indicated that he does not see any immediate need to tighten monetary policy, as current indicators do not suggest that the Fed’s actions are harming the economy or interfering with its goals. “So I don’t see any need to tighten monetary policy today,” he added.

Looking ahead, Williams acknowledged that lower interest rates would be necessary as inflation approaches 2% target. He explained that once inflation is sustainably at this level, Fed would need to reduce its “restrictive influence” on the economy, and move to a “more neutral kind of position.”

ECB’s Centeno: Interest rate will come down

ECB Governing Council member Mario Centeno stated at a news conference today that Eurozone inflation rate’s fall towards the 2% target is “real,” and assured that the monetary policy interest rate will decrease.

“The market expects that the interest rate reduction will begin in June… I’m not going to anticipate the decision,” Centeno commented. He also emphasized his preference for gradual rate cuts over sharp, sudden reductions.

Japan’s Q1 GDP contracts -0.5% qoq, weak consumption and capital spending

Japan’s GDP contracted by -0.5% qoq in Q1, slightly worse than the expected -0.4% qoq decline. On annualized basis, GDP fell by -2.0%, missing forecast of -1.5% drop.

Private consumption, which makes up over half of the Japanese economy, decreased by -0.7%, exceeding anticipated -0.2% decline. This marks the fourth consecutive quarter of decline, the longest streak since 2009.

Capital spending fell by -0.8%, slightly more than the expected -0.7% decrease. This was the first decline in two quarters.

Exports declined by -5.0%, despite ongoing support from inbound tourism, while imports fell by -3.4% amid reduction in energy imports. The trade figures reflect a broader slowdown in global demand, which is impacting Japan’s export-driven economy.

Australia’s employment grows 38.5k in Apr, unemployment rate rises to 4.1%

Australia employment grew 38.5k in April, well above expectation of 25.3k. Full-time jobs fell -6.1k while part-time jobs rose 44.6k. Unemployment rate rose from 3.9% to 4.1%, above expectation of 3.9%. participation rate rose from 66.6% to 66.7%. Monthly hours worked was unchanged. Number of unemployed rose 30.3k or 5.3% mom.

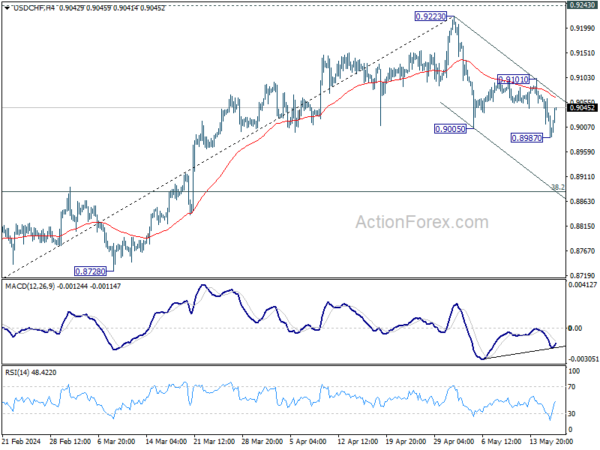

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9001; (P) 0.9036; (R1) 0.9057; More….

Intraday bias in USD/CHF is turned neutral again first with current recovery. But further decline is expected as long as 0.9101 resistance holds. Break of 0.8987 will resume the whole fall from 0.9223 and target 38.2% retracement of 0.8332 to 0.9223 at 0.8883 next. However, break of 0.9101 will turn bias back to the upside for stronger rebound.

In the bigger picture, price actions from 0.8332 medium term bottom are tentatively seen as developing into a corrective pattern to the down trend from 1.0146 (2022 high). Rejection by 0.9243 resistance, followed by sustained break of 38.2% retracement of 0.8332 to 0.9223 at 0.8883 will strengthen this case, and maintain medium term bearishness. However, decisive break of 0.9243 will argue that the trend has already reversed and turn medium term outlook bullish for 1.0146.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | GDP Q/Q Q1 P | -0.50% | -0.40% | 0.10% | |

| 23:50 | JPY | GDP Deflator Y/Y Q1 P | 3.60% | 3.30% | 3.90% | |

| 01:30 | AUD | Employment Change Apr | 38.5K | 25.3K | -6.6K | |

| 01:30 | AUD | Unemployment Rate Apr | 4.10% | 3.90% | 3.80% | 3.90% |

| 04:30 | JPY | Industrial Production M/M Mar F | 4.40% | 3.40% | 3.80% | |

| 09:00 | EUR | Italy Trade Balance (EUR) Mar | 4.34B | 4.77B | 6.03B | |

| 12:30 | USD | Initial Jobless Claims (May 10) | 222K | 219K | 231K | 232K |

| 12:30 | USD | Building Permits Apr | 1.44M | 1.48M | 1.46M | 1.49M |

| 12:30 | USD | Housing Starts Apr | 1.36M | 1.43M | 1.32M | 1.29M |

| 12:30 | USD | Import Price Index Y/Y Apr | 0.90% | 0.20% | 0.40% | |

| 12:30 | USD | Philadelphia Fed Survey May | 4.5 | 7.7 | 15.5 | |

| 13:15 | USD | Industrial Production M/M Apr | 0.20% | 0.40% | ||

| 13:15 | USD | Capacity Utilization Apr | 78.40% | 78.40% | ||

| 14:30 | USD | Natural Gas Storage | 76B | 79B |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more