Dollar Mixed As FOMC Looms, Aussie Selloff Continues

The financial markets appear to be a little on risk-off mode today, as FOMC rate decision is awaited. Additionally, ECB will announce policy decision tomorrow, followed by BoJ on Friday. Commodity currencies are the worst performers so far, as led by Aussie which was pressured following CPI data earlier today. Yen is currently the strongest, followed by Swiss Franc, and then Euro. Dollar, however, is overall just steady.

Fed will raise interest rate by another 25bps to 5.25-5.50% later today, and there is practically no chance for a deviation from this widely expected decision. The question is whether Chair Jerome Powell would give any guidance on the next move. And the answer is likely a “no”, given that two rounds of inflation and employment data are coming in before next FOMC meeting in September. Therefore, unless the Fed shifts from a wait-and-see stance and its commitment to quelling inflation, the event may not significantly roil the markets.

In Europe, at the time of writing, FTSE is down -0.75%. DAX is down -1.20%. CAC is down -2.15%. Germany 10-year yield is up 0.032 at 2.457. Earlier in Asia, Nikkei dropped -0.04%. Hong Kong HSI dropped -0.36%. China Shanghai SSE dropped -0.26%. Singapore Strait Times rose 0.57%. Japan 10-year JGB yield dropped -0.0191 to 0.448.

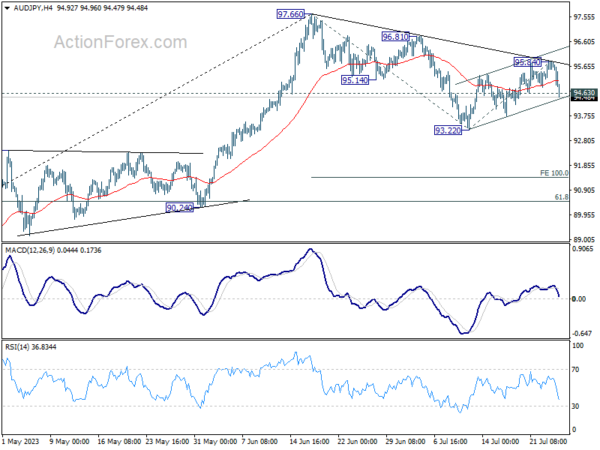

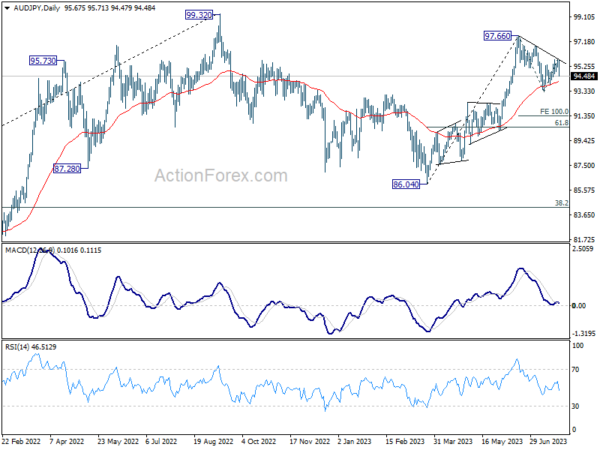

AUD/JPY gaining downside momentum towards 93.22 support and below

While Dollar is treading water ahead of FOMC rate decision, AUD/JPY is stealing the show as the top mover as markets enter into US session. Aussie’s selloff is gaining some momentum as markets continue to digest lower than expected CPI reading from Australia released earlier today. There are increasing calls for RBA to stand pat again on August 1, i.e. next Tuesday.

On the Japanese front, despite the prevailing anticipation that BoJ will maintain its monetary policy and yield curve control unchanged on Friday, traders might be rethinking their positions. This follows the advice of IMF’s Chief Economist encouraging BoJ to start planning for rate hikes and gradually distance itself from YCC. BoJ’s track record of catching the market off guard—acting when least expected and remaining idle when action is anticipated—complicates any definite predictions.

Anyway, the break of 94.63 minor support indicates that AUD/JPY’s corrective recovery from 93.22 has completed at 95.84 already, after hitting near term falling trend line resistance. Deeper fall is expected to retest 93.22 support first. Firm break there will resume the whole decline from 97.66.

Fall from 97.66 could be interpreted as a correction to rise from 86.04, or the third leg of the medium term pattern from 99.32. In either case, the next near term target after decisively breaking 93.22 will be 100% projection of 97.66 to 93.22 from 95.84 at 91.40.

Australian Q2 CPI records slowest quarterly rate since Q3 2021, annual inflation eases again

In Q2, Australia’s CPI decelerated from 1.4% qoq to 0.8% qoq, coming in below the expected 1.0% qoq. This marked the lowest quarterly rate since Q3 2021. Year-on-year, CPI eased from 7.0% to 6.0%, falling short of anticipated 6.2% yoy. Annual inflation rate has been on a downtrend for two consecutive quarters since peaking at 7.8% in Q4 2022.

RBA’s trimmed mean CPI registered at 0.9% qoq and 5.9% yoy, which were below forecast of 1.1% qoq and 6.0% yoy respectively. While CPI for goods slowed from 7.6% yoy to 5.8% yoy, CPI for services rose from 6.1% yoy to 6.3% yoy, hitting its highest level since 2001.

Michelle Marquardt, ABS head of prices statistics, noted the shift in inflationary drivers, stating, “This is the first time since September 2021 that services inflation has been higher than goods, highlighting the change from 12 months ago when goods like new dwellings and automotive fuel were driving inflation. Now price increases for a range of services like rents, restaurant meals, child-care and insurance are keeping inflation high.”

In June, monthly CPI slipped from 5.5% yoy to 5.4% yoy, in line with expectations. CPI excluding volatile items and holiday travel eased from 6.4% yoy to 6.1% yoy, and trimmed mean CPI fell from 6.1% yoy to 6.0% yoy.

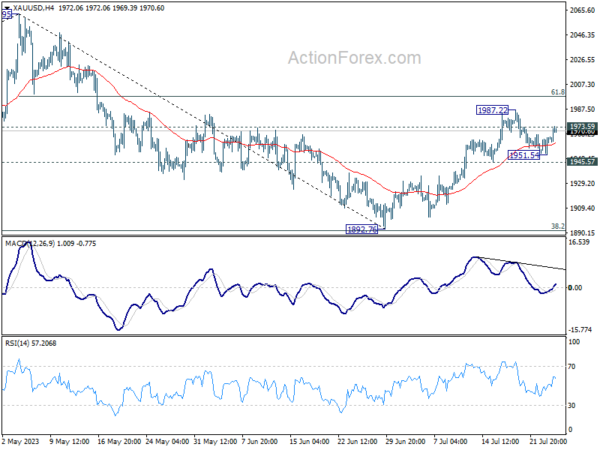

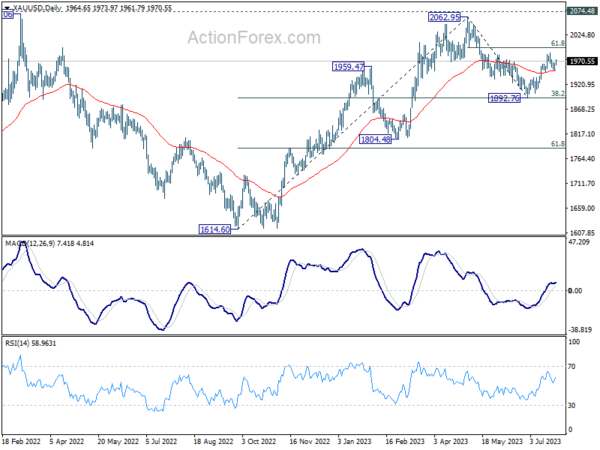

Gold rebounding, eyeing more upside

Gold rebounds notably today and immediate focus is now on 1973.59 minor resistance. Firm break there should confirm that pull back from 1987.22 has completed at 1951.54. Further rise should then be seen through 1987.22 to resume whole rally from 1892.76.

More importantly, the support from 55 D EMA (now at 1950.61) is a sign of near term bullishness. The bounce from this EMA could be strong enough to push Gold through the next obstacle at 61.8% retracement of 2062.95 to 1892.76 at 1997.93, which is just inch below 2000 psychological level.

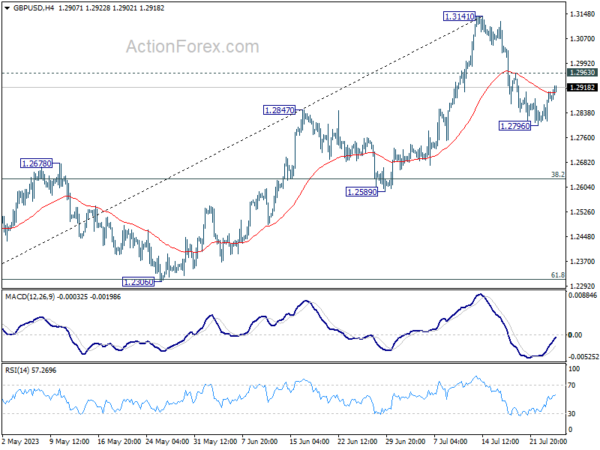

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2840; (P) 1.2872; (R1) 1.2935; More…

GBP/USD’s recovery from 1.2796 continues today but stays below 1.2963 minor resistance. Intraday bias remains neutral at this point. On the downside, below 1.2796 will resume the fall from 1.3141 to 55 D EMA (now at 1.2703) and possibly below. On the upside, break of 1.2963 minor resistance will turn bias back to the upside retest 1.3141 high instead.

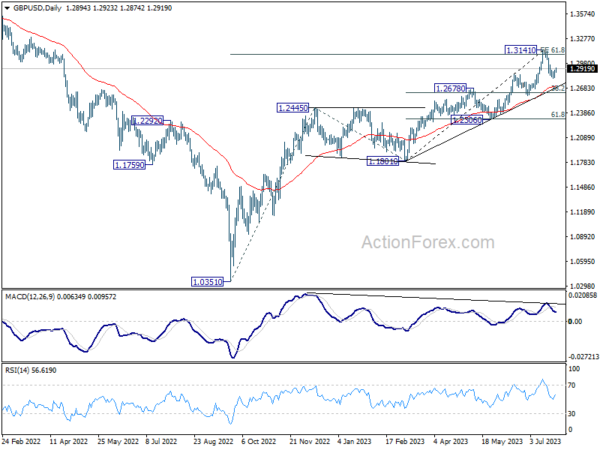

In the bigger picture, as long as 1.2678 resistance turned support holds, rise from 1.0351 (2022 low) is expected to continue. Next target is 100% projection of 1.0351 to 1.2445 from 1.1801 at 1.3895. However, sustained break of 1.2678 will argue that it’s at least correcting this rally, with risk of bearish reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Jun | 1.20% | 1.50% | 1.60% | 1.70% |

| 01:30 | AUD | Monthly CPI Y/Y Jun | 5.40% | 5.40% | 5.60% | 5.50% |

| 01:30 | AUD | CPI Q/Q Q2 | 0.80% | 1.00% | 1.40% | |

| 01:30 | AUD | CPI Y/Y Q2 | 6.00% | 6.20% | 7.00% | |

| 01:30 | AUD | RBA Trimmed Mean CPI Q/Q Q2 | 0.90% | 1.10% | 1.20% | |

| 01:30 | AUD | RBA Trimmed Mean CPI Y/Y Q2 | 5.90% | 6.00% | 6.60% | |

| 08:00 | CHF | Credit Suisse Economic Expectations Jul | -32.6 | -30.8 | ||

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Jun | 0.60% | 1.00% | 1.40% | |

| 14:00 | USD | New Home Sales Jun | 720K | 763K | ||

| 14:30 | USD | Crude Oil Inventories | -2.2M | -0.7M | ||

| 17:30 | CAD | BOC Summary of Deliberations | 6.70% | 7.10% | ||

| 18:00 | USD | Fed Interest Rate Decision | 5.50% | 5.25% | ||

| 18:30 | USD | FOMC Press Conference |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more